Processors’ Equipment Investment Plans Remain Strong in 2016

CAPITAL SPENDING SURVEY

Gardner’s exclusive research forecasts total spending on primary processing and auxiliary equipment at its highest level since 2008.

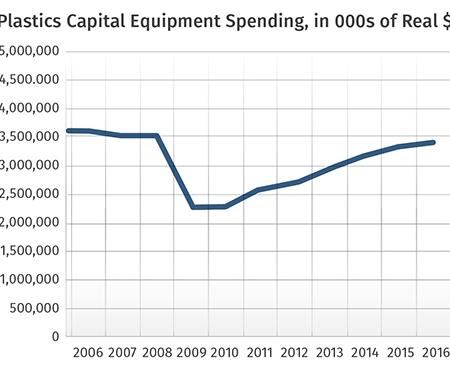

U.S. plastics processors will invest more than $3 billion on new primary processing machinery and auxiliary equipment for the third year in a row in 2016, reaching the highest level of spending since 2008. This projection is based on two separate research projects: An exclusive capital-equipment spending survey conducted by Gardner Business Media, the Cincinnati-based parent of Plastics Technology; and an analysis of the latest trends in plastics-processing capital-equipment production, imports/exports, and their leading indicators.

The combined research projects indicate that capital spending by plastics processors should increase 1.5% this year, reaching almost $3.39 billion. The slight increase in total spending will be driven by a 5% bump in auxiliary equipment spending, reaching almost $1.66 billion. Primary machinery spending will decline by 1.6% to just under $1.73 billion.

EQUIPMENT TRENDS

Injection molding equipment is by far the largest category of forecasted primary machinery spending, representing almost 67% of the total. As a result, the forecasted decline of 3.1% in 2016 for this equipment is the reason total primary machinery will be down a bit in 2016. Even though injection molding equipment spending will remain slightly more than $1 billion, 2016 will be the second year in a row this equipment category records a slight decline, Gardner’s research reveals.

Nearly 80% of injection machine spending will be on horizontal-type presses. Both horizontal and vertical machines should see reduced spending in 2016 compared with 2015. However, spending on vertical machines will still be significantly above 2014 levels, while spending on horizontal machines will be down from 2014. The survey also reveals that spending on electric machines has risen in the last two years, while spending on hydraulic machines has declined.

Spending on extrusion equipment has increased each year from 2012 to 2015. That trend should continue in 2016 with a projected 5.7% rise to $281 million. That would be the highest level since 2001.

Blow molding equipment spending has followed a similar pattern. Spending has increased in each of the last four years and should increase again in 2016. However, the rate of growth in spending on blow molding equipment (1.7% projected for 2016) is and has been noticeably lower than for extrusion equipment. In 2016, spending on blow molding equipment will reach its second highest level since 2008.

While thermoforming equipment represents the smallest segment of primary processing equipment, it has grown significantly since 2009. In fact, spending on thermoforming equipment in 2016 will be nearly double what it was in 2009. And, if the projected 8.6% growth for 2016 proves true, thermoforming equipment spending will reach its highest level since 2001.

Spending on auxiliary equipment increased in 2013, 2014, and 2015. In 2015, auxiliary-equipment spending increased 9.2%, and the projection for 2016 is an increase of 5%. That would be its highest level since 2008.

With the strong growth projected for extrusion equipment, it makes sense that auxiliary equipment related to the extrusion process is driving the growth in auxiliaries. Extrusion downstream equipment is projected to reach nearly $235 million in 2016. This would be a 100% increase from 2015 and 211% from 2014.

The projection indicates strong spending on extrusion dies as well. Spending on dies should approach $200 million in 2016. This would be an increase of 56% from 2015 and 187% from 2014.

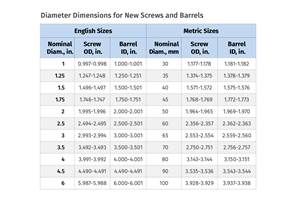

In addition, the projection indicates strong growth in multi-process chillers and cooling towers. The projection for 2016 is $155 million, an increase of 76%. Parts conveyors and dryers will also see significant growth in 2016. On the other hand, screen changers, screws/barrels, and robots should see decreased spending in 2016.

THE LEADNG INDICATORS

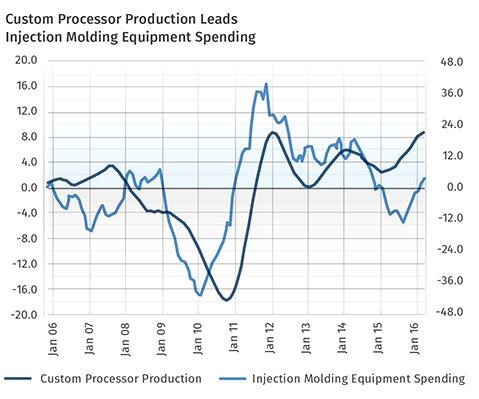

Gardner uses industrial production as a leading indicator of capital-equipment spending. Projections by equipment type can be made by tracking the rate of change in industrial production in just four end markets—custom processors, motor vehicles and parts, medical, and food/beverage processing—and correlating that to the rate of change in spending on capital equipment.

