Still an Up-and-Down Picture for Commodity Resin Prices

Supply/demand imbalances or sharply rising feedstock costs account for the mixed pricing trajectory for the five biggest-volume resins.

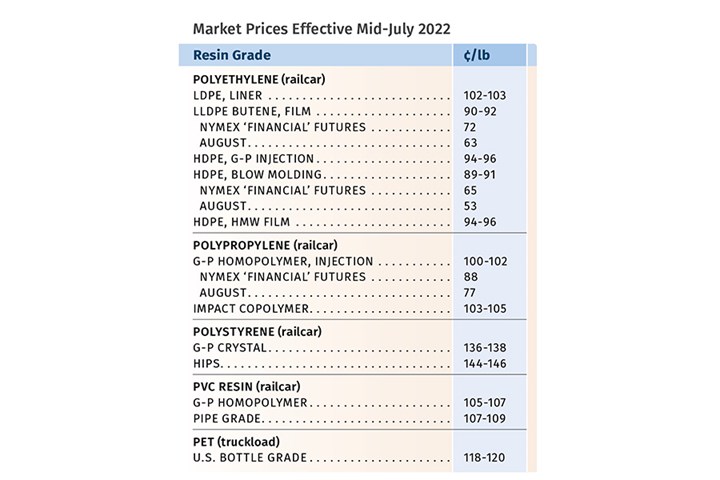

Once again, prices of the five major commodity resins are a mixed bag. Both PE and PP prices are on a downward trend, due to slowed demand and higher supplier inventories, with PVC in a somewhat similar situation, due to supplier inventory buildup yet relatively steadier demand. But sharply rising feedstock costs for both PS and PET are resulting in unprecedented price increases, though demand for the former is dismal compared with the latter.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior analysts from PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. for polyolefins at resin distributor/compounder Spartan Polymers.

PE Prices Trending Lower

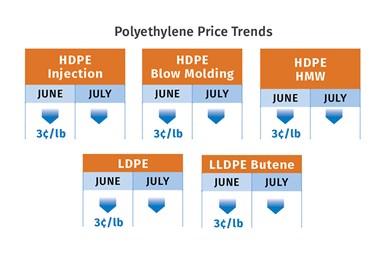

Polyethylene tabs in May generally increased by 3¢/lb while June prices were on a flat-to-lower trajectory, as suppliers revised and delayed their increases, generally asking for 3¢/lb in June and 5¢ to 6¢/lb in July, but the actual result appeared to be a June price decrease of 3¢/lb, wiping out the May hike, according to David Barry, PCW associate director for PE, PP, and PS; Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets; and The Plastic Exchange’s Greenberg.

Barry ventured that June was the start of a downtrend in prices, due to slowing demand and growing supplier inventories—the number of inventory days was estimated in the high 40s or even low 50s. Meanwhile, both export prices and domestic spot prices dropped—10¢/lb for the exports, which typically absorb for at least 40% of domestic capacity, and 5¢ to 10¢/lb for domestic prices. “Suppliers continue to run their plants in the 90%+ range, and new production from the completion of their Spring plant turnarounds has come on stream,” Barry said. “This while logistical constraints continue to hamper the volume of exports they typically sell. There was speculation that suppliers are throttling back on PE production.” Noted RTi’s Chesshier, “Processors are sitting on a lot of both resin and finished goods as big-box retailers are canceling orders.” She foresaw price erosion from June through this month, barring a disruptive hurricane event that would result in higher pricing.

Referring to suppliers, Barry noted that the “one arrow in their quiver” for continuing efforts to raise prices is the potential for production disruptions during the active hurricane season. Greenberg put it this way, “The proposed price increases come as the hurricane season slowly advances towards its peak period, while producers also look to maintain relatively high domestic resin prices before another new major producer [Shell] is expected to enter the market with new PE capacity over the next two months.

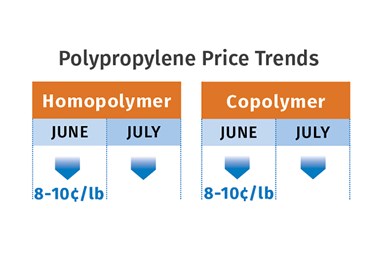

PP Tabs Down

Polypropylene prices in June were poised to drop by 8¢ to 10¢/lb, in step with propylene monomer, according to Barry, Greenberg, and Spartan Polymers’ Newell. Newell predicted that July PP prices would most likely dip as some of suppliers lose some of the margin gained recently (including 3¢/lb in May). Barring unplanned shutdowns, he expected the same for this month. Greenberg reported that despite a downtrend in spot PP prices amid recovering inventories and lower feedstock costs, suppliers announced a margin enhancement hike of 3¢/lb for June.

