Monomers Drive Up Polyolefin Prices

Polyolefin prices were on the way up in October, as resin suppliers pointed to rising monomer costs to justify their previously announced resin hikes.

Polyolefin prices were on the way up in October, as resin suppliers pointed to rising monomer costs to justify their previously announced resin hikes. So far this year, polyethylene prices have gained a total of 15¢ to 17¢/lb (the larger figure is for hexene and octene LLDPE). Polypropylene prices have risen a total of 11¢/lb.

According to Mike Burns, global business director for polyethylene at resin purchasing consultant Resin Technology, Inc. (RTI), Fort Worth, Texas, this is the first year in recent memory in which 10 months of continuous PE price increases were implemented—five in total—with no price reversals. PE suppliers saw double-digit profit margins (10¢ to 17¢/lb, Burns says) through August, compared with polypropylene suppliers’ margins of only 2¢ to 3¢/lb.

Despite lackluster domestic demand for polyolefins, an exceptionally strong export market for most of this year has kept resin producers’ plant operating rates above 90% and their inventories in balance. Still, industry sources expect weakening domestic and export demand to bring resin buyers some price relief late in the year—though less than occurred at the end of 2006.

Editor’s note: Based on new information, we have adjusted our polyolefin prices in the table lower than last month, in order to bring them closer to market reality.

Polyethylene prices up

Last month, it looked like PE producers would push through the full 4¢ increase that had been announced for Sept. 1. However, they face uncertain prospects of implementing the 5¢ hike announced for Sept. 15.

The London Metal Exchange (LME) short-term futures contract for November in blown film butene-LLDPE sold at 57.3¢/lb, slightly up from October’s 57.1¢.

Contributing factors: Suppliers attribute this price hike directly to increased ethylene monomer contract prices, which rose 3¢ to 52.5¢/lb in September, and further 2¢ to 4¢ increases loomed for October. Monomer prices are linked to escalating ethane prices and supply tightness. Another factor is a recent surge of resin exports.

“This latest price increase will not help domestic processors, as their business has been relatively slow and they have had difficulty in passing through this year’s increases,” says RTI’s Burns. One leading PE supplier says domestic demand in October was more robust than in September.

Still, Burns and other industry sources expect some price relief over the next two months. As a sign that things may be changing, spot PE prices dropped for the first time in August and remained flat in September. Also, some softening of monomer prices is possible as plant operating rates return to more normal levels after a series of planned and unplanned production outages.

PP prices rising

Polypropylene prices were expected to move up last month as suppliers seemed set to implement their Oct. 1 hikes of 3¢ to 4¢/lb. Meanwhile, LME’s futures contract for g-p injection-grade homopolymer for November sold at 59.3¢/lb, up from October’s 57.4¢.

Contributing factors: Driving this increase are higher monomer costs. Although record-high propylene monomer prices appeared to peak in August, the subsequent price relief was short-lived. One leading PP supplier attributed high monomer prices to planned and unplanned production outages, higher oil prices, and shifts to the use of lighter feedstocks, which reduces propylene supply.

September monomer contract prices moved up 2.5¢ to 53.75¢/lb. With the monomer said to be very tight, October propylene contracts were most likely to rise another 3¢, according to Scott Newell, RTI’s director of client services for PP. At the same time, Newell says resin exports are starting to slow, inventories are creeping up, and spot PP prices have dropped.

Engineering resins go higher

On Nov. 1, DuPont hiked prices of nylons, PET, PBT, PCT, and LCP by 12¢/lb, acetal by 10¢ and Hytrel TPE by 15¢. Competitors are considering pricing moves, too.

DuPont also raised tabs on ethylene copolymers—6¢ for EVAs and 8¢ on all others Nov. 1.

| Market Prices Effective Mid-Oct A |

|

|

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. jLME 30-day futures contract for lots of 54,564 lb.. |

Related Content

Prices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreSoft Prices for Volume Resins

While PP and PE prices may be bottoming out, a downward trajectory was likely for all other volume resins, including engineering types.

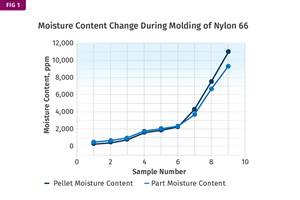

Read MoreWhat's the Allowable Moisture Content in Nylons? It Depends: Part 2

Operating within guidelines from material suppliers can produce levels of polymer degradation. Get around it with better control over either the temperature of the melt or the barrel residence time.

Read MorePrices Bottom Out for Volume Resins?

Flat-to-down trajectory underway for fourth quarter for commodity resins.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More