Resin and Energy Prices Will Stay High Through Winter

The overall U.S. economy will continue to expand at a sustainable rate during the next few quarters, but energy prices are expected to remain at high levels.

The overall U.S. economy will continue to expand at a sustainable rate during the next few quarters, but energy prices are expected to remain at high levels. Because of the close correlation between petroleum cost and resin prices, this means that manufacturers of plastics products should expect high materials costs for the remainder of 2005 and most of 2006. Supply conditions for these materials will improve significantly in the coming months, but demand for both energy and plastics materials will also expand in 2006 due to continued growth in the global and domestic economies.

The U.S. Department of Energy’s Energy Information Administration (EIA) has just released its energy outlook for the coming winter, and not surprisingly, the forecasts were rather grim. According to the EIA, the average household heating with natural gas will pay $350 more this winter to heat their homes, while households that use heating oil will pay nearly $380 more on average. These forecasts are based on expectations for normal winter weather in terms of heating degree-days. If this winter turns out to be colder than normal, then the average costs will obviously be higher.

And while it is clear from the accompanying chart that resins prices follow the trend in the crude oil market, most of the domestically-produced resins are manufactured from natural gas. Total U.S demand for natural gas is forecast to decline by just over 1% this year due to higher prices, but it will recover by 3% in 2006. Most of this gain will be driven by a 6% increase in demand for natural gas from the industrial sector. Demand for electric power generation will also continue at a strong pace in 2006, but it is not expected to be quite as strong as the 6% increase in 2005.

On the supply side, U.S. production of natural gas will decline by 3% in 2005 due to the major disruptions to the infrastructure in the Gulf of Mexico from Hurricanes Katrina and Rita. In 2006, production will rebound by more than 4%. Under this scenario, the expansion in domestic production will exceed the growth in total demand. This will put downward pressure on prices in the short term, but this situation will not be sustainable over the long run.

So considering all of the geopolitical, economic, and weather-related factors, here is where we are at the present time: Complete recovery of the U.S. energy infrastructure from recent hurricane damage will take many months; however, considerable recovery should occur by the end of 2005. But the market for crude oil was tight before the hurricanes hit, and the recent loss of production in the Gulf only exacerbated the situation. Therefore, prices for petroleum products and natural gas will remain high due to continued tightness in international supplies of crude oil as well as the hurricane-induced supply losses of crude oil, natural gas, and refinery capacity.

Under the baseline weather case, natural gas prices will average $9 per thousand cubic feet (mcf) in 2005 and will ease back to about $8.70/mcf in 2006. Retail gasoline prices will average $2.35/gal this year, but are expected to rise up to $2.45/gal in 2006. The outlook for crude oil prices calls for an average price of $58 per barrel in 2005 followed by an average of just over $60/barrel for 2006.

While most manufacturers will be able to absorb the higher energy costs in the coming months, the plastics sector will feel the pain more acutely. Not only will higher resin prices continue to crimp the profit margins for processors, but many households will have less money to spend on other manufactured goods once they have filled their gas tanks and heated their homes. Analysts for the retail sector are already predicting that high energy costs this winter will have a negative affect on Christmas spending and holiday travel plans.

The one other important factor to consider as we navigate through an environment of elevated energy and resin prices during the coming months is overall inflation. Although the high cost of petroleum has not yet shown up in any of the measures for core inflation, investors, consumers, and the Fed are becoming increasingly concerned that this will be a problem in the near future. Businesses are raising their prices, and the tightening job market will soon give workers an opportunity to demand higher wages.

At the present time, we expect the Fed to be successful in its efforts to head off an unacceptable rate of inflation without stalling the economic recovery. But this optimistic outlook also assumes that there will not be another spike in energy prices. If there is another major supply disruption, or if the coming winter is much colder than expected, then the outlook for next year could change substantially.

Related Content

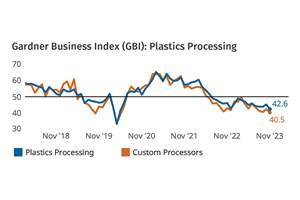

Plastics Processing Activity Contracted in July

Plastics processing GBI contracted for the third month in a row.

Read MorePlastics Processing Activity Drops in November

The drop in plastics activity appears to be driven by a return to accelerated contraction for three closely connected components — new orders, production and backlog.

Read MoreProcessing Takes a Dip in June

Plastics activity took a relatively big downturn in June, ending at a low for the year and lower than the same month a year ago.

Read MorePlastics Processing Activity Contraction Continues in August

Four months of consecutive contraction overall.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More