PE Film Market Snapshot 2020: Consumer Trash Bags

Trash bag market dominated by major players. Average annual growth pegged at 3.4% for the next three years though environmental issues loom.

This is the fifth in a series of blogs based on 2019-2020 research conducted by market-research firm Mastio & Co., St. Joseph, Mo. on key markets for processors of polyethylene film. There will be 10 articles in all, two a week. The first five will offer Mastio’s analysis—based on interviews with processors conducted direct by the Missouri firm—with film processors representing the five largest PE film markets. The second batch of five will be focused on the five fast-growing PE film markets.

The first of these blogs analyzed the stretch film market. The second focused on consumer/institutional product liners. The third discussed T-shirt bags. Last week, we looked at the institutional can liner market, and now we turn our attention to consumer trash bags, based on Mastio’s findings.

The consumer trash bag market can be divided into the categories of national-brand, private-label, and generic market segments. All three types of bags can be purchased by consumers in a variety of places including grocery, mass merchandise, and discount stores. National-brand and private label bags are usually sold at a higher price than generic bags. Typically, there is very little, if any, advertising to promote the generic bags, further helping to lower the costs to consumers.

Consumers can find trash bags in a variety of colors, ranging from soft pastels to something bolder and brighter. Current trends are the determining factor in the availability of specialty hues. Also available are scented and odor-blocking consumer trash bags. Vanilla, cinnamon, and spring flowers are just a few of the scents that customers will encounter when shopping for kitchen or bathroom trash bags. Combining colors and scents has transformed consumer trash bags from just a common necessity to a decorative commodity.

The Numbers

During 2019, approximately 1.33 billion lb of PE resin were consumed by film processors in the production of consumer trash bags. By 2022, consumption of PE resin for the consumer trash bag market is expected to reach 1.473 billion lb, with an average annual growth rate of 3.4%.

Consumer trash bag sizes are commonly specified in two different ways; measured by length and width in inches or measured by capacity (gallons). During 2019, bags that were sold by capacity ranged from 4 to 60 gal. Consumer trash bags are also sold in a variety of widths and closure styles. In 2019, bag widths ranged from 16.75 to 52 in., and bag lengths varied from 17.5 to 58 in.

There are a variety of consumer trash bag types available. The most popular types are small garbage bags, medium garbage bags, large garbage bags, tall kitchen bags, trash compactor bags, lawn and leaf bags, and drum liners. Some of the various closure styles and methods include draw string, wire or twist tie, and stretch and tie (wing tie) configurations. Additionally, many companies print suffocation warnings on their consumer trash bags.

Consumer trash bags are sold in a variety of gauges. Small trash bags are typically thinner in gauge due to their lightweight applications. Large trash and yard bags are typically sold in thicker gauges to hold more weight. Reported gauges of consumer trash bags ranged from 0.85 to 6 mils, with the most typical gauge being approximately 1 to 1.25 mils. Bag gauges can vary by both application and the companies that manufacture the bag. Generally, smaller bags use thinner gauge films, while larger bags use heavier gauge films.

Small trash bags are typically thinner in gauge due to their lightweight applications. Large trash and yard bags are typically sold in thicker gauges to hold more weight.

The Players

In 2019, the five largest participants in this market included Reynolds Consumer Products (Presto Products Company Div./Reynolds Consumer Packaging Div.); Poly-America, L.P.; The Clorox Co. (Glad Manufacturing Co. Div.); Inteplast Group Ltd. (Integrated Bagging System Div.); and Berry Global Group, Inc. (Engineered Materials Div.). Collectively, these companies consumed approximately 1.070 billion lb of PE, accounting for more than 80% of the market.

The Resins

The resin most commonly utilized for consumer trash bags in 2019 was LLDPE. LLDPE resin provides added strength, puncture, and tear resistance over LDPE, which makes the bags less apt to puncture. Blending or coextrusion of LLDPE resins with LDPE materials allows processors to downgauge the film while maintaining or increasing the overall strength of the consumer trash bags. The metallocene single-site catalyst based LLDPE (mLLDPE) resin is used to improve the strength and puncture resistance of consumer trash bags. When used in blends or in coextrusion with conventionally produced PE resins, mLLDPE resin greatly enhances the physical properties of the films in lower gauges. Additionally, mLLDPE resin was utilized to manufacture draw strings due to its elasticity.

