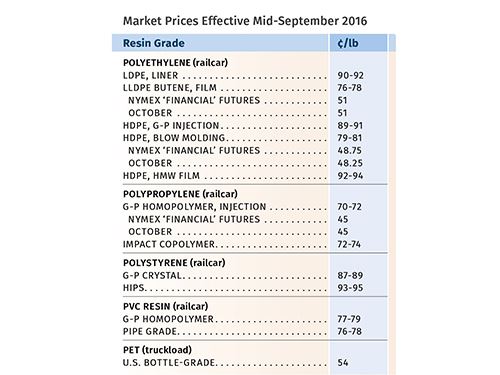

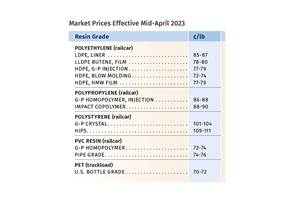

Resin Prices Mostly Higher

Third quarter ends with upward movement for most resin prices, even for high-volume engineering grades, except for PET.

Prices of nearly all large-volume commodity and engineering resins ended the third quarter largely on an upward trajectory, with the exception of PET. Overall, this has been an events-driven upward movement that included the impact of domestic flooding and hurricanes, unplanned feedstock and resin outages, and tight supply/demand dynamics in some cases. Barring further major disruptions, prices for most of these resins—other than PET—are likely to hold even through the remainder of the fourth quarter.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of the Plastics Exchange, The, Chicago, and Houston-based PetroChemWire (PCW).

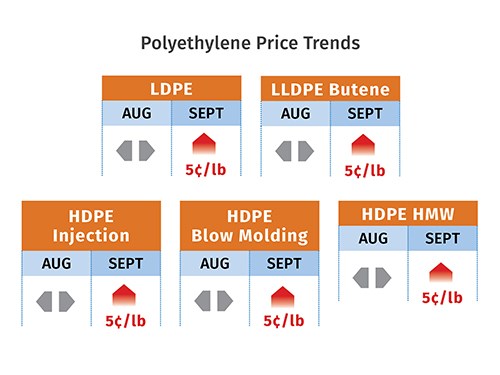

PE PRICES HIT NEW PLATEAU

Polyethylene prices were expected to move up 5¢/lb last month, the full increase sought by suppliers for September. Another 4¢/lb hike issued by at least one supplier for this month was unlikely to succeed, according to industry sources. Stretch-film processors announced a 6% September price increase, which PE suppliers saw as acceptance of their higher resin tabs that month, according to Mike Burns, RTi’s v.p. of client services for PE. Since the September increase was not demand-driven, PE prices are unlikely to rise further this year, barring a major capacity disruption or crude oil prices exceeding $55/bbl, said Burns. He noted that the increase boosts the domestic price premium over the global PE price to 15¢/lb, when it ought to be no more than 10¢/lb to avoid competition from imported finished goods such as bags.

Rising ethylene costs, up more than 10¢/lb in August alone, and several unplanned production disruptions due to flooding and other issues, were two key drivers in this price resurgence.

Nearing end of August, news reported by PetroChemWire included ExxonMobil notifications to customers of its Baton Rouge, La., and Beaumont, Texas, plants of limited availability/delayed shipments of certain products. There were reports in early September that Chevron Phillips’ Cedar

Bayou, Texas, LDPE unit had restarted, while LyondellBasell’s Morris, Ill., facility was not expected back on line until late September.

There was a buying frenzy of discounted material in step with the September price-hike notifications. The Plastics Exchange’s Greenberg reported, “The spot PE market remained active, though the volume of new offers slowed. Some grades [were] outright difficult to source, including LDPE for film.” Spot prices rose by as much as 5¢/lb for some grades.

PP PRICES SPIKE

Polypropylene prices rose by 3.5¢/lb in August, in step with that month’s propylene monomer contract increase to 37¢/lb. Based on early September spot propylene prices of 43.5¢/lb, September contracts were likely to surge to 45¢/lb—the largest increase in the monomer for over a year.

“We expect to see an increase in PP prices of at least a 5¢/lb and as much as 8¢/lb,” said Scott Newell, RTi’s v.p. of PP markets. This was attributed to broad-based and mostly unplanned supply issues at propylene production plants, crackers, and refineries. In addition, there are several planned cracker out- ages scheduled for the September-October time frame.

The Plastics Exchange’s Greenberg reported spot monomer prices jumping by more than 10¢/lb through most of August, and forecasted increases of another 7-9¢/lb based on September propylene contract nominations. “The market could be eying a double-digit monomer price increase, which has not been seen since January 2013.”

Nearing the end of August, PCW reported that PP spot prices were 1-2¢/lb higher as suppliers responded to rising monomer costs, Availability was adequate although there was some talk about tighter supply of impact copolymer due to approaching maintenance outages in late third/early fourth quarters. RTi’s Newell noted that going into September, the market was still not balanced, with supply exceeding demand, and he ventured that spot PP prices would rise but remain quite a bit lower

than contract prices. He noted that demand for 2016 thus far is roughly even with 2015, with domestic demand slightly lower and overall North American demand up less than 1% due to the impact of PP resin imports.

