Stretching Film's Limits

In the hyper-competitive stretch-film market, more layers often mean more market share. Moving from five layers to seven or nine can give an edge through higher performance or reduced cost.

Stretch-film processors were used to a market that doubled every five years. Between 1985 and ’90, demand grew from 250 million lb/yr to 500 million lb, and from 1990 to ’95 it swelled to 1 billion lb. Even as recently as five years ago when five-layer stretch film swept the market, resin demand still grew in double digits. But for the past couple of years, stretch-film resin demand stalled at around 1.4 billion lb. Stretch film is 65% to 70% cast film, mostly for machine wrapping, and 30% to 35% blown film, mostly for commodity hand wrap and a few highly puncture-resistant specialty films.

Competition in this film sector is a cutthroat fight for market share. Processors’ profits are often in fractions of a cent per lb, and the rate of new machine installations is down to only a couple a year. The only North American processors who appear to be growing and reinvesting are those making the new highly layered films.

When five-layer stretch film was introduced in the mid ’90s, it replaced a lot of one- and three-layer films composed of hexene and/or octene LLDPE. It required a fourth extruder and a five-layer feedblock and allowed use of less-expensive butene LLDPE reinforced with thin support layers of then-new metallocene LLDPE. A typical five-layer structure could be A-B-C-B-A with 10% hexene LLDPE surface skins, 20% mLLDPE subsurface layers, and a 40% butene LLDPE core.

Stretch-film machines grew larger and output rates rose along with the number of layers. The standard five years ago was five 20-in. rolls up and three layers. Now it’s six rolls up and five layers. Five-layer stretch now accounts for 40% of all stretch film made in North America, and metallocene resin use has grown from nothing in 1995 to 12% of all LLDPE used in stretch film.

But mLLDPE is pricey, so processors went to seven and nine layers mostly to enable use of more wide-spec or butene LLDPE and less mLLDPE—and, in a few instances, to create higher-performing films. For example, all makers of seven-layer stretch film say they can replace thicker films having fewer layers without sacrificing load-retention capacity.

For the past few years, all the cast stretch-film lines installed in North America have been designed for five or more layers. They set new records for numbers of layers—first seven, then nine. Now processors and machine builders are talking about 11, 14, and even 70 layers.

“We commercialized microlayer feedblock technology for barrier properties, but stretch film could also be an application. We can produce layers at the angstrom thickness level [1 angstrom = 0.0001 micron] or tenths of a percent of film thickness,” says Gary Oliver, senior corporate scientist at Cloeren Inc. “Processors are interested, but nobody is testing it yet.”

More and more layers

Most of the new highly layered lines went to new players in the stretch film business, bringing shifts in market share. Chaparral Films in Mauriceville, Texas, was the first to come out with five-layer stretch film in 1994 and reportedly was the first with seven layers in ’96, though this was never publicly announced. Chaparral made even higher numbers of layers on a developmental basis, according to sources at Cloeren, which built the dies and feedblocks and was an investor in Chapparal. (ITW Stretch Packaging Systems in Glenview, Ill., bought Chaparral in 1996 but makes only five-layer films.)

Poly Rafia in Atlacomulco, Mexico, was next in line with seven-layer capability in 1996 and added a second line in 2001. When Quintec Films Corp. in Shelbyville, Tenn., and Pinnacle Films Inc. in Charlotte, N.C., started up in the fall of ’98, both new firms made nothing but seven-layer stretch film. Quintec was awarded U.S. Patent #6,265,055 in July 2001 for stretch films with “two outer layers and at least five inner layers.”

“With enough extruders and layers, you can make a cost-effective, high-performance film with metallocenes. That’s the market opportunity we saw,” says William Rice, president of Pinnacle, which installed a second seven-layer line last April. “Most old established players in this field can’t afford to add new higher-tech capacity. They aren’t reinvesting in new seven-layer lines.”

However, two longer-established processors have added seven-layer stretch-film capacity since then: Pliant Corp. of Schaumburg, Ill., and AEP Industries Inc. of S. Hackensack, N.J.

