Plastics Processing Expands in July

With an Index reading of 52.3, processors report first monthly expansion since the coronavirus disruption.

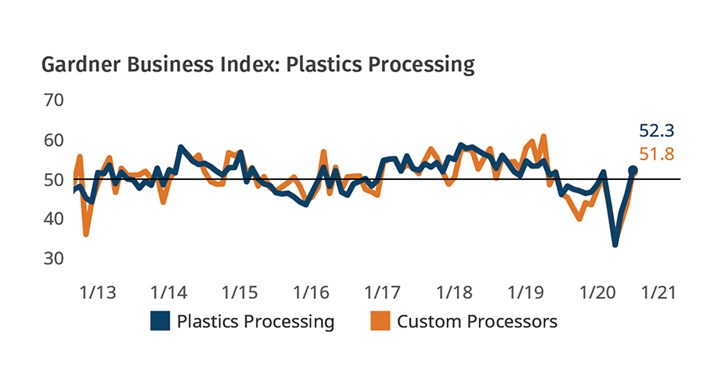

The Gardner Business Index (GBI) for plastics processors—based on monthly surveys of Plastics Technology subscribers—reported its first expansionary reading in July, coming in at 52.3, while the nation and economy continue to battle the spread of the novel coronavirus. Survey results provided by custom processors in particular also revealed better business conditions (Fig. 1).

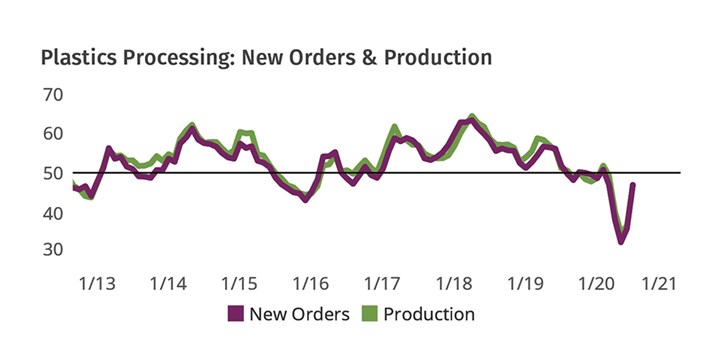

Among the components that constitute the overall index, new orders and production both showed expanding activity in July vs. June (Fig. 2). All index components had higher readings in absolute terms for the month, with exports and backlogs reporting quickly slowing decline in their respective areas of activity.

FIG 1 Both the overall and custom processor indices reported expanding business activity in July for the first time since COVID’s severe disruption of the economy.

The greater than nine-point gain in the index for new orders was not only the highest since April 2019, but indicated expanding order activity for the first time while the economy operates under the shadow of COVID-19. Historically, new orders have acted as a bellwether for other components of the index, including production, backlogs and employment. Should new orders continue to experience expanding activity in future months, it would be reasonable to expect these other measures of business activity to expand too. Simultaneously, the industry continues to signal that supply chains remain severely disrupted; this may delay the return of normal production levels and hiring.

FIG 2 New orders and production reported their first month of slowing decline in July after a sharp drop in June.

Editor’s Note: The Plastics Processing Business Index is unique in its ability to measure business conditions specific to plastics processors on a monthly basis. The challenges facing manufacturers today require leaders to have good data in order to make effective forward-looking decisions. It is particularly important at this time for our readers to complete the survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the plastics industry.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

About the Author: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

-

US Merchants Makes its Mark in Injection Molding

In less than a decade in injection molding, US Merchants has acquired hundreds of machines spread across facilities in California, Texas, Virginia and Arizona, with even more growth coming.

-

Making Gains in the Drain Game

AWD blends extrusion and thermoforming technologies with plenty of home-brewed equipment and processes to keep water away from where it isn’t supposed to be.

-

Winners Announced for SPE Thermoforming 2023 Parts Competition

More than 30 entries were considered, including 10 in the Sustainability category.

.jpg;width=70;height=70;mode=crop)