Other reported LLDPE resins utilized in this market include LLDPE-hexene, LLDPE-octene, LLDPE butene, LLDPE-super hexene, and recycled post-consumer LLDPE (PCR-LLDPE).

HMW-HDPE was also utilized in 2019 yielding added strength to consumer trash bags. Consumer trash bags constructed with HDPE are three times stronger and more durable than LLDPE or LDPE trash bags of the same thickness. HDPE is more puncture resistant and/or less apt to zipper if punctured versus bags constructed with LDPE resin. Consumer trash bags constructed with HDPE have less surface gloss, are stiffer, and have less stretch than either LLDPE or LDPE bags. Additionally, HDPE resin requires specialized film extrusion equipment and is more difficult to process.

Blending or coextrusion of LLDPE resins with LDPE materials allows processors to downgauge the film while maintaining or increasing the overall strength of the consumer trash bags.

LDPE-homopolymer resin was the third most commonly consumed material in this market during 2019.

Processing Trends

During 2019, blown film extrusion was the only reported film extrusion process utilized to produce consumer trash bags. Monolayer film construction was most prevalent for this market (88.5%). Multi-layer coextruded film and bag construction accounted for a small but gradually increasing portion. Multilayer coextrusion allows consumer trash bag manufacturers to incorporate the use of HDPE or LLDPE resins with LDPE resins, making a stronger bag while downgauging the thickness of the bags. Not only are trash bag manufacturers able to make more bags with less resin, the coextrusion technology enables processors to use greater amounts of PCR and industrial scrap material in the bags without sacrificing bag strength or quality.

The Future

The consumer trash bag market is threatened from the perception that plastic bags are viewed as bad according to consumer trends and legislation. Any large shifts in this direction could considerably hurt any of the PE bag markets. A few states have passed laws banning disposal of lawn and garden waste in landfills. Campaigns promoting the idea of using lawn and garden waste, including leaves, grass clippings, bush trimmings, etc., as a mulch for grass and other plants have reduced the demand for lawn and leaf bags.

Sustainable and biodegradable resins continue to be significant factors. As consumer trash bag manufacturers look for ways to provide consumer trash bags which meet these needs, they are considering corn starch derived polylactic acid (PLA) and vegetable oil resins as an additive with conventional PE resins. Unlike PE resin, PLA resin is biodegradable within commercial composting settings; however, it has not been proven to biodegrade in landfills.

Factors that are hindering the shift towards PLA include the following: the cost per pound of PLA versus PE; the low melting point of PLA; and mryiad recyclability issues for PLA. Therefore, PLA is considered a contaminant to the recycling process, and public dislike exists around the use of genetically modified corn. The effects of altering the material from its organic state are still unclear.

During 2019, approximately 1.33 billion lb of PE resin were consumed by film processors in the production of consumer trash bags.

Related Content

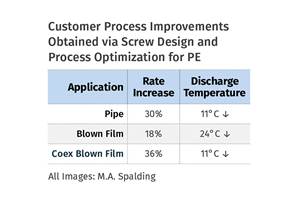

How Screw Design Can Boost Output of Single-Screw Extruders

Optimizing screw design for a lower discharge temperature has been shown to significantly increase output rate.

Read MoreReduce Downtime and Scrap in the Blown Film Industry

The blown film sector now benefits from a tailored solution developed by Chem-Trend to preserve integrity of the bubble.

Read MoreWhy Are There No 'Universal' Screws for All Polymers?

There’s a simple answer: Because all plastics are not the same.

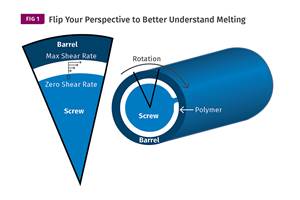

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so the barrel appears to be turning clockwise around a stationary screw.

Read MoreRead Next

PE Film Market Analysis: Cheese Packaging

Market is projected to grow by 4.4% over the next three years. Coextruded blown film structures dominate.

Read MorePE Film Market Analysis: Geomembrane Liners

Market to average 3.4% growth over the next two years.

Read MorePE Film Market Snap-Shot: Institutional Can Liners

Monolayer blown-film constructions account for more than 92% of institutional trash bags, but use of multi-layer coextrusion is growing to allow incorporation of recycled content.

Read More