PE & PP Prices Down

A buyer’s market for both polyolefins could continue though this quarter and into the fourth.

As we were approaching the end of the first week of August, it appeared that prices of both polyolefins had dropped, in both cases nixing out price hikes that took place in second quarter. Ample supplies, slowed domestic and global demand and lower feedstock costs are all key drivers in this pricing trajectory. This according to the latest reports from two of our industry resin pricing pros: David Barry, senior editor at Houston-based PetroChemWire (PCW); and CEO Michael Greenberg of the Plastics Exchange in Chicago.

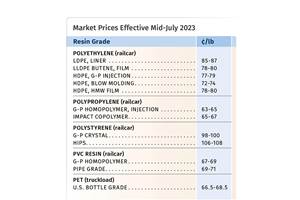

▪ PE: Despite suppliers being out with a 3¢/lb price hike in the June/July time frame, industry analysts and certainly processors were expecting the opposite—price concessions of about the same amount that would effectively nix out the April 3¢ price hike, the one and only increase of 2019. Mixed industry reports had it that at least some processors had seen a 3¢/lb decrease in June and that the rest would see it in July. PCW’s Barry recently reported that PE suppliers had indeed lowered contract prices by 3¢/lb by July’s end.

And Greenberg reported as follows: “July contract pricing became a little more clear and most PE market participants should see a 3¢/lb mark down. Although the relief is welcomed, many will continue to push for further decreases as spot levels have declined even more. If you’ve been able to supplement your purchasing through the spot market you have done well this year.”

Barry ventured that suppliers are generally looking towards demand strengthening in fourth quarter, but that further new capacity still coming on stream in the Gulf Coast fromExxonMobil Chemical, LyondellBasell Industries, Formosa Plastics, and Sasol could outweigh a stronger demand pull.

Barry also cited broader economic concerns noting the manufacturing index from the Institute of Supply Management (ISM) indicated manufacturing growth in July was the slowest in nearly three years. The ISM month-to-month survey, based on input from more than 300 manufacturing purchasing agents, also showed lower production and new orders for the plastics and rubber processing industry.

In addition, Barry reported that international buyers were pushing for further price cuts in August, and that grades like HMWPE film grades and HDPE injection molding grades showed no letup in downward pressure. “HMWPE film prices dipped below HDPE BM amid ample supply of the film grade and new environmental regulations in Latin America that were said to be weighing on the demand outlook for plastic bags.”

▪ PP: As noted in an earlier blog, PP prices in July increased by 0.5¢/lb, decoupling for the first time in a couple of years from propylene monomer contracts which settled up 1.5¢/lb—essentially translating a 1¢/lb margin contraction for suppliers. This slight upwards move followed the 4¢/lb June decrease which nixed out May’s 4¢/lb increase, the only one for 2019. Moreover, PP prices dropped by about 24¢/lb between November 2018 and March 2019.

According to PCW’s Barry, expectations for August propylene monomer contracts were generally for flat to slightly lower. “Butane cracking, soft PP demand and high propylene inventories were mentioned as bearish factors for the propylene market.”

Moreover, Barry reported that the July 31 explosion and fire at the ExxonMobil Baytown, Texas olefins plant created new uncertainty for the market, as the site houses several PP units as well as monomer supply. “Initial indications were that no significant disruptions to resin deliveries were expected. Overall, operating rates in the PP industry have been healthy this summer, and core demand in July was described as lackluster, especially in the nonwoven and automotive sectors.”

Greenberg reported the spot PP market as active throughout July and into August. “After rallying early in the month as spot monomer costs jumped, PP prices fell under pressure as upstream costs started to ease; however, overall pricing for spot homopolymer and copolymer PP added a penny this week following the fire at Exxon's Baytown plant. Some of this week’s orders were for business as usual, other customers procured material to bridge their late railcars, while some saw supply risk and added a buffer to their resin inventories. Material availability was still good, although not on par with earlier in the month.”

Barry reported that LyondellBasell was reportedly building inventory for a planned outage at its Bayport, Texas PP facility, scheduled to begin later this month, and that Formosa was likely to have minor maintenance outages scheduled during August as well.

Related Content

Nexkemia Acquires Polystyrene Recycling Assets

The polystyrene manufacturer finalized its purchase of Eco-Captation, a recycler.

Read MoreAdvanced Drainage Systems to Build New Florida Manufacturing Facility

New manufacturing facility will complement other ADS facilities in the southeast region.

Read MoreNova Makes Senior Leadership Changes

The company’s aim is to bolster sustainability ambitions

Read MorePS Prices Plunge, Others Appear to Be Bottoming Out

PS prices to see significant drop, with some potential for a modest downward path for others.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More