For injection molding equipment, custom-processor industrial production is the most important. It tends to lead injection molding spending by about 12 months on average. Industrial production at custom processors is very close to its all-time high back in 2005 and 2006. However, the rate of growth in custom-processor production has been decelerating throughout 2015. This indicates that spending on injection molding equipment will decline in 2016.

In addition to industrial production at custom processors, industrial production of motor vehicles and parts and medical equipment is an important leading indicator for injection molding equipment. While motor-vehicle and parts production is at a record high and well above the levels of the mid-2000s, the rate of growth is decelerating slightly. It is likely to decelerate even faster in 2016, as consumer spending on vehicles is growing slower. Medical-equipment production is also at an all-time high, but the rate of growth has slowed sharply in 2015. The trend in production in these two industries adds to the evidence that spending on injection molding equipment will decline in 2016.

For each of the other plastics-processing equipment types, the packaging industry is the most important leading indicator. There is no data available on the production of packaging, but an excellent substitute is the production of foods and beverages, since all of these products must be packaged in some way.

Food and beverage production is at an all-time high. And, unlike the other industries mentioned, food and beverage production is growing at an accelerating rate. In fact, the rate of growth when this article was written was virtually the fastest since late 2006. The rapidly accelerating growth in food and beverage production is the prime reason that Gardner’s projection shows an increase in extrusion, blow molding, and thermoforming equipment in 2016. However, while custom-processor production leads injection molding equipment by about 12 months, the lead time between food and beverage production and the other equipment types is just three to six months, which makes forecasting these other equipment types more difficult.

Since auxiliary equipment is needed along with all the primary equipment types, it is best to use both custom-processor and food and beverage production to forecast spending. In this case, custom processors’ production provides a longer-term view, while food and beverage production provides a shorter-term view.

THE HOT INDUSTRIES

Across all equipment categories, custom processors will account for 30%, or $1.02 billion, of the projected spending on capital equipment in 2016. Based on demographic data collected by Gardner, 69% of custom processors make parts for the automotive industry, 57% for the medical/pharmaceutical industry, 41% for electronics/computers/telecommunications, and 39% for aerospace/aviation.

The projected $1.02 billion in custom processors’ equipment spending is down roughly 20% from 2015. About 66% of the spending by custom processors will be on primary processing equipment. Therefore, custom processors will spend about $415 million on injection molding presses, $75 million on extrusion machines, and $67 million on thermoforming equipment. Within auxiliary equipment, custom processors will spend the most on robots (about $60 million) and extrusion downstream equipment (about $55 million).

According to Gardner’s projections, the second-largest end market in 2016 will be plastic/rubber products. Spending on all equipment for this market is projected to be $863 million, an increase of nearly 200% from 2015. This spending will be split close to 50/50 between primary-processing and auxiliary equipment. The most significant portion of primary-equipment spending will be on extrusion machines, with blow molding and injection molding equipment seeing an equal, but smaller, amount of spending. Because plastic/rubber product manufacturers plan on buying a significant amount of extrusion machines, the bulk of their auxiliary spending will be on extrusion dies and downstream equipment.

While this end market is quite broad, Gardner’s research indicates that most of the spending will come from packaging materials/unlaminated film and sheet, bottles, and pipe/fittings. Other important markets include machinery/equipment, petrochemical processors, automotive, medical, and wood/paper products.

Plastics production is nearing a cyclical peak and starting to grow at slower rates. As a result, the equipment market is seeing some fragmentation as some equipment types are strong while others are starting to weaken. If you are buying equipment in high demand, like extrusion machines, then prices will likely remain elevated and delivery times rather lengthy. The opposite is likely to be true for machine types that are experiencing somewhat weaker demand, like injection molding presses.

Related Content

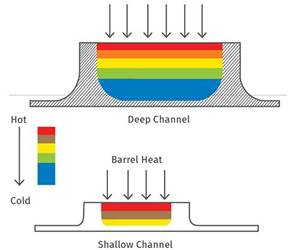

The Importance of Barrel Heat and Melt Temperature

Barrel temperature may impact melting in the case of very small extruders running very slowly. Otherwise, melting is mainly the result of shear heating of the polymer.

Read MoreRoll Cooling: Understand the Three Heat-Transfer Processes

Designing cooling rolls is complex, tedious and requires a lot of inputs. Getting it wrong may have a dramatic impact on productivity.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreWhat to Know About Your Materials When Choosing a Feeder

Feeder performance is crucial to operating extrusion and compounding lines. And consistent, reliable feeding depends in large part on selecting a feeder compatible with the materials and additives you intend to process. Follow these tips to analyze your feeder requirements.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More

.JPG;width=70;height=70;mode=crop)