Newell noted that demand is dropping, in step with the economy. Supplier inventories were at 36 days, reflecting a continuing effort to match supply to demand while keeping production rates in the low 80s percent range. In addition, he noted that monomer prices were at some of the lowest levels in quite some time, despite high crude oil prices, reflecting the lack of demand. He generally saw PP prices as moving lower to somewhat stable for the remainder of the year, barring unplanned shutdowns due to weather events. He noted that about 2 billion lb of new capacity is expected to come on stream in the second half of the year from ExxonMobil and Heartland.

Barry ventured that PP prices would start dropping incrementally as early as July, noting that spot PP prices had dropped 10¢/lb by June’s end. “Suppliers traditionally have been ‘comfortable’ with a 20% price spread between PP and propylene monomer, but that spread today is more like 35%.” He said further decline in monomer prices was likely, noting weak offshore demand for propylene derivatives like acrylonitrile and propylene oxide.

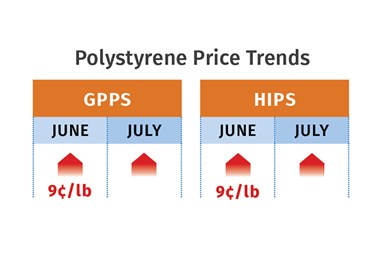

PS Costs More & More

Polystyrene prices in June moved up another 9¢/lb, having gained a total of 18¢/lb in the three previous months. Moreover, one major supplier issued a 21¢/lb increase for July, which was attributed to an unprecedented $2/gal increase in benzene prices, bringing the June contract price of benzene to over $6/gal, largely driven by high gasoline prices, according to both PCW’s Barry and RTi’s Chesshier. Still, a reversal of this dramatic PS pricing trajectory was foreseen by both sources—as soon as this month.

Barry noted that there were signs of slower demand ahead, with July and August being traditionally slower months for PS sales. By June’s end, the implied styrene cost based on a 30/70 formula of spot ethylene/benzene was 9¢/lb higher since the start of that month He characterized the domestic secondary PS market as having scarce spot offers and limited buying interest.

Chesshier noted that within an 18-month period—January 2021 to June 2022, PS suppliers implemented increases of 62¢/lb, significantly more than feedstock cost increases. This latest plan for a double-digit increase by at least one supplier has never been seen in the PS market. “The question is, can the PS market absorb this increase without further demand destruction or will processors turn to alternative resins? Expect to see a strong pushback from processors,” she commented.

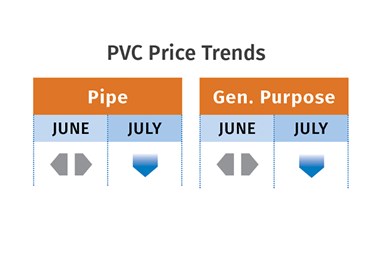

PVC Prices Flat

PVC prices in May and June were flat, accompanying high production levels and a buildup of supplier inventories. Prices in July-August were likely to be flat to lower, according to both Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. “PVC pricing normally flattens out in the summer after spring price increases, except in those years when a hurricane intervenes,” reported Todd. “A market pundit predicted that PVC prices would drop this summer because of high producer inventories amid nonexistent export demand. PVC production reportedly reached an all-time high in May, as did producer inventories.”

RTi’s Kallman noted that PVC exports were still low due to continued logistical constraints, and export prices held stable after dropping to levels competitive with domestic resin earlier in the spring. He said the market had a supply surplus, with 15 inventory days, versus the more typical 11-12 days for PVC. “Demand is still running at pretty reasonable rates, but there are a lot of headwinds going into the second half of the year related to higher interest rates and lower mortgage applications. Unplanned chlorine production outages in June, pushing chorine prices up, and the potential for a damaging hurricane event were potential disruptors.

PET Prices Up

PET prices in June were expected to move up 12¢ to 14¢/lb after gaining 9¢ in May, reflecting significantly higher-priced paraxylene used to produce key feedstock PTA. Paraxylene is diverted for use in gasoline production when prices are really high, according to RTi’s Kallman. He expected PET prices to remain high through at least August. He noted that the demand was expected to continue at a robust clip through the summer driving season.

He added that there are “lots of imports coming in” priced on par with domestic resin after coming down from higher levels earlier in the year as logistical constraints have improved.

Related Content

Recycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More