China Bets Big on Automation

With the full brunt of the Chinese government behind it, the country’s industrial robot inventory is forecast to explode 2500% from 70,000 in 2016 to 1.8 million by 2025.

With the full brunt of the Chinese government behind it, the country’s industrial robot inventory is forecast to explode 2500% from 70,000 in 2016 to 1.8 million by 2025.

Those figures courtesy the China Center for Information Industry Development and shared in a July 26 webinar from the Robotics Industry Association (RIA). The RIA had three China robotics experts outline the market’s opportunities and the explosive growth it could create for western suppliers of industrial automation.

The webinar followed a statement from the International Federation of Robotics (IFR) detailing the same types of projections. In that report, Wang Ruixiang, president of the China Machinery Industry Federation (IFR), said he expects his country to join the top 10 nations in the world in terms of robot density—that is the number of industrial robots per 10,000 employees.

In 2015, that figure stood at 36 per 10,000, putting it at No. 28, well below the U.S. (152), Germany (282), Japan (323) and South Korea (437). With a stated goal of selling 100,000 domestically made industrial robots every year by 2020, the industry believes it can join the world’s leaders sooner rather than later.

Ruixiang’s comments came at the China International Summit of the Robot Industry, and they echo reports inside and outside China, from industry and government, on how robotics will help maintain the country’s status as the world’s factory. That factory will also make robots to be consumed in China and abroad. Currently, foreign robot manufacturers enjoy a 69% share of the Chinese automation market, but local players see a shift coming.

At a roundtable during the IFR’s most recent meeting in Münich, Daokui Qu, CEO of Chinese robot manufacturer Siasun, said that by 2020, he believes Chinese robot makers share of the domestic market would increase to 50%.

Regardless of where the robots are made, more and more of them are headed to Asia according to the IFR. In 2015, the region registered the highest sales figures for robots globally—156,000—up 16% from the year prior, with China taking up 43% of that total with 67,000, almost double the second biggest player, South Korea, with 37,000.

Opportunities for U.S. Automation Suppliers

During the RIA webinar, Nelson Lee, president of Sunels Tech & Capital Corp., noted that while there are 2600 domestic robotics and automation related companies in China, many are quite small, with 90% generating less than $16 million in sales. He also said they are forced to rely on imports of key components like reducers, servomotors and controllers.

Despite these challenges, Lee said the Chinese automation industry will continue to expand because of strong government support, including related policies. In fact, on March 21, the Chinese government issued a Robotic Industry Development Plan for 2016-2020, projecting that annual sales of industrial robots will reach 260,000 units by 2024, with the value of the industry to hit nearly $15 billion. To achieve these lofty goals, the domestic industry has sought to partner with western leaders—one example: Chinese firm Midea Group’s pursuit of global leader Kuka.

Economic Slowdown ≠ Robotic Slowdown

In the Q&A portion of the webinar, one questioner noted China’s relative slowdown economically and asked whether or not that would impact the burgeoning automation industry. For Lee, the retraction is actually a positive harbinger.

“China is now making its economy more efficient; getting out of low quality, low efficiency industries and focusing more on advanced manufacturing industries,” Lee said. “This policy basically helps the development of the robotic industry because robotics are so advanced. So even though China is slowing down, the government and companies are putting more effort into robotics.”

While many segments of the economy might elicit a tepid response in conversation, automation does not.

“Whenever we are in China—when we talk with officials and companies—once you mention robotics or robots, they get excited; they want to sit down and talk with you,” Lee said.

Those statements definitely reflect Plastics Technology’s own reporting on the pursuit of advanced manufacturing in the Middle Kingdom, here and here. (Pictured: attendees at Chinaplas 2015 in Guangzhou get up close and personal with automation).

Related Content

NPE2024 and the Economy: What PLASTICS' Pineda Has to Say

PLASTICS Chief Economist Perc Pineda shares his thoughts on the economic conditions that will shape the industry.

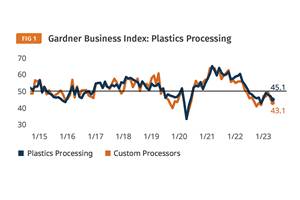

Read MorePlastics Processing Contraction Continues

Contraction dominated the GBI index for overall plastics processing activity and almost all components, collectively suggesting a slowdown.

Read MorePlastics Index Shows Supply Chain Improvement Despite Production Slowdown

Future expectations reach 2024 high on the heels of the recent election.

Read MoreProcessing Activity Dips in May

Plastics processing took a downturn in May, the first appreciable dip since November 2023.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More