Meanwhile, Sigma Plastics Group, a major bag-film maker that has been in the stretch-film market since ’94, installed the world’s first nine-layer stretch line in Belleville, Ont., in 2000. “We’ve gone from nothing to 15% market share in eight years. We’re pretty proud of that,” says Per Nylen, executive v.p. of Sigma Stretch Film, based in Lyndhurst, N.J. Most recently, AmTopp in Livingston, N.J., one of Inteplast Group's three divisions, ordered a nine-layer Battenfeld Gloucester line for delivery later this year to its plant in Lolita, Texas. .

One reason resin poundage for stretch film isn’t growing much right now is that film has thinned down. In 1985, the standard was 90 gauge (0.0009 in.). Today it’s 65 to 80 gauge. One major impact of downgauging is that it has made older lines less efficient. “Equipment that used to make 1-mil film at 3000 lb/hr is making 70 gauge today, so they have lost 30% of their machine capacity,” notes Andrew Christie, president of Optex Process Solutions LLC in Fulton, N.Y., a consultant on stretch films. The only way an older line could keep up is with a brand-new winder, but processors have tended to make such a large investment only for new lines.

Even if the film poundage is static, the number of pallet units wrapped in stretch film is still growing healthily. Not only is today’s film thinner to start with, but it can stretch farther. In 1985, it took 12 oz of film to wrap an average pallet. That number dropped to 5 oz in. ’95 and to 4 oz in 2000, a threefold increase in units wrapped for the same pound of plastic.

Pinnacle (the only stretch-film maker that would provide concrete performance data for this article) reports that its 63-gauge, seven-layer Apex film shows 360% to 370% ultimate stretch on a standard test device from Highlight Industries, a maker of stretch-wrapping machines.

That means there’s still plenty of room to downgauge further, especially in the highly layered films. “We test films and find that most have an ultimate level of stretch over 350%, but the average actually applied to pallets is probably only 165% to 180%,” says Kurt Riemenschneider, president of Highlight Industries. “In many cases. the stretch films are better today than the stretch-wrapping equipment.” Film already on the market could wrap many more pallets than it does, potentially creating even more overcapacity.

Further development in this vein was reported by Pliant at the Flexpo 2002 Conference in September in Houston (sponsored by Chemical Market Resources in Houston). Pliant said it made 1-mil monolayer blown film with up to 500% stretch in R&D to evaluate three different mLLDPEs.

Why more layers?

Highly layered films apply only to cast stretch film for machine wrap. Blown stretch film for hand wrap has one to three layers of hexene/octene LLDPE blends with expensive cling additives that are not used in cast films.

Film with more layers doesn’t usually have more different materials. Rather, the additional layers are created in the feedblock by splitting one resin stream into thin slices stacked together or alternated with layers from a different resin stream. The technique is commonly used in sheet extrusion to get a more uniform resin distribution.

“Coextrusion of thin alternating layers can improve puncture strength,” says Cloeren’s Oliver. “Extruding metallocene resins thinner actually makes them less splitty—the same way glass, if it’s thin enough, is flexible.”

“Look at nine layers as like plywood,” says Sigma’s Nylen. “We get higher pre-stretch, puncture, and tear resistance with nine layers than with five.”

Alternating thin layers of mLLDPE also allow greater use of low-cost wide-spec or butene LLDPE and reduce the amount of mLLDPE needed. In a seven-layer film with three mLLDPE layers, the metallocene content might drop to 33% versus as much as 40% mLLDPE spread over two layers of a typical five-layer stretch film.

While there are thus good reasons for letting the feedblock create multiple layers from one resin stream, there are also arguments to be made for using more extruders. “Coextruding layers of a single resin with two extruders increases throughput of a line but doesn’t affect film properties,” explains Oliver. “A high-output line with two 4.5-in. ex truders instead of one 6-in. extruder also gives the flexibility to do complex or simple products, and temperature control is a lot easier on a 4.5-in. extruder than on a 6-in. extruder.”

Pliant’s seven-layer stretch films can be made with three, four, five, or six extruders. Its first seven-layer line in Lewisburg, Tenn., has five extruders plus a small sixth machine that extrudes edge bead out of trim waste. Pliant’s newest seven-layer line, installed three months ago, has four extruders. Predefined plugs for the feedblock allow it to make seven layers with three or four different polymers. It also uses a chill roll believed to be North America’s largest for cast stretch film. The large roll quenches the film faster, further improving puncture strength and cling, Pliant reports.

