Resin Supply/Demand & Sustainability Were Key Themes at Global Plastics Summit

Speakers at fifth annual summit deem sustainability crucial to growth in packaging while forecasting trends in key materials.

With the industry still reeling from a devastating season of hurricanes, the fifth annual Global Plastics Summit (GPS 2017) drew more than 350 attendees from over 20 countries. Held in Chicago, the October event was hosted by Houston-based IHS Markit and the Plastics Industry Association (PLASTICS), Washington, D.C.

Several presentations from IHS Markit analysts and others discussed the impact of the hurricanes on resin availability and pricing. Sustainability was also front and center at the GPS 2017, with presentations by a couple of major resin suppliers and upstream industry collaborators, particularly in the packaging arena.

PROJECTIONS ON KEY RESINS

Drawing strong attention were presentations focusing on forecasts for PE, PP, PET and commodity engineering resins. Here are some takeaways:

• Polyethylene: IHS Markit’s Nick Vafiadis, v.p. for global polyolefins and plastics, addressed the market impact of new global PE capacity but also the impact of Hurricane Harvey on the U.S. Gulf Coast. In short-term pricing trends, he expects that the announced 7¢/lb increases would go through, meaning that processors will be paying a total of 10¢/lb more for PE since August. However, he does not expect PE prices to rise much higher, as that would invite in cheaper imported finished goods. He projected a trough for PE prices in 2019, but one that will be relatively shallow.

Despite PE production delays—both on new plants and restarts, Vafiadis expects that capacity will outstrip demand in 2017-2018. In particular, he projects unprecedented growth in capacity for metallocene PE for film and packaging, which he contends will commoditize the material.

North America will be a net importer of PP until after 2020, when new capacity starts to become available.

• Polypropylene: IHS Markit’s Joel Morales, senior director of polyolefins America, discussed new Chinese PP capacity and its impact on global markets. He sees stronger demand for PP, but given the short-term absence of new U.S. capacity, he projects a tighter market and higher prices. Morales predicts that North America will be a net importer of PP until after 2020, when new capacity starts to become available.

Morales expects global PP supply/demand balance to be tighter in the coming years, resulting in high supplier margins. All eyes are on Asian PP demand, which will help determine global prices. Global reinvestment will occur, but not in the near term. Resulting global tightness could lead to uncompetitive pricing versus alternative materials.

Mark Nikolich, CEO of Braskem America Inc., discussed what he termed “the revival of PP.” He noted that the billions of pounds of dedicated propylene monomer production underway in North America (a change from decades of propylene production as a mere byproduct) are likely to lead to PP capacity growth, starting in 2020. He said the macro drivers that are bringing about a “PP renaissance” include PP’s relative competitiveness with other resins and non-plastic materials; fuel-efficiency standards for new vehicles and the resulting pressure for weight reduction; manufacturing reshoring; and increases in consumer spending (reportedly outpacing GDP growth by 0.5-1%/yr).

• PET: IHS Markit’s Tison Keel, director of PET, PTA & EO derivatives, noted that fiber continues to be the largest and fastest-growing PET end use market, concentrated particularly in Asia.

Global PET capacity now exceeds demand by 25%, spurring keen competition in pricing. Keel noted that North America is both oversupplied and still building new capacity. Demand growth will not consume the surplus anytime soon, and suppliers’ margins are squeezed thin. He noted that North American PET suppliers have responded with consolidation from eight to four producers since 2011, active pursuit of tariff protection from imports, and increased back-integration into feedstocks to boost profitability.

IHS Markit’s Paul Blanchard, senior director for engineering plastics, addressed ABS, PC, and nylons 6 and 66:

• ABS: Global demand for ABS is now catching up with supply. Blanchard forecasts 4% annual growth globally. Moreover, he noted that the North American ABS market relies in part on Asian imports, which account for about 25% of domestic consumption. He ventures that prices of ABS will be relatively moderate over the next two years.

• PC: Globally, the largest consumption of PC is taking place in China, with several new entrants now bringing on new capacity there. At the same time, the global growth rate for PC usage is no higher than GDP, so new capacity is expected to exceed demand. As for U.S. prices, Blanchard expects that high plant operating rates through 2018 will support firm prices.

• Nylon 6 & 66: Blanchard noted that while nylon 6 fiber demand is slowing, demand for engineering grades is growing faster, particularly in China. He projects relatively flat domestic pricing for nylon 6. Blanchard also sees Northeast Asia becoming the largest consumer of nylon 66. For the U.S., he projects fairly stable pricing and fairly balanced supply/demand.

