Advanced Manufacturing Has Outsized Impact U.S. Economy

But overall impact is waning, pointing to need for federal and state-local strategies to boost the sector’s growth and broaden its reach.

But overall impact is waning, pointing to need for federal and state-local strategies to boost the sector’s growth and broaden its reach.

Earlier this month, think tank The Brookings Institution released a report with those findings and more entitled “America’s Advanced Industries: New Trends” by Brookings Fellow Mark Muro, former Research Analyst Siddharth Kulkarni, and Nonresident Senior Fellow David Hart.

The report found that the overall sector expanded between 2013 and 2015, despite global headwinds, including China’s slowdown. That growth, however, was concentrated in a sliver of auto manufacturing and “tech” service industries, with three auto industries and four digital services industries taking up more than 60 percent of the nation’s advanced-sector growth during that time.

Forward 50

This report is a follow up on February 2015 paper by Brookings entitled “America’s Advanced Industries: What They Are, Where They Are, and Why They Matter”. In that, Brookings identified 50 industries that constitute the advanced industries sector. Those 50 were further broken down into three primary groups—manufacturing, energy, services—of which manufacturing was the largest with 35 categories.

Of those, many were directly related to plastics, like “resins and synthetic rubbers, fibers, and filaments” with more that touched on segments which rely heavily on polymers like aerospace and motor vehicle parts, medical equipment and household appliances. Resin and rubber was one of only 10 advanced industries that ran a trade surplus, trailing only royalties and aerospace.

Why Do These Advanced Industries Matter?

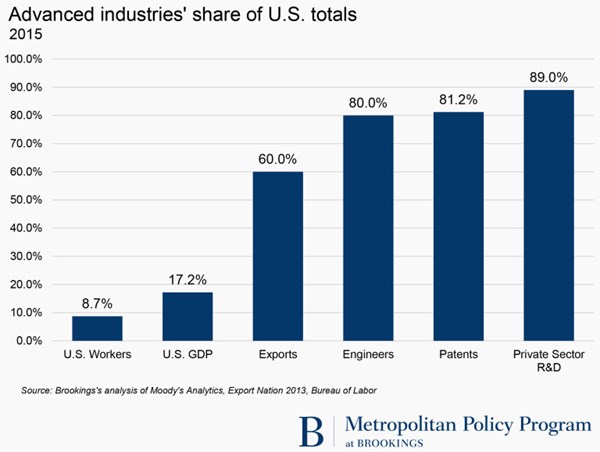

These manufacturing-heavy sectors are so important to the U.S. economy because of their outsized influence on it. According to Brookings, the advanced sector conducts 89 percent of the nation’s private-sector R&D and generates more than 80 percent of the nation’s patents.

In terms of overall productivity, the advanced industries sector has grown about 2.7 percent annually since 1980, far faster than has the rest of the economy, which has managed annual productivity growth of just 1.4 percent.

Finally, there is the impact on trade. The advanced industries sector generates 60 percent of U.S. exports despite representing less than 10 percent of the nation’s employment.

Concentrated Growth

Despite slower growth from 2010–2013, advanced manufacturing industries still added more than 132,000 jobs from 2013–2015 period, taking up 20 percent of all advanced-sector employment growth. Roughly 70 percent of that employment growth came in three auto-related industries: motor vehicle parts, motor vehicles, and motor vehicle body and trailers

High-tech service industries were the leading source of advanced-sector growth in the 2013–2015 period, adding 500,000 new jobs over that time or 80 percent of new advanced-sector jobs. Nearly two-thirds of those came in four spaces: computer systems design, web search and internet publishing, software and products, and data processing and hosting.

Energy Bust

The advanced-energy sector has gone from a significant contributor in the 2010–2013 period to a “bust,” according to report author, Muro. “The U.S. ‘fracking” boom led to an oil and gas glut and energy demand stagnated worldwide.”

Going forward, the report sees two immediate issues to be addressed.

“This report speaks to two of the nation’s most pressing economic problems: its serious inclusion crisis and its stubborn productivity slump. On both counts, the vitality and expansion of the advanced-industries sector is crucial because the sector is the main source of the productivity growth and productivity-driving innovations and business models that support higher wages and rising living standards for the average worker.”

Related Content

Processing Making Slow, Steady Progress

Plastics processing activity didn’t make its way into expansion territory in March, but seems headed in that direction.

Read MoreNPE2024 and the Economy: What PLASTICS' Pineda Has to Say

PLASTICS Chief Economist Perc Pineda shares his thoughts on the economic conditions that will shape the industry.

Read MorePlastics Processing Activity Contracted in July

Plastics processing GBI contracted for the third month in a row.

Read MoreProcessing Takes a Dip in June

Plastics activity took a relatively big downturn in June, ending at a low for the year and lower than the same month a year ago.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More