Plastics Processing Activity Contracted in July

Plastics processing GBI contracted for the third month in a row.

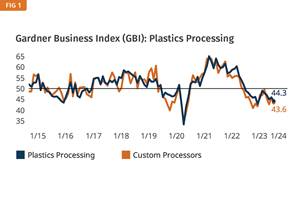

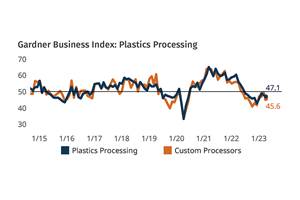

The Gardner Business Index (GBI): Plastics Processing contracted for the third month in a row, the good news being the magnitude is the smallest of the three declines. That said, the index is holding on at just one point higher than the November 2023 low that marked the lowest reading since May of 2020.

The Gardner Business Index (GBI): Plastics Processing (43.5) for July is down one point relative to June’s 44.5. The index is based on survey responses from subscribers to Plastics Technology. Indices above 50 signal growth; below 50, contraction.

It appears that accelerated contraction in new orders, production and backlog drove accelerated contraction in July’s overall Plastics Processing index. Contraction in exports also accelerated a little, while employment contraction stayed relatively steady within the tight range it has occupied for most of 2024. Supplier deliveries lengthened at a slightly slower rate in July, the second month in a row, which fits other metrics that suggest the manufacturing industry is not ‘on fire’ such that suppliers have a hard time keeping up.

Sentiment about future business remains positive, but slightly less so each month of this year.

The index for custom processors fared better than the overall processor index in July, contracting more slowly, a one-point gain potentially signaling a small start to recovering from a significant GBI drop in May.

GBI: Plastics Processing accelerated contraction in July, with custom processing activity contracting slower, landing almost two points higher than the overall index in July.

New orders, production and backlog contracted at accelerated rates in July, driving the drop in the overall plastics index, with employment ‘holding its own’ to minimize the decline.

Related Content

Plastics Processing Index Remains Virtually Unchanged

Future business indicators rose again this month, but other inputs changed only slightly.

Read MoreProcessing Takes a Dip in June

Plastics activity took a relatively big downturn in June, ending at a low for the year and lower than the same month a year ago.

Read MorePlastics Processing Business Index Contracts Further

All components dip as index hits low point of 2023.

Read MorePlastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More