Smaller, Thinner Connectors Drive LCP Growth

Strong demand for smaller and thinner electrical components that must withstand higher temperatures is pushing the envelope for suppliers of liquid crystal polymers (LCPs). This trend has prompted development of a new range of ultra-high-heat materials that boast high flow for thinner walls and faster cycle times in lead-free, surface-mount connectors.LCPs’ predominant market is still connectors, but suppliers of these premium-priced resins are looking to diversify into electronic packaging, automotive lighting, and consumer goods like cookware.

Strong demand for smaller and thinner electrical components that must withstand higher temperatures is pushing the envelope for suppliers of liquid crystal polymers (LCPs). This trend has prompted development of a new range of ultra-high-heat materials that boast high flow for thinner walls and faster cycle times in lead-free, surface-mount connectors.

LCPs’ predominant market is still connectors, but suppliers of these premium-priced resins are looking to diversify into electronic packaging, automotive lighting, and consumer goods like cookware. Global demand for LCPs is climbing 12%/yr and the market has made a full recovery since the technology “bust” of 2001, according to Austin Peppin, senior consultant for market-research firm BRG Peppin.

Asia is the leader

In the last five years, many of the world’s largest telecommunications, bus-iness-equipment, and computer companies have moved production to the Far East, and U.S. connector manufacturers like Molex and Tyco Electronics have followed suit. As a result, approximately 67% of world LCP consumption is in Asia. China has become the leading market, but most product specification and application development still takes place in the U.S, Europe, and Japan.

Seven of the 12 LCP suppliers are based in Japan. One of the exceptions is Ticona, the leading supplier with a 20% share. Polyplastics Co., Ticona’s Japanese joint venture with Daicel Chemical Industries, has 12% of the market, according to Peppin. Other key players include Japan’s Sumitomo Chemical Co., with a 12% share, and DuPont Engineering Polymers, with 9%.

Total 2006 global consumption of about 68 million lb includes 45.8 million lb in the Asia/Pacific region, 13.6 million lb in North America, and 8.6 milion lb in Europe, according to BRG. Approximately 90% of the total consists of reinforced, injection molded materials. Electrical components account for 86% of consumption.

Increased demand has prompted both Ticona and Sumitomo to locate new plants in China. Sumitomo will build a 13.2-million-lb compounding facility in Wuxi, China, next year and Ticona says it will manufacture in the Shanghai region in 2008-2009. Meanwhile, Toray will boost polymer capacity by 4.4 million lb in Japan.

Higher heat, thinner walls

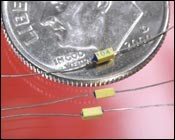

A key trend is the continuing miniaturization of connectors and other electronic components. These ever more complex parts are working in hotter environments at higher electrical frequencies, says Ed Hallahan, Ticona’s global product manager for Vectra LCP. Consequently, there is greater demand for LCPs with greater heat resistance and flowability, two properties that are often difficult to reconcile. But more heat resistant, faster-filling LCP grades can now produce fine-pitch connectors with wall thicknesses down to 0.2 mm. Ticona’s newest high-heat series includes Vectra S135 with an HDT of 340 C/644 F, suitable for surface-mount applications with lead-free solder. It boasts improved weld-line strength and reduced viscosity. Ticona is also working on new high-heat grades to fill even thinner walls.

Another new grade, Vectra S471, is a mineral/glass-filled grade with similar heat resistance but better dimensional stability. Vectra S475 is a new mineral/glass version with the highest flow.

DuPont’s new high-temperature series includes Zenite 9140HT with an HDT of 356 C/673 F. The 40% glass-filled grade is described as “processor-friendly” because its high-temperature stiffness requires only a modest increase in melt temperature. Miniaturization has also created electronic parts with a lower profile, notes Bill Hassink, DuPont’s senior development program manager. DuPont introduced Zenite ZE55201, a 50% mineral/glass-filled, ultra-low-warp grade for these low-profile connectors, which require better balanced shrinkage to avoid warpage.

A new high-heat entry from Toray Resin Co. is Siveras LX with improved weld-line strength, toughness, and low outgassing. It offers higher flow than competing LCPs for fine-pitch connectors, according to Shinichi Matsushima, sales and marketing manager. What’s more, 35% and 45% glass-filled Siveras L304T reportedly offers cost/performance advantages over high-heat nylon in connectors.

