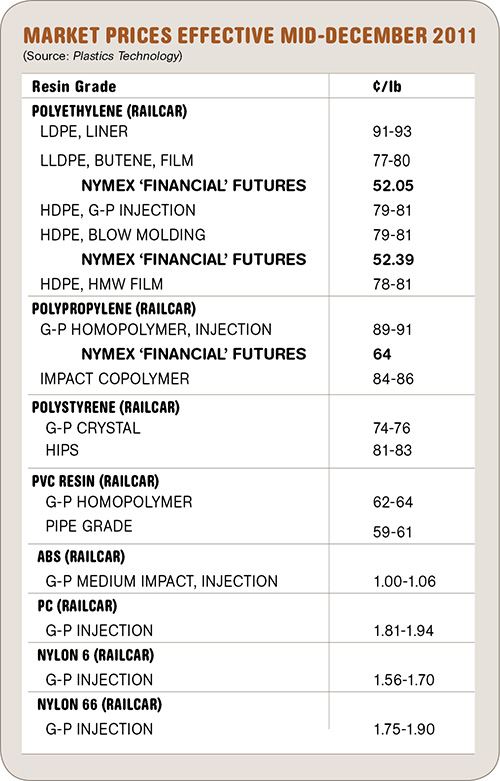

Some Resin Prices Bottom Out, Others Are Still Falling

With the start of the new year, commodity resin prices, except for PVC, appear to have bottomed out.

With the start of the new year, commodity resin prices, except for PVC, appear to have bottomed out. Ditto for ABS. But further price declines are forecast in this first quarter for PVC, nylons, and PC, driven by slowed global demand, oversupply, and reduced feedstock costs, according to resin purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Tex.

PE PRICES COULD REBOUND

Polyethylene prices appeared to have hit bottom in the November-December time frame, and now upwards pressure is expected to start building. Suppliers have three pending increases since November, totaling 18¢/lb. At least some of that is expected to be implemented in the first quarter. Domestic buyers are entering the year in a “buy” position after year-end inventory reductions. There is tight material availability due to suppliers’ production cutbacks. And feedstocks are once again exerting price pressure, primarily because of planned cracker shutdowns.

Flat-to-soft pricing in November/December was driven largely by falling demand (down 8%), not feedstock price movements. Operating rates dropped to an average of 87%; production was down by 1%. Product availability was ample and secondary-market buyers saw some opportunistic purchases through the first half of December.

Outlook & Suggested Action Strategies

30-60 Days: Anticipate upwards price pressure. There could be multiple price increases during the first quarter. Consider prebuying early.

PP PRICES RIDING THE BOTTOM

Polypropylene prices were flat last month after falling a total of 20¢/lb in October/November, in concert with price decreases in propylene monomer. ExxonMobil made an attempt to hike monomer prices by 3¢ last month, while Braskem followed with a 3¢ hike on PP. Neither appears to have received support, as market fundamentals simply do not support any increases.

The year’s pricing trough was in December, with PP down by 39¢/lb from the year’s high in May, and propylene monomer was down to 58¢/lb. Following a very active secondary market in October, when spot material was selling at a discount, deals were essentially nil after November.

PP demand dropped 6% last year from 2010, and PP supplier inventories increased by nearly 40 million lb. Typically, with 40+ days of supply and soft demand, suppliers throttle back production. Instead, they upped production late in the year to take advantage of lower monomer prices and to stock up for the forward sales that have taken place.

Last month, Sunoco moved up the permanent shutdown of its Marcus Hook, Pa., refinery from the originally scheduled July 2012, date because of deteriorating market conditions. This closure could have serious implications for monomer supplies into Braskem’s Markus Hook PP plants.

Outlook & Suggested Action Strategies

30-60 Days: Last month was a low-risk buying environment, though the lower prices did not necessarily spark any real demand. Expect to see a prices rebound in the first quarter. Buy as needed. Scheduled outages at the cracker and refinery level set the stage for tighter monomer supplies.

PS PRICES DROP FURTHER

Polystyrene prices dropped further in November: GPPS by 1¢ to 2¢/lb and HIPS by 3¢ to 5¢. December prices were expected to fall another 1-2¢ for GPPS and 2-3¢ for HIPS, possibly signaling a market bottom. According to RTI consultants, the decline in prices between September and December brought more than usual variability from account to account. Those who achieved the greatest decreases were buyers with healthy competition in their supply base, ability to switch between alternate suppliers, and a mix of contract and spot/distributor purchases.

With falling feedstock prices, cash cost to make resin dropped over three months by 10¢ to 13.5¢/lb for GPPS and 14-19¢ for HIPS. Resin contract prices through November were down 9¢/lb for GPPS and 11¢ for HIPS. Ditto for spot prices, which by the end of November had fallen 13¢/lb for GPPS and 17¢ for HIPS.

Industry data from October showed an inventory drawdown of 17.3 million lb, the result of throttling back operating rates to 76% from the low- to mid- 80s, as well as a modest increase in demand from below-average to average. The latter was viewed as mainly opportunistic buying due to soft prices.

