Processing Index Contracts as Coronavirus Disrupts Economy

COVID-19 results in weaker new orders, production dips and a disrupted supply chain in March. But for how long?

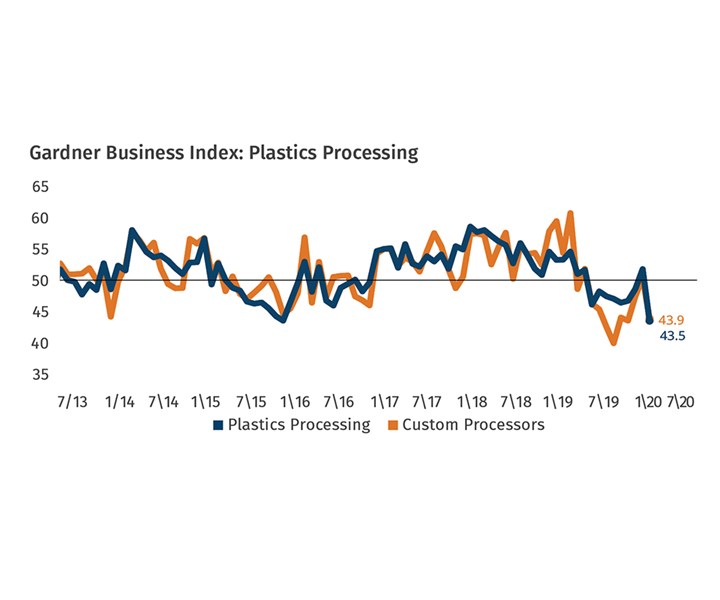

These are unsettling and somewhat confusing times in plastics processing. On the one hand, anecdotal evidence suggests processors were extraordinarily busy in March, responding at breakneck speeds to demands for medical products and packaging of all kinds spurred by COVID-19. Sources say some molders with capacity constraints even turned to their machine suppliers to run parts for them. On the other hand, all this activity was not reflected in March’s Plastics Processing Business Index, which dipped to 43.5.

FIG 1 After a nascent recovery appeared to be at hand earlier in the year, the Plastics Processing Business Index contracted sharply as the world’s economy was ordered to close in hopes of slowing the spread of COVID-19.

Gardner Intelligence reports that several components of the Index—calculated as an average of its components—reached all-time lows, including new orders, export orders, production and employment. Remember, though, that these readings represent the breadth of change occurring within the plastics processing industry and should not be confused with the rate of decline taking place. These low readings indicate only that a large proportion of the industry reported decreased levels of business activity.

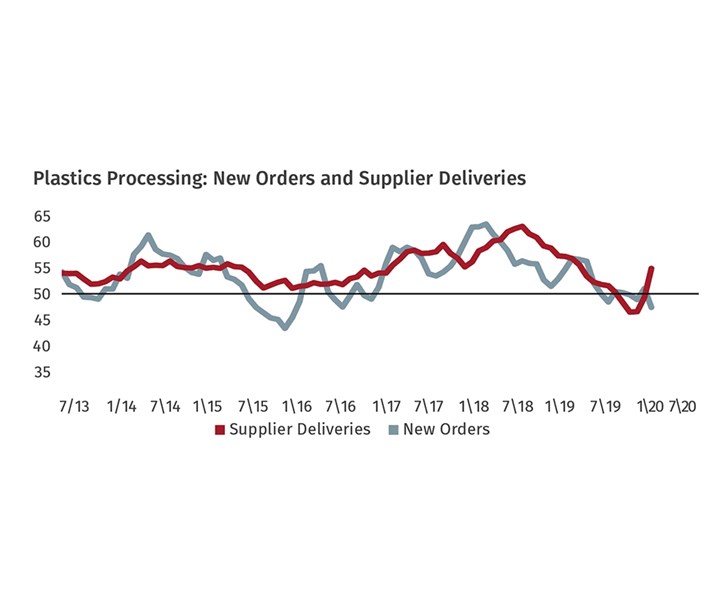

The reading for supplier deliveries moved significantly higher. In normal times when demand for upstream goods is high, supply chains cannot keep pace with these orders. The resulting backlog of supplier orders thus lengthens their delivery times. This delay causes our surveyed firms to report slowing deliveries. By the survey’s design, when this slowing effect occurs it elevates the supplier deliveries reading. The world’s efforts to slow the spread of COVID-19 has significantly disrupted supply chains worldwide.

FIG 2 The reading for supplier deliveries is designed to increase when supplier deliveries slow, under the assumption that suppliers are experiencing higher backlogs and need longer to get goods to manufacturers. In the current situation, though, it is COVID-19’s massive disruption to the world’s supply chains that is causing those longer delivery times and the supplier delivery figure to rise

While the majority of information we received from the market pointed to a challenging March, suppliers to plastics processors reported that all elements of their business activity expanded, the first time such an event has occurred in recorded history.

About the Author: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

-

How to Configure Your Twin-Screw Extruder: Part 3

The melting mechanism in a twin-screw extruder is quite different from that of a single screw. Design of the melting section affects how the material is melted, as well as melt temperature and quality.

-

Strategically Manage Pressure to Help Ensure Quality in Co-Rotating Twin-Screw Extrusion

Pressure measurement provides an invaluable window into any extrusion process, but it must also be strategically managed at every stage of the process to ensure a quality part is being extruded.

-

Sirmax Adapts Integrated Recycling Approach to US Supply Conditions

Integrating compounding and recycling to leverage untapped postindustrial recycling feedstocks.

.jpg;width=70;height=70;mode=crop)