Why Blow Molders Are Switching to EPET

High clarity, easy incorporation of handles, and recycling resin code No. 1 are the principal drivers for converting to EPET resins for extrusion blow molding.

A shifting market preference for extrudable PET (EPET) versus PETG copolyester in order to make extrusion blow molded (EBM) clear bottles that can be recycled with the standard PET stream appears to be gaining momentum. The recycling issue was given a major push by the State of California in October 2017, with the passing of Assembly Bill 906, which revised the state’s definition of PET to exclude PETG—essentially barring products made from the glycol-modified copolyester from using ASTM resin identification code (RIC) No.1 (“PETE 1”), in order to prevent contamination of the post-consumer recycle (PCR) PET stream.

The bill, which could have broad impact beyond California’s borders, officially went into effect Oct. 1, 2018, with PETG products now falling under RIC No.7, defined as “Other,” which includes materials made with more than one resin from categories 1-6.

Another contributing factor is the growing popularity of clear handleware containers, especially for orange and other juices, as well as ready-to-drink (RTD) teas. EBM can mold integral through-handles, unlike stretch-blow molding of conventional PET.

“Extrusion blow molding of clear bottles integrating a true through-handle and that can carry the ‘PETE #1’ resin symbol for recycling with PET has long been a packaging goal for consumer-products groups,” says Joe Slenk, applications engineer at EBM machine builder Bekum America.

One recent success story for EPET has been orange juice, such as Simply Orange, a Coca-Cola Co. brand, which converted from PETG for recyclability. The first big EPET conversion was the 89-oz Tropicana orange-juice jug from Pepsi, which converted, not from PETG, but from white opaque HDPE several years ago in order to take advantage of the crystal clarity of PET. Industry sources also point to EPET conversions from PVC in non-beverage products for improved recyclability.

The resulting market shift has been assisted by the two main domestic suppliers of EPET resin, DAK Americas and Indorama Ventures. They have developed high-melt-viscosity EPET grades for EBM with hang strength, toughness, and reduced crystallization rates.

The inherent challenge of parison formation with PET’s poor melt strength (or “hang strength” in EBM) originally resulted in the development of EBM-grade copolyester resins, such as PETG, first introduced over 30 years ago. “Unfortunately, copolyester materials are not readily managed in the established PET recycle infrastructure due to their lower drying and melting temperatures,” says Bekum’s Slenk.

George Rollend, technical fellow at DAK Americas in technical marketing development, notes that over the years, container recyclers have had major processing issues with a relatively small percentage content of PETG present in the bottle recycling stream. “This is due to the substantially lower melt point of PETG vs PET,” he explains.

“During recycle processing, the lower-melting amorphous PETG begins to stick to the conventional bottle-grade PET within the recycle stream, causing agglomeration and clumping of the total stream. This causes interruptions in the process, and makes it impossible to achieve a quality recycle product. As a result, PETG is considered a contaminant by recyclers, and there is a movement to eliminate PETG from carrying the No. 1 recycle code on containers.”

Traditionally, bottle-grade PET lacked the melt strength and slow crystallization necessary for use in EBM applications. Within the last six years or so, improved EPET resins hit the market. One example is DAK’s Array EBM with enhanced melt strength. Another is Polyclear EBM from Indorama, described by new-business development manager Frank Ebbs as designed for clear, high-gloss EBM containers with or without handles that offer improved drop performance and can be recycled with the clear PET PCR stream with no detrimental effect.

Similarly, Eastman Chemical, a major PETG producer, launched Aspira One for EBM in late 2012. It is a proprietary copolyester designed specifically for compatibility with recycling code No. 1 PET. When asked to comment on industry rumors that Eastman may exit the EBM resin business, the company’s global business manager, Brad Potter, told Plastics Technology, “Eastman remains committed to the EBM container market and to meeting the industry’s evolving requirements. PETG continues to provide unmatched performance in terms of quality, design flexibility and processability and does not require brands to lower their performance standards. At the same time, we recognize the importance of sustainability to our customers—and to their customers—and so we are actively exploring a range of approaches, including but not limited to mechanical recycling, that will allow them to meet both their performance and sustainability objectives.”