LCPs are also finding uses in high-heat consumer electronics. Examples are a hard-disk actuator for a portable music player and a Blu-ray disk pickup lens holder, according to Toray.

Sumitomo has met the demand for fine-pitch connectors with a new generation of high-flow materials that double the flow length of standard grades. Soon-to-be-introduced SumikaSuper LCPs boost flow length from 10 to 20 mm, according to William Pleban, business development manager for Sumika Electronics Products, a U.S. subsidiary.

For the growing number of high-frequency electronic applications, Sumitomo has developed new “loss-tangent” LCP materials. They absorb less radio-frequency energy than standard LCPs and retain the signal in high-frequency connectors and antennas for cell phones and other telecommunications equipment.

Beyond electronics

Suppliers are also looking to exploit these LCPs’ outstanding properties in additional markets such as consumer cookware and lighting. For instance, Ticona launched Vectra E540i for injection molded baking pans and trays. The material withstands all food preparation steps from -40 to 465 F and is suited to conventional or microwave ovens and freezers. Ticona claims that cookware made of LCP comes to temperature more quickly, transfers heat more uniformly, and cools more safely. The new materials have an inherently smooth surface that enables easy release for baked goods and is much easier to clean than aluminum.

LCP is starting to find use in lighting because of its thermal capability and lack of outgassing. As automotive lighting components like sockets and bezels get smaller, the area to dissipate the heat is also reduced. So LCP is seen as a viable alternative to PBT and PPA in such applications.

A high-intensity-discharge (HID) lighting system for greenhouses in Europe consists of a lamp holder made of DuPont’s 45% glass-filled Zenite 7145L LCP. It has an HDT of 295 C/563 F, thermal aging resistance (RTI of 240 C), and a cost advantage over ceramics or thermosets.

Another emerging LCP market is as a replacement for ceramics and metals in electronic packaging. Ticona recently announced that proprietary epoxies from RJR Polymers Inc., Oakland, Calif., are the first to bond to a range of LCPs for fabricating air-cavity packaging for sensors and other electronics. LCP air-cavity packaging is a containment system that protects sensors, microelectromechanical systems (MEMS), integrated circuits, and other elements from environmental and mechanical influences. Such packaging is typically less than 38 mm long and 38 mm wide and consists of a housing, a lid, and a lead frame encapsulated in the housing. RJR’s LCP molding operation uses a patented method to seal leads from the lead frame as they pass through the package sidewall. A small amount of epoxy is placed on the frame during molding to form a strong metal-to-plastic bond. LCPs help to speed prototype design and cut tooling cost relative to ceramics.

(One other LCP supplier, Solvay Advanced Polymers, declined to discuss its Xydar products for this article.)

Compounders have a niche

While makers of LCP base polymers provide standard products that address the needs of most connector manufacturers, specialty compounders have carved out small niches with plateable, conductive, and wear-resistant grades, plus other unique technologies. For example, Cool Polymers, a formulator of thermally conductive compounds, offers two grades that are electrically conductive and two that are electrically insulative. Thermal conductivity of filled injection molding grades ranges between 10 and 20 W/mK compared with 0.2 W/mK for typical LCPs. These materials are lubricious and cause no tool wear or other degradation, according to sales manager Gary Arnold. A major advantage is that 3D net shapes are achieved at up to 50% lower cost than with ceramics or metal.

RTP Co. also fills specialty performance gaps with compounds that provide EMI shielding, wear resistance, or plateability. Another focus is electronic encapsulation, which requires LCPs with exceptional dimensional stability, stiffness, and flow. In a capacitor housing for a hearing aid, RTP 3400 Series LCP contains a custom reinforcement that increases dimensional stability both out of the mold and during temperature cycling.

RTP also focuses on improving LCP compounds’ weld-line strength and transverse properties, typically the Achilles heel of LCPs. This is done by modifying the reinforcement package and flow characteristics, according to Brett Weishalla, sr. product development manager.

The main thrust in LCPs at LNP Specialty Compounds, a business of SABIC Innovative Plastics (formerly GE Plastics), is conductive and lubricated grades. Carbon-fiber reinforced grades with or without PTFE are available in 10% to 30% loadings for electronics material handling, data storage, and automotive electronics. The company is investigating carbon nanotube technology to decrease surface resistivity in ESD applications and is examining various filler loadings and flow aids to improve weld-line strength.

Read Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More