2018’s Tooling Turndown: Temporary Hiccup or Longer Lasting Correction?

Leading industry consultant charts possible paths for the North American automotive tool and die industry going forward as the outlines of a realignment take shape.

Forecasts pointed to 2018 being “the big year” for the U.S. automotive tool and die industry, but the failure of multiple new vehicles to launch and the uncertainty and cost pressures fueled by the ongoing trade conflict slowed the sector significantly and could impact it going forward.

Laurie Harbour, president and CEO of industry consultancy Harbour Results Inc., Southfield, Mich., laid out the current situation in the North American automotive tooling market (injection molding tooling and metal stamping dies) in a recent webinar. Initial forecasts for 2018 pegged the estimated source year tooling spend at $11.7 billion—projected growth over 2017’s banner mark of $10.3 billion.

However, through three quarters of the year, 14 vehicle launches had been dropped or not yet started, leaving 2018 some $2.2 billion below forecasts. Harbour said there were still some launches planned for the last 60 days of the year, but whether those come to fruition or not, remains unsure.

Not surprisingly, the interruption in launches resulted in a lot of work being put on hold. Tools that were sourced but for some reason stopped jumped by 6.6 points so that more than 15% of shops’ current tool work was placed on hold. Outsourcing, which jumped in 2017 as tool makers struggled to fulfill orders with their own capacity, was also down, dropping 6 points and leaving overall utilization at 79%.

“So these things all combined to make for a difficult time in 2018,” Harbour said. “This level of utilization is also putting a tremendous amount of pressure on pricing. Those companies that are at a low utilization are managing some of their new quotes, but reducing some of their pricing so they can keep their shops full with new tool business.”

Global Slowdown

Looking at broader industry dynamics, Harbour said the automotive industry is in the midst of a global slow down. In the years following the great recession of 2009, compound annual growth rates topped 6%, but for 2018 and looking forward, those rates are forecast to drop to between 1-2%. Previously hot markets in China and Southeast Asia are no longer forecast to experience double-digit growth, while mature markets in the west are projected to be flat or see demand contract.

“We’re going to begin to see a fight for market share,” Harbour said, “where companies will release new products in the hope of gaining share around the globe.” Here in North America, where the annual vehicle market had been around 17 million units for a couple of years, a dip is expected in 2018, with a further reduction possible in 2019 and 2020 to around 16.2 million units.

Harbour did compile another forecast, accounting for some of the bleaker possible scenarios based on lower demand and heightened trade conflict. In this negative impact forecast, which in addition to trade woes looked at the influence of the burgeoning used car market and the possibility of a recession, the number of vehicles manufactured could dip below 15 million units in 2020.

Used Cars, No Cars, No Drivers

Setting aside trade and any possible recession, Harbour said three issues that the industry is already dealing with are the flood of used cars on the market; changing attitudes towards vehicle ownership by younger generations; and the very early impact of alternative mobility technology, including driverless options, and the new players pushing it: Google, Apple, et al.

On the used car front, automakers got more creative in leasing programs to entice buyers who couldn’t secure more traditional financing via banks, offering very competitive 24- and 36-month terms. The majority of those leases are set to reach maturity in 2019, with 4.1 million used vehicles set to enter the marketplace.

“There were 39 million used cars sold into the market in 2017,” Harbour said. “It’s a very good portion of the market that will steal from the new car sales in the future, particularly if we see some softening of the economy.”

As the Detroit Three Go, So Goes the Market

Moving forward, the North American automotive tool and die industry, which is disproportionately dependent on the so-called Detroit Three OEMS—Ford, GM, Chrysler—faces the prospect of diminishing tooling demand from those domestic car makers. For larger moldmakers with more than $30 million in revenue, more than two-thirds of their business comes from the Detroit Three, who are forecast in 2019 to have less production share than all the other OEMs in the market for the first time. By contrast, Japanese OEMs only source about 30% of their tooling from North American mold shops.

By 2025, the Detroit Three will make 1 million fewer vehicles, while the other OEMs produce 1.2 million more vehicles out of their North American facilities. Vehicle launches for the Detroit three from 2019 to 2021 are forecast to come in at 62 compared to 93 for other OEMs. In 2019, the Detroit Three are planning nine vehicle launches, down from 31 in 2018, with the expected effect on the rest of the sector.

“When the Detroit Three get a cold in the market place,” Harbour said, “the rest of the tool industry gets the flu. That’s what we started to see a little of in 2018.”

So will the sniffles subside?

“Lots of people have asked us whether we expect to see a recession,” Harbour said, “and our crystal ball isn’t any clearer than anyone else’s, but we believe there will be a softening in the market. I don’t anticipate that it will be a very deep recession if we do see that, but the trade war is one of those unknowns that will have an impact long term.”Related Content

Hot Runners: Truths. Myths, Overlooked Areas: Part 2

Here’s a view from the trenches of a tooling manager who, over 30 years, has experienced the joys and pains of using virtually every type of hot runner on the market. Part 2.

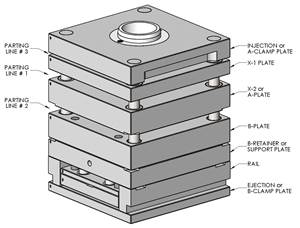

Read MoreHow to Design Three-Plate Molds, Part 1

There are many things to consider, and paying attention to the details can help avoid machine downtime and higher maintenance costs, and keep the customer happy.

Read MoreHow To Design Three-Plate Molds – Part 4

There are many things to consider, and paying attention to the details can help avoid machine downtime and higher maintenance costs — and keep the customer happy.

Read MoreHow to Start a Hot-Runner Mold That Has No Tip Insulators

Here's a method to assist with efficient dark-to-light color changes on hot-runner systems that are hot-tipped.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More