Pliant’s first high-performance seven-layer film, designated R-122, was introduced in 2001 but not fully commercialized until 2002. It was developed to improve on the strength and reduce the noise level of Pliant’s OPTX five-layer film. R-122 is a premium product with Pliant’s highest mLLDPE content (over 50%), allowing both downgauging and high pre-stretch ratios. Nonetheless, it is one of Pliant’s best selling stretch films in 51- and 63-gauge versions.

R-122’s thinness gives customers more usable footage for the same roll weight: 9000 ft for a roll of 51 gauge R-122 film and 7250 ft for 63-gauge R-122, while a standard 80-gauge roll has only 5000 ft. The 51- and 63-gauge films can contain C pallet loads (irregular unboxed load with lots of protrusions) and beat the performance of some of the toughest 70- and 80-gauge films in the market, Pliant says.

R-122 took over a year to develop because initial production rates were too slow to be considered commercial. Throughput suffered and processing was more difficult with the higher mLLDPE content, so Pliant made processing and resin formulation changes.

Pinnacle’s Apex high-end stretch film, introduced in 2000, also uses seven layers and mLLDPE to achieve thinness. “We can replace a standard 80-gauge stretch film with 63-gauge film. For light loads we can go as thin as 55 gauge,” says Pinnacle’s Rice.

Black Clawson’s seven-layer stretch-film line at Quintec uses five extruders and an Ultraflow feedblock from Extrusion Dies Industries with selector spools to change layer sequence. Black Clawson says a typical seven-layer structure might be 5% to 15% skin tack layer, 5% to 10% sub-skin performance layer, 15% to 20% inner performance/refeed layer, 40% to 50% bulk/refeed core, 5% to 10% inner performance/refeed layer, 5% to 10% sub-skin performance layer, and 2% to 15% skin slip layer.

Not all highly layered stretch films use mLLDPE. Sigma doesn’t use any in its nine-layer films, noting that TD tear strength is lower with mLLDPE than with standard hexene/octene blends. AmTopp doesn’t plan to use mLLDPE in its nine-layer films, either. AEP Industries also avoids mLLDPE.

AEP rebuilt an existing four-extruder line and added a seven-layer feedblock. Its first seven-layer product was EXRW (Excaliber Roll Wrap)—heavy-gauge, 3-mil films for paper-roll wrap, a new market for one-sided cling wrap. Protecting giant rolls of paper requires surface toughness but little stretch.

AEP’s newest five- and seven-layer films, EXP (Excaliber Plus), are high-strength films designed for downgauging on high-speed automated stretch wrappers. EXP film can wrap at speeds of up to 60 rpm, whereas 20 rpm is typical for machine wrapping and 30 rpm is considered high, says Michael Hildreth, AEP’s technical manager.

Sigma focuses on less-expensive commodity films with its nine-layer line. Its Battenfeld Gloucester system uses four extruders and a Cloeren die and feedblock. The sub-skin B, core C, and sub-skin D are split into alternating layers: A-B-C-B-C-D-C-D-A.

Non-stop, high output

Non-stop operation and high uptime efficiency are critical to eking out profits in stretch film. On-line width adjustment coupled with changeable flow paths in the feedblock are essential to changing layer sequences on the fly.

Stretch-film lines are also running faster and faster to beat the competition. “A couple of producers can sustain 1700 to 1800 ft/min at 4100 lb/hr,” says Robert Moeller, product manager for extrusion systems at Black Clawson. Higher production in turn requires faster winding and more automation.

The latest stretch-film winders run at up to 1400 ft/min vs. about 600 ft/min for conventional stretch-film winders. The newest winders produce a set of six to 10 hand-wrap rolls every 50 to 60 sec, and the same number of rolls of machine wrap (with larger diameters) every 3 to 5 min, depending on gauge. Such blazing speeds require automatic roll unloading and re-coring.

