Prices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

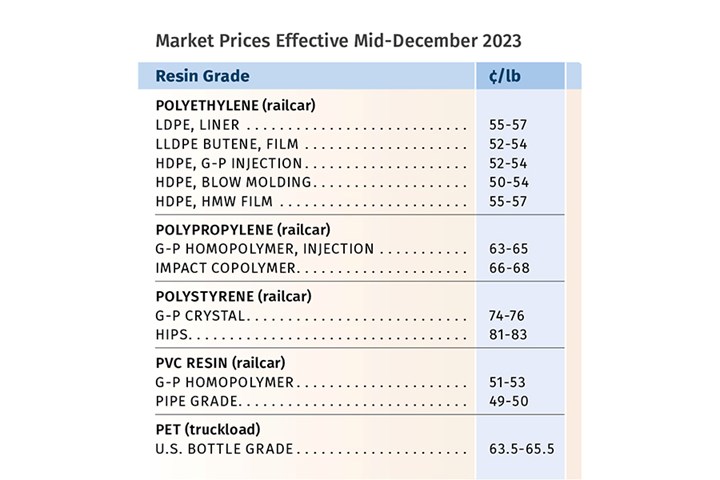

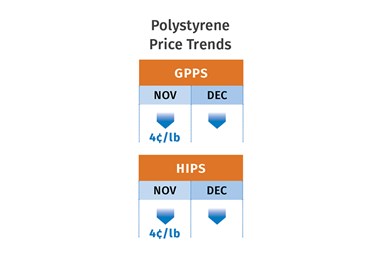

Prices of volume resins were all heading downward by year’s end, and projections for at least the first month of first quarter 2024 are generally for flat or lower pricing, particularly for the five commodity resins as new year contract negotiations were underway. All this, with the caveat there are no major production disruptions caused by inclement weather or other unplanned feedstock, and/or resin shutdowns.

In general, 2023 was ending with processors having more leverage than resin suppliers, with the latter having had a year of profit margin compression. Key factors included a drop in feedstock prices, with exceptions such as propylene monomer and benzene; though price corrections were underway for both as availability recovers. An overall underwhelming demand for all resins characterized most of last year, this despite resin suppliers’ efforts to throttle back production, in some cases significantly. Lowered export prices were also underway by fourth quarter due to slowed global demand which indirectly influenced unpublished market discounts domestically.

These are the views of purchasing consultants from Resin Technology Inc. (RTi); senior analysts from Houston-based PetroChemWire (PCW); CEO Michael Greenberg of The Plastics Exchange; Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers; and resin pricing expert Robin Chesshier.

PE Prices Down, Then Flat

Polyethylene prices were largely expected to drop by 3¢/lb within November-December, which would nix the September 3¢/lb increase, which brought the total increases this year to 12¢/lb. This according to PCW’s David Barry, The Plastic Exchange’s CEO Michael Greenberg and resin pricing expert Robin Chesshier. As for this month, these sources would not be surprised to see suppliers issuing a new increase as is typical at year’s end, but note that barring any major adverse production event, such an increase would likely take a couple of months to implement.

Says PCW’s Barry, “There has been a lot of nonmarket adjustments being made so that most processors did not incur the full 12¢/lb. It has been a challenging market as buyers need to stay alert and not rely on published industry indices.” Chesshier notes that for November, the indices showed flat pricing for at least November. Moreover, all three industry pros note that in 2024 resin pricing contract negotiations, the buyers are definitely in the driver’s seat. Barry and Greenberg noted that suppliers have dropped export prices in order to move material, which contributed to the bearish sentiment. Adds Barry, “Exports are improving since the September-October time frame and that is due to domestic suppliers lowering prices. As an example, blow molding PE was selling at 33¢/lb to 35¢/lb in early November, from the previous 38¢/lb to 39¢/lb.”

Greenberg characterized the spot market as having ample PE grades across-the-board and reported that despite suppliers aiming for a November increase of 3¢/lb in November, the market has lost its upward momentum and larger buyers have been clamoring for a decrease. “We think that PE contracts will roll flat at best and would not be surprised to actually see 3¢/lb peel off.”

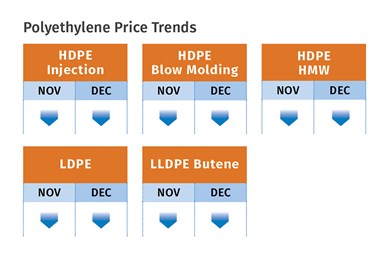

PP Prices Up, Then Flat-to-Down

Polypropylene prices in November moved up once again by 5¢/lb in step with propylene monomer, according to PCW’s Barry, Spartan Polymers’ Newell, and The Plastic Exchange’s Greenberg. As for the December-January time frame, these experts somewhat differed slightly in their predictions, all of which was based on how quickly monomer supplies recovered. All, however, project that barring a major disruption event, that some correction was underway for propylene monomer.

Barry and Greenberg venture that PP prices could remain flat through December and possibly this month, noting that while monomer supply issues appear to have improved going into the last two months of the year, it was not yet evident on the market. They are more likely seeing January 2024 as the time for monomer price correction. Newell ventures there is potential to see a price drop in PP in December and perhaps more so this month. All three note that PP inventories are quite tight as suppliers have done a good job to throttle back production due to lackluster domestic demand.