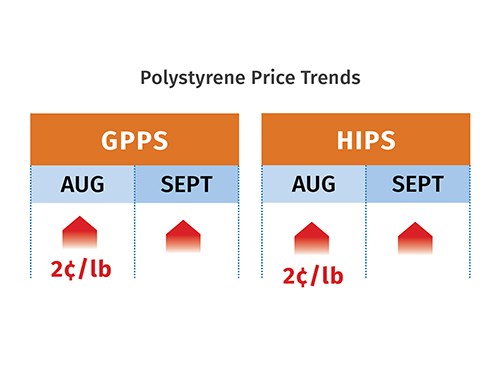

PS PRICES UP

Polystyrene prices moved up 2¢/lb in August, and were expected to rise again last month as suppliers sought a 3¢ hike, according to both PCW and Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC. By August’s end, PCW reported that with spot benzene trading about 20¢/gal higher and ethylene also trading higher on tight supply, there appeared to be sufficient cost pressure for a further price increase in September.

Benzene contracts in August moved up 15¢/gal and that month’s ethylene contracts were settling up by 2.75¢/lb to 33¢/ lb. At press time, September benzene contracts appeared to be settling another 20¢/gal higher, which Kallman says equates to a 2¢/lb cost increase for PS production. Kallman said PS suppliers were more likely to get 2¢ out of their 3¢ September increase. Softening of PS demand is typical after the summer season.

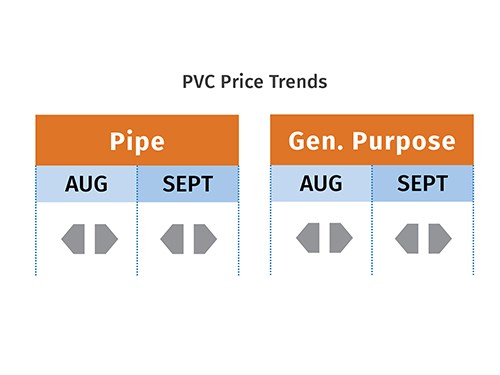

PVC PRICES FLAT TO HIGHER

PVC prices stayed flat in August, and were expected to be flat for the sixth consecutive month in September. However, PVC suppliers are seeking to implement a 4¢/lb price increase this month, according to RTi’s Kallman and PCW, owing primarily to ethylene price increases resulting from production disruptions. PCW’s August weighted-average spot ethylene price was 34.986¢/ lb, up 7.334¢/lb, and contracts settled up 2.75¢/lb. Moreover, September ethylene contract nominations were coming in 2-3¢/lb higher.

How much of the new increase will be implemented is dependent on export markets as well as downstream demand, according to Kallman, who notes that the end of the construction season is also upon us. Meanwhile, PCW reported that Houston-based Westlake Chemical confirmed the acquisition of Atlanta-based Axiall Corp., on Aug. 31. The combined company is the second largest PVC supplier in North America and the third-largest globally.

PET PRICES FALL

Domestic bottle-grade PET prime resin prices in August averaged 54.82¢/lb, down 1.13¢/lb from July, based on PCW’s Daily PET Report. This represents PET resin on a delivered Chicago basis. On Sept. 1, the price was 54¢/lb.

Meanwhile, U.S. imported PET (packaging grade) averaged 49.47¢/lb in August, down 0.62¢/lb; the price on Sept. 1 was 48.75¢/lb. This represents imported PET resins on a delivered duty-paid U.S. ports basis. Prices for both were being pressured downward in September by lower feedstock costs for paraxylene, PTA, and MEG, down 1-1.5¢/lb by the end of August, according to a large-volume buyer of prime and recycled PET.

With another 2.4 billion lb/yr of prime PET being brought on stream by year’s end by M&G Chemicals, in a domestic market already saturated with the resin, PET prices long-term still have some falling to do by some estimates, said Xavier Cronin, senior editor of PCW’s PET Daily and Weekly Recycled Plastics reports.

ABS PRICES FLAT FOR NOW

ABS prices were flat through the first two months of the third quarter. But by late August, suppliers faced upward cost pressure from benzene, propylene, and butadiene, according to RTi’s Kallman.

Though there were no price increases in the offing at press time, Kallman pointed out two additional factors that could change the price trajectory: the consistency of domestic demand in automotive and appliance sectors, and imports were not as well priced in the third quarter vs earlier quarters due to apparent monomer disruptions in Asia.

PC PRICES FLAT TO SLIGHTLY UP

Polycarbonate prices were largely flat to slightly higher through most of the third quarter, and while there were no resin price increases announced, cost pressures from benzene and propylene feedstocks were being felt by PC suppliers.

The clincher, though, is that imports have slowed, which could counteract the feedstock cost pressure, said RTI’s Kallman. He ventured that PC prices could remain unchanged, in view of the fact that while domestic demand for automotive is good, demand for the construction sector was winding down.

NYLON 6, 66 PRICES UP

Nylon 6 prices were expected to move up 5-10¢/lb by the third quarter’s end, driven primarily by fast-rising benzene prices and increases in caprolactam, according to RTi’s Kallman. He said prices through the fourth quarter would be flat, noting that domestic demand has held steady.

Nylon 66 prices remained flat through the first two months of the third quarter, but one major supplier issued a 10¢/lb global increase for Oct. 1. Most of the cost pressure is being faced by suppliers that produce the material via the benzene/propylene route, according to Kallman. Those that produce nylon 66 via the butadiene route are also facing cost pressure but to a lesser extent. Demand in automotive continues to be good, with E/E and construction trailing behind.

Related Content

PP Prices May Plunge, Others Are Mostly Flat

PP prices appear on the verge a major downward trajectory, with some potential of a modest downward path for others.

Read MoreRecycled Content to be Incorporated in PS Foam Packaging

Pactiv Evergreen and Amsty announced a collaboration that will bring ISCC plus certified product into select food packaging.

Read MorePrices of PP, PET Drop; PE, PS and PVC to Follow

Going into fourth quarter, prices of the five commodity resins were heading downward, barring supply interruptions.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More