Outlook & Suggested Action Strategies

30-60 Days: There is a strong possibility that December/January resin pricing will prove to be the bottom of the cycle. Buy as needed. Unless demand remains weak, seasonal cyclical forces should begin to push prices upward in February.

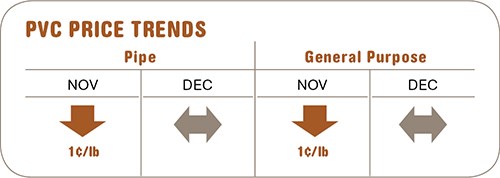

PVC PRICES FLAT

PVC resin prices remained flat last month after dropping 2¢/lb in September, and 1¢ each in October and November. PVC feedstock costs declined by a penny in October and were off by zero to 5¢ in November.

Downward pressure on PVC was offset partly by the 1¢/lb increase in the November ethylene contract price to 55¢/lb, along with an increase in exports and suppliers cutting operating rates to under 79% from the low-to-mid 80s. In the fourth quarter, demand rose modestly to 80% of industry capacity. While domestic demand fell 4% and production fell 5%, exports are up 13%. The recently announced easing of credit in China is also expected to give a boost to demand this year.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed. RTI anticipates softer global demand in this quarter will help maintain lower domestic PVC prices. The strength of exports will be a key factor in price movement.

ABS PRICES BOTTOM OUT?

ABS prices dropped at varying amounts between September and December, for a total decrease of more than 20¢/lb for most grades. On the basis of December feedstock prices, cost to produce ABS was down by more than 28¢/lb from the May 2011 highs.

G-P ABS prices have fallen faster than extrusion and specialty grades. With continued import activity, North American suppliers have had to react to lower prices abroad. ABS demand continues to slump around the globe and domestic demand remains slower than anticipated. Suppliers in North America are now running at very low operating rates—less than 50%, while many Asian plants remain offline or have throttled down to minimal production rates.

Outlook & Suggested Action Strategies

30-60 Days: Prices are expected to flatten out this month, as this could be the bottom of the cycle. Some feedstock costs are likely to increase. Creating competition for your resin business is critical and including approved imported ABS material should be part of your strategy.

NYLON PRICES DOWN

Prices of nylon 6 and 66 were being pressed downwards by falling feedstock costs. What was a more balanced nylon market just a couple of months back has moved to a well-supplied buyers’ market due to slowed global economic demand.

While domestic automotive demand for nylon 66 remains steady, demand in other markets and for export is weaker. There were reported pricing concessions for nylon 66 of 3¢/lb starting in early December, with more anticipated by the first of this month.

Suppliers have cited a need to hold onto margins in order to recapture what was lost last summer and to support reinvestment. However, they have benefitted from ongoing feedstock decreases. Some producers who use the “butadiene route” to nylon 66 manufacture saw feedstock costs drop 8-9¢/lb in November and an expected 5-6¢ additional decline last month. Overall feedstock costs were up 1-2¢/lb from December 2010.

Suppliers who use the “propylene route” to nylon 66 saw their feedstock costs drop 12-13¢/lb in October, another 3-4¢ in November, and an expected 1-2¢ last month. For the full year, their costs were down 3-4¢/lb.

Meanwhile, pressure on domestic nylon 6 suppliers to lower prices has been building up as caprolactam prices weaken. Feedstock costs for integrated nylon 6 suppliers dropped 7¢/lb in October and 2-3¢ more in November. December costs dropped by 1-2 ¢ as benzene settled 15¢/gal below November contract levels. For the year, nylon 6 feedstock costs are down 3¢/lb from 2010.

Outlook & Suggested Action Strategies

30-60 Days: Expect a buyers’ market, driven by reduced global demand. Feedstocks are expected to continue to trade significantly lower into at least the early part of this quarter.

Expect nylon 6 prices to be under increasing downward pressure due to the significant drop in demand and price of caprolactam.

PC PRICES CONTINUE TO DROP

Polycarbonate prices continued to slump through last month, with further downward pressure expected this month. Prices fell as much as 15¢/lb in the last quarter, depending on the grade, market, and degree of competition.

Despite weaker global demand, PC demand from the domestic automotive sector is surprisingly resilient. The supply-chain impact on Japanese auto transplant producers from the recent Thailand floods has been more modest than that of the tsunami in early 2011. Domestic producers were more than willing to pick up the slack, leading to little discernible impact on domestic PC demand from automotive through the end of 2011.

Meanwhile, feedstock costs dropped 1-2 ¢/lb in November, and a 2-3¢/lb drop was expected by the end of December due to falling benzene and propylene prices. That would bring feedstock costs down a total of 20-22¢/lb from their May 2011 peak. Moreover, increased global PC capacity is creating more supply options and applying further downward pressure on PC prices.

Outlook & Suggested Action Strategies

30-60 Days: Pursue price concessions aggressively, as supply will continue to be long due to slower demand and increased global capacity. Feedstock prices will be flat to slightly up, with modest economic growth expected this quarter.

Related Content

Prices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MorePrices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More