In fact, total demand for PP in 2023 appeared to be slightly positive, all owed to some exports activity. Says Barry, “PP suppliers are facing some challenges as a large number of PP imports are coming through in December from places like the Middle East and China.” These sources also note that some downward PP resin price adjustment is likely as ‘new kid on-the-block’ Heartland Polymers — as well as capacity increases from Invista and Formosa in second quarter — will make it a more competitive market. But, adds Greenberg, “Keep in mind though, any further upstream production issues could easily sway this market again since PP inventories throughout the supply chain are still considered tight.”

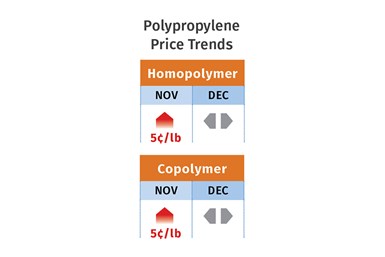

PS Prices Drop

Polystyrene prices dropped by 4¢/lb in November, having risen by a total of 10¢/lb between July and October, driven by higher benzene prices, according to PCW’s Barry and resin pricing expert Robin Chesshier. Both saw the potential for prices in December to drop by at least another 4¢/lb, as benzene prices were heading downward.

While Barry ventures prices in January would likely be flat, Chesshier saw the potential for another, but smaller dip due to poor demand and improved benzene supply. Barry reported the implied styrene costs based on a 30% ethylene/70% benzene spot formula dropped by 1.7¢/lb within November, and further decline was expected in December.

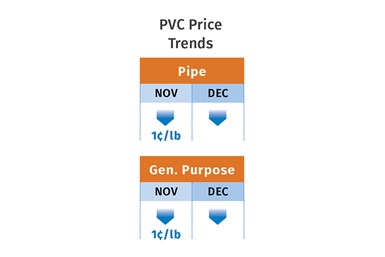

PVC Prices Down

PVC prices were expected to drop by 1¢/lb to 2¢/lb within November-December, after remaining flat in October, according to Paul Pavlov, RTi’s v.p. of PP and PVC, and PCW’s senior editor Donna Todd. Pavlov notes that suppliers’ margins and domestic sales across-the-board on PVC market sectors in 2023 decreased in comparison to both 2022 and 2021. He ventures that January prices are likely to be flat and perhaps a bit up depending on some market recovery, noting that suppliers’ plant operating rates were in the low-to-mid 80s percentile with inventory days at 16, versus a more typical 12-13 days.

Reported Todd in late November, “A market pundit changed its prediction for November prices from down 2¢/lb to 1¢/lb. This was a bit of a surprise to some market watchers, who pointed out that spot ethylene prices had started November at 21.25¢/lb and then dropped by 3¢/lb to 18.25¢/lb at midmonth.” She also noted that Formosa Taiwan dropped its export prices a total of $140/mt in the October-November time frame, resulting in domestic suppliers having to drop their export prices.

PET Prices Down

PET prices were expected to drop by another 2¢ to 3¢/lb in the November-December time frame, after dropping 4¢/lb in October. This based on raw material formulation contracts, according to Mark Kallman RTi’s v.p. of PVC, PET and engineering resins. He ventured that prices in January would most likely be flat. He characterized demand as static, following underwhelming demand in second and third quarters, and the market as well supplied with continued better-priced imports.

ABS Prices Flat, Then Down

ABS prices appeared to remain largely flat throughout the fourth quarter, despite one major supplier’s attempt to push through an increase. This after dropping a total of 15¢ to 27¢/lb in the previous three quarters, according to RTi’s Kallman. He notes that raw material prices peaked in October, and attractively-priced Asian imports continued to play a role in the market. For January, Kallman ventures ABS prices would decline as 2024 contract negotiations favored buyers.

PC Prices Flat, Then Lower

Polycarbonate prices also appeared to remain flat through part of the third quarter and into the fourth. This after falling a total of 10¢-to- 17¢/lb earlier in the year, according to RTi’s Kallman. He ventures that prices for January would be lower, again as 2024 contract negotiations were underway, with buyers having the leverage. “Demand has been overall static and there is not much optimism for an uptick in demand within first quarter of 2024. Supply has been relatively ample and includes well-priced PC imports.

Prices of Nylon 6, 66 Drop

Nylon 6 prices dropped 5¢/lb in the September-October time frame, after dropping a total of 20¢/lb to 40¢/lb in first and second quarters, according to resin pricing expert Chesshier. She saw potential for further price erosion in the November-December-January time frame, largely dependent on lower priced benzene. Some suppliers aimed for increases of 30¢/lb in the fourth quarter, but that fell by the wayside as the market was well supplied, which includes lower priced imports.

Nylon 66 prices remained relatively static in most of the fourth quarter, though some decreases in nylon 66 compounds took place. This after a total decline of about 20¢/lb or more earlier in 2023, according to RTi’s Kallman. Depending on raw material price movements, he ventures a drop of 4¢/lb to 5¢/lb in January, as a result of new contract negotiations. The domestic market continues to be well supplied, including well-priced imports.

Related Content

The Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More