At least three U.S. processors have also invested in fully automated box loading of blown film for hand wrap. AEP was the first in the early 1990s, followed by Intertape Polymer Group’s Danville, Va., plant and at least one plant of Minneapolis-based Tyco Plastics. Machine wrap, which runs more slowly, typically uses partial automation. Fully automated box loading is more common in Europe, where labor costs are higher.

In the early ’90s, stretch-film lines also grew wider to increase throughput. To reduce neck-in from very wide dies, processors use a dual-chamber vacuum box and edge pinning to hold the film against the chill roll.

Winders have also grown wider. When Black Clawson builds winder rolls wider than 120 in., it uses a two-piece core shaft with a center support. This allows a single winder with 3-in.-diam. shafts to wind a wide web at high line speeds. On the other hand, the latest winders from Battenfeld Gloucester and Davis-Standard’s Egan Div. are designed as dual winding units, each with shorter shafts that reportedly provide more stability, though they cost more for equipment and maintenance.

Blown stretch film

Neither mLLDPE nor many layers are used so far in blown stretch film, though orientation developments could open opportunities for more layers and performance. Last fall, Battenfeld Gloucester introduced an in-line MD orienter that stretches film 200% to 300%. Blown stretch-film output is typically cooling limited, but this development allows an extruder pumping the same lb/hr to produce two to three times more linear ft/hr of stretch film.

Gloucester’s prototype MDO unit uses an S-wrap of two preheating rolls, one to heat each side of the film. It also has an S-wrap of two rubber pull rolls turning three to four times faster than the preheat rolls to stretch the film. Two heated annealing rolls recover some of the stretch. Finally, two cooling rolls lock in the residual stretch.

A question mark about oriented monolayer film is the effect that high levels of pre-stretch could have on additives “blooming” to the surface of the film. Research is being done now to characterize this effect, which is well understood for multi-layer film with a surface cling layer.

Stretch-wrapped silage and large cubes of garbage are relatively new niches for blown stretch film developed by AEP, Tyco, and Sigma within the past three years. Three-layer film is preferred for silage to prevent decomposition, and the biaxial stretch gives better puncture resistance against hay stalks.

Anti-corrosion stretch wrap, called VCI (vapor corrosion inhibitor) is a new niche product used to protect iron bars and other metal products from rust. VCI is difficult to make because the inhibitor additive is corrosive.

Downgauging and sophisticated structures make today’s stretch film go farther. Pliant’s newest seven-layer line puts 9000 ft of 51-gauge stretch film on a roll, vs. only 5000 ft of conventional 80-gauge film.

Making seven-layer film with high mLLDPE content at high output rates requires North America’s largest-diameter cast chill roll. (Photo: Pliant)

Pinnacle Films makes only seven-layer, high-performance stretch films using mLLDPE. Last year it added a second seven-layer line.

High-performance seven-layer films can stretch farther than most wrapping machines can pull them, even on a load like this with protruding corners. (Photo: Highlight Industries)

The world’s first nine-layer stretch-film line at Sigma Stretch Films doesn’t use mLLDPE. Its extra layers create a commodity film less expensively.

Automatic core loading, roll unloading, and boxing is more prevalent in Europe, where labor costs are higher. (Photo: SML)

Related Content

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MorePart 2 Medical Tubing: Use Simulation to Troubleshoot, Optimize Processing & Dies

Simulation can determine whether a die has regions of low shear rate and shear stress on the metal surface where the polymer would ultimately degrade, and can help processors design dies better suited for their projects.

Read MoreMedical Tubing: Use Simulation to Troubleshoot, Optimize Processing & Dies

Extrusion simulations can be useful in anticipating issues and running “what-if” scenarios to size extruders and design dies for extrusion projects. It should be used at early stages of any project to avoid trial and error and remaking tooling.

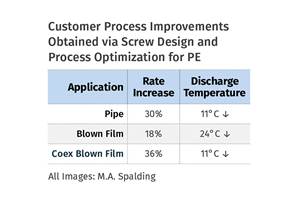

Read MoreHow Screw Design Can Boost Output of Single-Screw Extruders

Optimizing screw design for a lower discharge temperature has been shown to significantly increase output rate.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More