SUSTAINABILITY VITAL TO PLASTICS GROWTH

On the issue of sustainability, keynote speaker Mark Saurin, commercial v.p. of Packaging and Specialty Plastics in the Materials Science Div. of DowDuPont, addressed the need to ensure a sustainable future for growth of plastics. He noted that due to increased global demand and abundant low-cost feedstocks in the U.S., the plastics industry is undergoing a manufacturing shift from East to West with an unprecedented wave of new investments in PE capacity of nearly 20 billion lb/yr, phased to ramp up from now until 2021.

He predicted growth in PE consumption averaging 1.3 times GDP, or 4.2%, to 2020. Said Saurin, “Plastics have proven to be a reliable and sustainable choice for multiple types of high-performance applications, and a future of growth seems certain for our industry. But there is an Achilles heel to this bright scenario—the rising amount of plastics waste that is polluting our oceans, environments, and communities. We must acknowledge that the world has a severe waste-management issue, and plastics is the poster child for our trash problem, with disturbing images of overflowing landfills and debris-strewn beaches, rivers, and seas. Every day, voices are getting louder and challenging the use of plastic packaging. Special-interest groups are mobilizing. We must work together as an industry to drive end-of-life options for plastics that support a circular economy that will take plastics out of the waste stream and recycle for energy or another strategic purpose. This is just not a reputation issue—it is business critical. In order to preserve our ability to sustain a preference for plastics with consumers and the value chain, we must close the loop on the recyclability of plastics.”

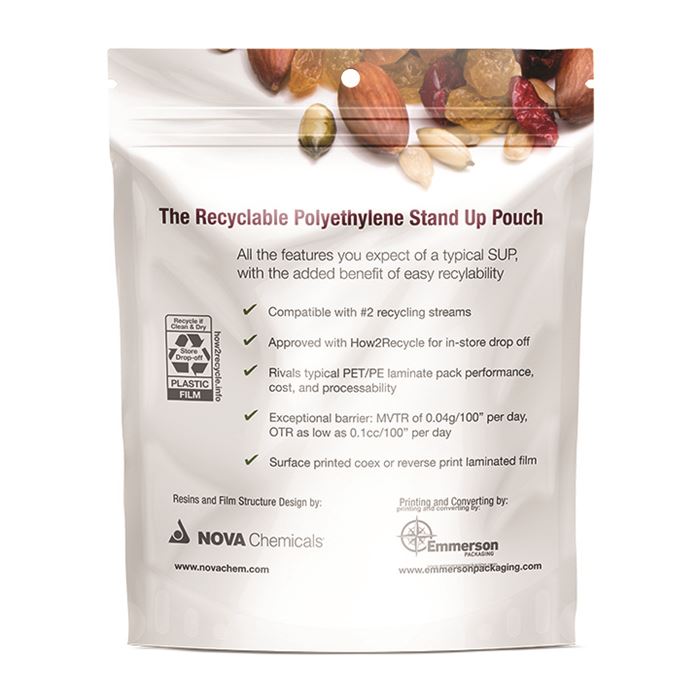

A collaboration across the value chain to design and market a recyclable, all-PE stand-up pouch was presented by Todd Becker, PE sales director at Nova Chemicals Inc., Pittsburgh; Kathy Bolhous, CEO of Charter NEX Films, Milton, Wis.; and David Potter, v.p. of supply chain and product engineering at Plastic Packaging Technologies, Kansas City, Kan. This team also developed a large, all-PE pet-food bag, which will be commercialized soon.

Questions about Materials? Visit the Materials Zone.

Jason Paladino, v.p. of applications development at Berry Global (formerly Berry Plastics), Evansville, Ind., discussed how consumers drive packaging innovations: “By anticipating consumer trends, we have a sneak peek into the future of our industry.” Paladino noted, for example, that “recyclability of packaging” has become a key interest to consumers.

IBM Research’s Jeannette Garcia, research staff member, addressed value from secondhand plastics as a resource for new chemistry. For example, IBM Research, Yorktown Heights, N.Y., has taken polycarbonate CD waste and used a catalyst to break it down to yield a monomer that allowed IBM to produce a polysulfone.

According to Garcia, their next set of challenges is designing catalysts that can break down polyolefins, foams, and composites.

Related Content

Flexible-Film Processor Optimizes All-PE Food Packaging

Tobe Packaging’s breakthrough was to create its Ecolefin PE multilayer film that could be applied with a specialized barrier coating.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More