Availability of adequate EPET material to support growing demand does not appear to be an issue. Rollend says, “We think the supply of EPET is more than sufficient to meet the current demand at this point in time.” Indorama’s Ebbs agrees.

HOW BIG IS EPET’S POTENTIAL?

DAK’s Rollend pegs the current EPET market size in the range of 100 million lb/yr. He sees opportunities in large handleware (greater than 60 fl oz), particularly in dishwashing and laundry detergents. Agricultural chemicals and automotive fluids also beckon. Non-handleware applications include wide-mouth jars and some narrow-neck bottles. “Non-handled, wide-mouth jars of various shapes and sizes are being commercialized with DAK’s Array EBM resins. These include jars for jams and jellies; liquor flasks of 100, 200, and 375 ml; and tall wide-mouth jars.” He also points to future opportunities in personal care (health and beauty aids), nutritional supplements, pharmaceuticals, and niche food and beverage products.

Indorama’s Ebbs anticipates that EPET will win market shares in juice, tea, nectar, water, olive oil and laundry detergents. He says the initial applications were juice and tea in containers with handles. “The newer applications are household, food and water packaging.”

Rollend cites a number of factors in favor of EPET over PETG for consumer packaging. One is its relatively low cost: “DAK Americas’ Array EBM product was developed as an EPET formulation with significantly more melt viscosity at affordable costs.” Another is greater tolerance for recycle. He says that most PETG polymers cannot meet the rigors of a 25% and 50% recycle loading, as called for in the “Critical Guidance” document from the Association of Plastic Recyclers (APR), whereas DAK’s EPET is optimized for regrind use up to 50% or more. Moreover, Rollend notes that machine builders have learned how to deal with the idiosyncrasies of higher-viscosity EPET materials on existing EBM wheel and shuttle machines.

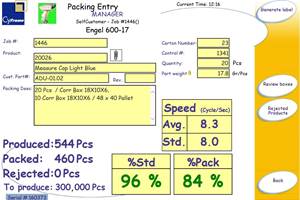

Notes Bekum’s Slenk, “We have been developing the technology to run EPET for years and now have over a dozen machines currently running fully automated, round-the-clock production of PET handleware bottles. This trend is continuing, as we have several new machine orders for EPET applications.”

Other points cited by Rollend:

• Brands have begun to encourage EPET use by reducing their performance specs—notably in drop impact. If you have a secure handle, the container is less likely to drop.

• EPET has melting properties similar to stretch-blow PET resins.

• EPET crystallizes, so it can be reprocessed in standard PET crystallizing and drying equipment.

• EBM tooling is typically less expensive than preform injection and blow tooling for the PET stretch-blow molding process.

HOW DOES PROCESSING EPET COMPARE WITH PETG?

Sources at EBM machine builders—such as Slenk at Bekum; Bill Farrant, president of Kautex Machines; and Bob Jackson, president of Jackson Machinery, which represents Hesta Blasformtechnik of Germany—are in substantial agreement on the processing similarities and differences between EPET and PETG, and the consequent implications for machinery selection. Processing temperatures for EPET are much higher—over 500 F, vs. around 400 F for PETG. At the same time, it’s important to keep EPET melt temperatures as low as possible to maintain melt strength. According to Slenk, “Hang strength is a challenge with this material, and parison formation becomes difficult if it’s too hot.”

One answer, machine suppliers agree, is to limit screw rpm and thus shear heating. That can limit throughput, so an EPET EBM machine could benefit from a larger extruder or one with longer L/D than a PETG machine. Hesta, for example, offers both 24:1 and 32:1 screws for its machines. Head design is also important to prevent overshearing the melt, Slenk points out. DAK’s Rollend adds that screw design is most critical in processing EPET with high levels of regrind, in order to prevent surging and consequent tail-length variation that has a strong influence on overall container wall-thickness control.

