Plastics Processing Business Continued Contracting in April

Global economic shutdown causes downturn in new orders and production.

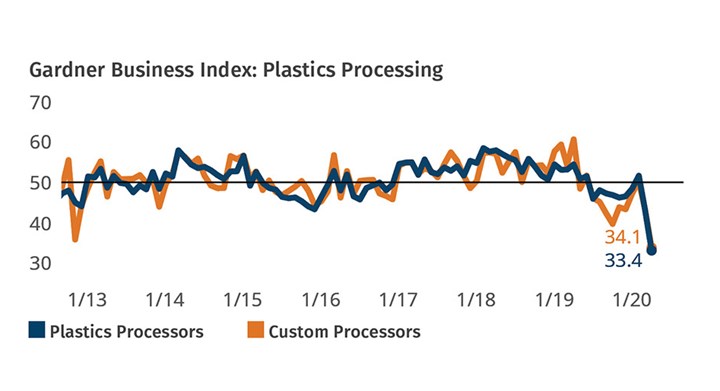

Gardner Intelligence’s Plastics Processing Business Index experienced unprecedented deceleration of most measures of business activity for the month. April’s reading of 33.4 was more than 10-points below both the prior month’s low and the previous cyclical low of 2015. Survey data provided by only custom processors was little better, with a monthly reading of 34.1.

Gardner Intelligence’s review of the underlying index components observed that the Index—calculated as an average of its components—saw new orders, export orders, production and employment set new all-time lows for the second time in two months. Perspective: These readings represent the breadth of change occurring within the plastics industry and are not to be confused with the rate of decline taking place. They indicate only that a large proportion of the industry reported decreased levels of each business activity type.

FIG 1 Business activity contracted at an accelerating rate in April to levels not previously experienced. As the economic slowdown across the country and globe continues, plastics processors have reported a severe decline in new orders and production activity.

FIG 1 Business activity contracted at an accelerating rate in April to levels not previously experienced. As the economic slowdown across the country and globe continues, plastics processors have reported a severe decline in new orders and production activity.Efforts to slow the spread of COVID-19 further worsened the disruption to the plastics industry’s supply chain in April. The slight rise in supplier deliveries indicates a further slowing of deliveries and implies a worsening disruption of supply chains. As discussed here in March, the reading for supplier deliveries is designed to increase when the pace of orders slows, under the assumption of growing upstream backlogs resulting from strong demand. However, at present, the economic disruption cause by COVID-19 is disrupting normal economic activity and causing the observed delay in delivery times.

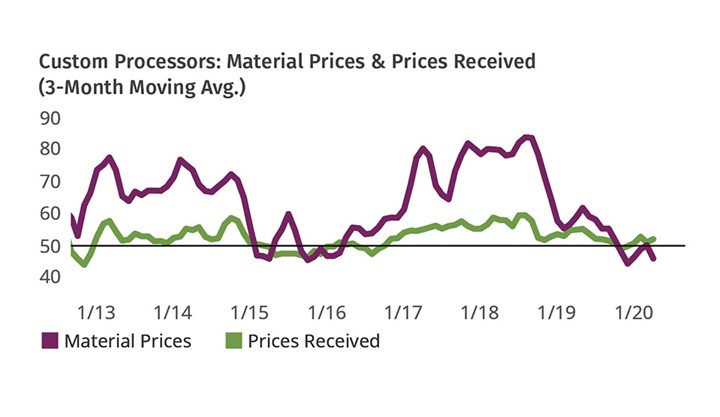

FIG 2 Despite a challenging first quarter of 2020, custom processors reported that their prices for goods sold has improved, along with a slight decrease in material prices. While this is subject to change in future months, the combination of events implies that profit margins may have improved in the first quarter.

FIG 2 Despite a challenging first quarter of 2020, custom processors reported that their prices for goods sold has improved, along with a slight decrease in material prices. While this is subject to change in future months, the combination of events implies that profit margins may have improved in the first quarter.For the first time since 2016, the index for prices received fell below 50 while the index for material prices moved above the 50-mark. This combination of events suggests that profit margins are under increasing pressure because of recent events.

Editor’s Note: The Plastics Processing Business Index is unique in its ability to measure business conditions specific to plastics processors on a monthly basis. The challenges facing manufacturers today require leaders to have good data in order to make effective forward-looking decisions. It is particularly important at this time for our readers to complete the survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the plastics industry.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology Magazine.

About the Author: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

Plastics Processing Contraction Slows Slightly

While the market is still sluggish, future business outlook rose significantly from last month.

Read MoreProcessing Takes a Dip in June

Plastics activity took a relatively big downturn in June, ending at a low for the year and lower than the same month a year ago.

Read MorePlastics Index Shows Supply Chain Improvement Despite Production Slowdown

Future expectations reach 2024 high on the heels of the recent election.

Read MorePlastics Processing Activity Contraction Continues in August

Four months of consecutive contraction overall.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More

.jpg;width=70;height=70;mode=crop)