Next-Generation Technologies Benefit Demand for LCPs

‘5G’ and ‘3D printing’ are key drivers in growing demand for LCPs according to FactMR study.

A new study from U.K.-based research and consulting firm FactMRon liquid crystal polymers (LCPs) indicates that demand is growing at a very rapid pace with a multitude of applications, ranging from E&E and automotive to consumer goods, sports, leisure and medical devices. Sales in 2018 were up 13%, and that is expected to increase by another 6%/yr between 2019 and 2029.

The study attributes this growth to the growing traction for LCP films to develop high-in-demand flexible printed circuits and for semiconductor packaging. Furthermore, increasing application of LCP films in flexible solar cells, owing to its exceptional heat resistance and low water absorbency are also underpinning gains for the market. Moreover, fast-growing technologies, such as 5G communication and 3D printing hold high stakes of growth for the LCP market during the foreseeable period, says the study.

In the emerging 5G communication, LCPs are being viewed on a large scale as a novel material with an optimistic outlook for mobile phone antennas, according to FactMR. Several companies in the LCPs arena are leveraging the potential of this trend. In light of the growing lucrativeness of Asia Pacific, in particular, a number of companies have shifted their focus towards the region to squeeze higher gains. For example, in January 2019, Celanese Corporation acquired the Indian firm, Next Polymers Ltd., a compounder of engineered plastics, such as LCPs to expand its market presence in the region, and a month later acquired leading India custom compounder of engineering thermoplastics OmniPlastics to extend geographical reach, increase product portfolio, and appeal to a wider pool of customers.

In the 3D printing arena, a group of researchers have recently developed a new grade of recyclable LCP for fused deposition modeling (FDM) 3D printing, which promise several benefits over the traditional ink models, and could flip the growth prospects of the 3D printing market players. Other key findings cited include:

▪ East Asia Leads the Pack: While the applications and adoption of LCPs continues to gain momentum globally, East Asia, led by China remains the most lucrative for market players. East Asia accounted for ~60% of the overall sales of LCPs, with China being the largest global manufacturer of electronic devices and components across the globe.

▪ E&E Industry: This industry continues to expand at a steady pace, specifically in Asia-Pacific region. The growing presence of a large number of manufacturers and high-production capacity of electronic devices in China continue to increase the opportunities for market players in this region. Demand for LCPs is increasing by leaps and bounds in correspondence to the growth of this industry.

LCPs are widely leveraged for a variety of surface-mount technology, such as connectors — for example, small-outline, dual-inline memory modules for laptop and computers as well as flexible-printed circuits for tablets and smartphones. While providing excellent flow to fill multifaceted geometries in short cycle times, outstanding thermal and chemical resistance, and unique mechanical properties, LCPs also achieve UL 94 V-0 flame retardance without requiring flame retardant additives, and the scrap can be recycled for future use.

▪ Staggering Demand for Miniaturization: The rapidly growing demand for smaller and thinner electrical components that can withstand higher temperatures and wear has been solidifying the areas of growth for LCP manufacturers. Most of the demand from the E&E industry is for the production of various types of connectors, electronics components, miniaturized components for smartphones, such as card slots. LCPs offer high flowability and faster cycle times in thinner-wall application required for the connectors. Growing use of LCPs for connectors that demand high-heat resistance has been creating a stream of opportunities for the growth of the market.

▪ Material of Choice for Fine-pitch Electrical Connectors? LCPs continue to witness adoption for an unprecedented number of applications, with a new grade of LCP exhibiting desired compatibility that is required to meet the prerequisites of fine-pitch electrical connectors. Sumitomo Chemical, for instance, has developed two novel SumikaSuper LCPs that are specifically designed to meet the demanding requirements of fine-pitch connectors. These novel SumikaSuper LCP grades reportedly provide exceptional process ability and low warpage in extremely thin-wall sections to precisely mold the thin, small, light interconnects and through holes.

▪ The Current Players: The global LCP market is moderately consolidated with leading players that include Celanese Corp., Polyplastics Co Ltd, Toray Industries, Sumitomo Chemicals, and Solvay S.A. collectively holding sizeable shares. The market frontrunners are constantly leveraging novel materials and exploring potential applications of LCPs. New product development and customized application-based offerings have emerged as a key strategy of market players to gain an extra edge in the market, which is heading towards intensifying competition.

Related Content

High-Productivity PBT and Nylon Compounds Launched

BASF’s new HPP portfolio is the result of cost-optimized and energy-efficient production.

Read MoreNew Cleanroom-Rated Static Eliminator

Neutralize static hands-free in sensitive medical, pharmaceutical and electronic manufacturing operations.

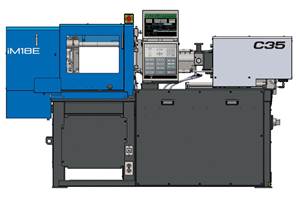

Read MoreCompact Hybrid Injection Molding Machine Launched

Sumitomo Heavy Industries Ltd. (SHI) has introduced the iM18E, promising the smallest footprint in 20-ton machines.

Read MoreBiomass Balanced LCP for Reduced CO2 Emissions and Improved Renewable Content

Polyplastics’ Laperos bG LCP is slated for commercialization in spring 2025.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More