Processors Record All-Time High Activity Levels

Survey data reveals quickening expansion among both captive and custom operations.

The Gardner Business Index (GBI) for plastics processors—based on monthly surveys of Plastics Technology subscribers—registered a three-point gain in February to close at 60.8. A small portion of the month’s expanding activity growth came from a modest acceleration in the level of new orders and production.

The latest tally was supported by higher readings for supplier deliveries, production, and exports. Employment and backlog activity both accelerated more quickly with four-point gains. This brought employment activity to a 2 ½-year high and backlog activity to its highest level since at least 2011. The fastest expanding component of the index was again supplier deliveries, with an eight-point gain, nearly 14 points above the prior record-high reading. Rising supplier delivery readings indicate slowing order-to-fulfillment times and challenges in upstream product availability.

FIG 1 The Plastics Processing Index rose sharply in February, with every index component reporting expanding activity. An extreme rise in the supplier deliveries reading coupled with strong gains in new orders and employment lifted both indices to all-time highs.

According to survey data reported by only custom processors, nearly all respondents reported slowing supplier deliveries, which sent the total Custom Processors Index to an all-time high. Further, custom processors indicated strongly expanding new orders and employment activity during February, but a more modest expansion in production activity. Taken as a whole, the industry is signaling that it’s making every effort to improve production while being frustrated by limited inventories.

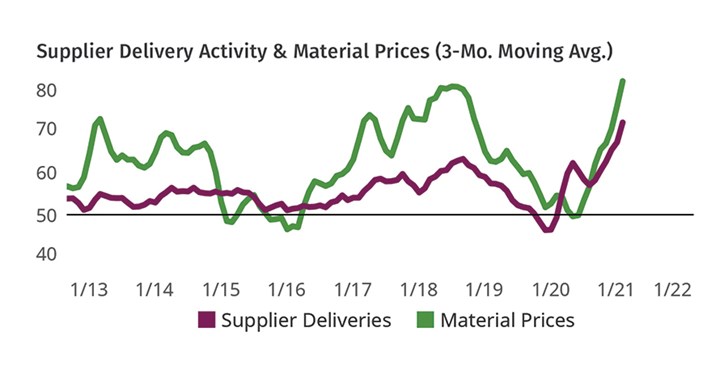

FIG 2 The history of the Plastics Processing Index clearly visualizes the amplified effect of modest changes in supply-chain performance on much larger movements in material prices. The unprecedented challenges facing the supply chain may result in similarly unprecedented pricing shocks.

EDITOR’S NOTE: Finding reliable and relevant data to help guide your business is always important, but especially so during challenging economic times. For this reason, the GBI Plastics Processing and Custom Processing Indices serve as a great tool for making data-driven decisions. Thank you to everyone who has previously completed GBI surveys. Your participation helped increased response counts by 15% in 2020, making the GBI better than ever because of your involvement. Thank you for your time and efforts and for trusting us to provide you with the latest industry and business insights both in the past and in the future.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

ABOUT THE AUTHOR: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

-

Processing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

-

Plastics Processing Activity Contraction Continues in August

Four months of consecutive contraction overall.

-

Plastics Index Shows Supply Chain Improvement Despite Production Slowdown

Future expectations reach 2024 high on the heels of the recent election.

.jpg;width=70;height=70;mode=crop)