Some Price Relief for Commodity Resins

Prices lower for polyolefins and flat to slightly higher for PS, PVC and PET.

Prices of PE and PP, which have seen historic highs in the last couple of years, are ending this year lower as supply appears to have outpaced demand. In contrast, year-end prices of PS, PVC and PET appeared to be flat to higher with supply constraints of feedstocks and/or resin, coupled with strong demand, particularly in the case of PVC and PET.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior editors from Houston-based PetroChemWire (PCW), and CEO Michael Greenberg of The Plastics Exchange.

PE Buyers Gain Leverage

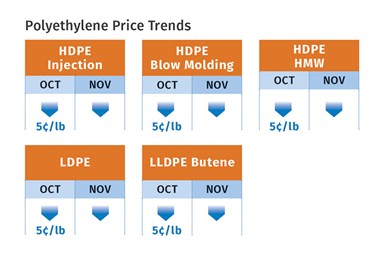

Polyethylene prices dropped in October by 5¢/lb and were expected to sink lower in November-December, according to Mike Burns, RTi’s v.p. of PE markets, as well as PCW senior editor David Barry and The Plastic Exchange’s Greenberg. Burns thought PE prices could fall as much as 10¢/lb in the fourth quarter. He said, “Suppliers conceded almost two years of historic pricing power in October, after 2021 increases totaling 41-43¢/lb. Starting in August, supply began to outpace demand, which continued to be healthy.”

Barry noted that spot buying activity remained lackluster, with many processors holding out for lower prices. Going into November, he reported spot prices were on a downward slide, with HDPE in the lead: “Overall, supplier inventories were ample, and some market observers said producers would need to either rapidly accelerate the pace of exports in November or throttle back production.”

Greenberg reported that most spot commodity PE grades had slipped under $1/lb, except for still-scarce injection and rotomolding grades of LL/LDPE which commanded the highest premiums “All PE film grades remained under pricing pressure. Other grades such as HDPE injection and blow molding, which had been more sought after over these past three quarters, have seen premiums deflate gradually as availability improved.”

All three sources saw processors having much more leverage for their 2022 contract settlements due to the buildup in supplier inventories, bolstered by major new capacity coming on stream next year from the SABIC/ExxonMobil venture, Shell, and the fully operating Braskem Idesa plant.

PP Prices Sinking

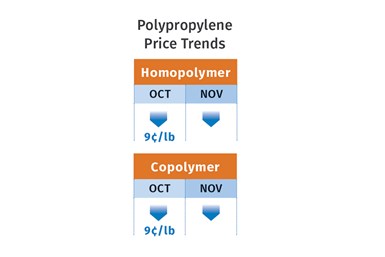

Polypropylene prices dropped in October by 9¢/lb in step with propylene monomer, and further moderate declines were anticipated through year’s end, according to Scott Newell, RTi’s v.p. of PP markets, PCW’s Barry, and The Plastic Exchange’s Greenberg. Said Newell,“We’re closer to a bottom than we thought initially, as monomer is tight, partly because PP demand has slowed, leading suppliers to throttle back production.” He saw potential for monomer to drop by another 5¢/lb, and PP would follow, in the last two months of the year.

Barry noted that spot-market availability of homopolymer grades had improved more rapidly than copolymer, but he characterized nearly all products as well supplied. “Buyers were opting to wait as long as possible to transact and were concerned about holding high-cost inventory with prices falling. In addition, year-end downstream orders for some types of finished goods were weakening.”

Going into November, Greenberg reported spot PP prices were down by over 12¢/lb as a combination of improving supply, lackluster demand and weak monomer costs had pressured the market lower. “Spot PP prices are in the midst of swinging from premium to discount as the market unwinds,” he said. “PP exports have increased somewhat, although not massively. Domestic demand has softened as processors work down their defensive inventory positions built during the third quarter. Small processors, large contract buyers and distributors alike are enjoying a rare taste of pricing power and they anticipate further price erosion in both spot and contract prices.”

PS Price Outlook Mixed

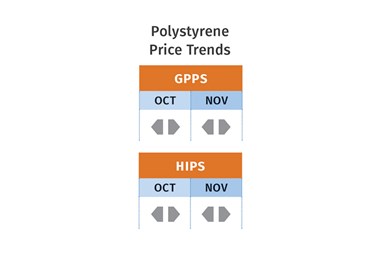

Polystyrene prices were flat in October and were likely to remain unchanged last month and perhaps into this month, according to Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets, as well as PCW’s Barry. Suppliers claimed that production hiccups had somewhat tightened supply and that styrene monomer prices had increased.

But Chesshier noted that PS buyers had more leverage to negotiate and ought to be looking for concessions: “The cost to produce polystyrene is down for two consecutive months. We had eight consecutive months of increases, all of which were attributed to feedstock prices—primarily benzene. By late October, prices of benzene had dropped to $3/gal from a $4/gal peak in April, and styrene monomer had dropped by 23% in that similar period. Moreover, butadiene prices have also fallen, there’s sufficient resin supply, and we are in the slow season for polystyrene.” Bottom line: prices should be coming down, she contended.

On other hand, by October’s end, Barry reported that implied styrene monomer cost based on a 30/70 ratio of spot ethylene/benzene was at 41.3¢/lb, up 1.9¢/lb over the previous month. He noted that suppliers were characterizing domestic supply as balanced to tight, with no loosening up till year’s end. “GPPS supply was considered adequate, but HIPS production has been limited by polybutadiene rubber shortages. Shortages of mineral oil and zinc stearate ingredients were also mentioned as an issue for producers,” he reported.

PVC Prices May Rise

PVC prices remained flat in October, but suppliers were aiming to push through a 5¢/lb increase in November, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. Neither source thought that all of the increases would go through.

Kallman ventured that they could be split between November and this month and possibly negotiated lower ahead of 2022 contracts. He cited demand that is about 7.5% higher than 2020 year-to-date, with supply still tight, making it a sellers’ market. Todd reported that resin buyers were skeptical that the entire 5¢/lb would be implemented for November, with some believing that only 3¢/lb would be pushed through. “Buyers acknowledged that PVC prices have been rising due to strong demand rather than because of a cost push from either ethylene or chlorine, but they have already absorbed 26.5¢/lb in price increases through October of this year on top of the 19¢/lb implemented in the second half of 2020, for a total of 45.5¢/lb.”

PET PRICES UP

PET prices moved up about 1.5¢/lb in October and were likely to gain another 1.5-2¢ in November, according to RTi’s Kallman. He saw flat pricing more likely for this month.

Key drivers behind rising prices include tight domestic resin supply due to constraints on feedstocks PTA and MEG that resulted from planned and unplanned outages, higher energy costs, and strong domestic demand. “Demand remains strong as consumers appear to be stocking up again,” said Kallman. He noted that PET imports are helping to fill the gap, though at prices on par with domestic prices.

Related Content

Polyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MorePrices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More