Despite higher melt temperature than PETG, cycle times with EPET are said to be similar because it sets up faster.

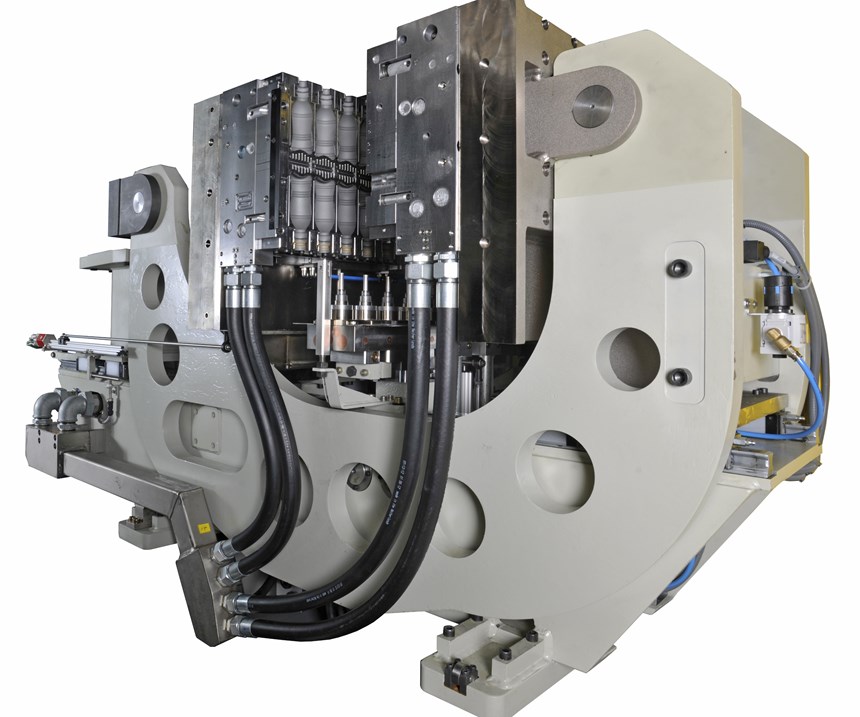

Another key consideration, several sources agree, is a need for higher clamp force for EPET in order to get a good pinch-off. Exactly how much more force may be required appears to be a subject of debate, though a ballpark of 20% was suggested by one machinery OEM. Jackson notes this influenced the boosting of clamp force from 32 tons to 44 tons on Hesta’s newest and largest all-electric EBM machine, the Hesta 900.

Slenk says uniformity of clamp-force distribution is perhaps equally important, and cites that as one reason the C-Frame clamps on Bekum machines have been very successful in EPET applications.

EPET may not be a drop-in for PETG with regard to tooling. Some modifications for sharper pinch-off may be required. Rollend suggests that EPET molds may benefit from deeper flash pockets, sharper knives, prouder edges, and steeper angles. He adds that drying requirements for EPET are very similar to those for standard bottle-grade PET, which typically are more intensive than those for PETG.

Equipment suppliers point out that all of the above considerations assume even greater importance when it comes to converting from non-polyester resins, such as HDPE or PVC, to EPET.

Related Content

Breaking News From NPE2024

Here is a firsthand report of news in injection molding, extrusion, blow molding and recycling not previously covered.

Read MoreProcessing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

Read MoreFirst Water Bottles With Ultrathin Glass Coating

Long used for sensitive juices and carbonated soft drinks, KHS Freshsafe PET Plasmax vapor-deposited glass coating is now providing freshness and flavor protection for PET mineral water bottles.

Read MoreUse Interactive Production Scheduling to Improve Your Plant's Efficiencies

When evaluating ERP solutions, consider the power of interactive production scheduling to effectively plan and allocate primary and secondary equipment, materials and resources on the overall production capacity of the business and conclude that this is a key area that cannot be overlooked.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More