Survey Says: Manufacturers Experience Fewer Changes with Less Impact from COVID-19

In the second week of a survey on COVID-19, manufacturers reported fewer changes to their business with less severe impact on their with the lone exception of travel related activities.

During the week of March 9, Gardner Intelligence conducted for the second time a short survey to gauge the effects of COVID-19 on discrete parts manufacturers across all the industries that Gardner Business Media covers. Gardner Business Media is the parent company of Plastics Technology Magazine.

The survey asked two basic questions:

- What changes has your business experienced as a result of COVID-19?

- What adjustments has your business made as a result of COVID-19?

For each of those questions, respondents were asked to rank the severity of the change or adjustment from minimal to moderate to major.

Of note, the second survey had 50% more respondents (slightly more than 300 vs. slightly more than 200) than first survey.

In the charts posted at the top of this blog post, the percent of respondents as of March 13 are green dots and the percent of respondents as of March 6 are gray dots. The orange bars indicated the severity of the impact of March 13 and the gray hashes were the severity of impact as of March 6.

According to this last week’s survey, 58% of manufacturers experienced no change in their business, which was up from 53% in the first survey. This improvement indicates that conditions did not worsen from the first survey and may have improved.

All but two of the changes experienced by manufacturers were unchanged in the second week of the survey. The two experiences that did change, supplier lead times and parts availability, both saw a smaller percent of respondents experiencing that change. This week just 16% of manufacturers were experiencing changes in supplier lead times versus 24% last week. And, just 9% of manufacturers were experiencing changes in part availability this week versus 19% last week.

For both supplier lead times and parts availability, the severity of the impact in the second week was much lower than the first. For supplier lead times, the percent of respondents reporting the impact as major decreased to 35% from 47%. For parts availability, the percent of respondents reporting the severity as major decreased to 22% from 58%. The severity of almost every other change experienced by businesses decreased in the second week of the survey as well.

Regarding adjustments made by businesses in the last week, the most significant change was travel or travel related. Last week, 47% of businesses adjusted travel versus 34% in the first week. And, 32% of businesses adjusted their tradeshow attendance or participation versus 23% in the first week. However, the severity of the impact decreased somewhat in both cases.

In addition, more manufacturers adjusted their training and budgets last week than the first week. Noticeably more respondents indicated the adjustment to training was major last week compared with the first week. Meanwhile, more manufacturers reported the severity of their budget adjustments in the second week as minimal compared with major in the first week.

Finally, fewer manufacturers reported making adjustments to their supply chains (down to 9% from 13%) and lead times (down to 8% from 15%) in the second week of the survey. Not one respondent in the second week reported the adjustment to the supply chain as major, signifying less severe impacts on supply chains overall in the second week versus the first week. The severity of the impact on lead times was relatively unchanged.

The reduced effects on supply chains and lead times according to this survey are supported by data from MachineMetrics, which shows a steady increase in capacity utilization through the first two-and-a-half months of 2020 at machine shops that defies the cycles of the previous two years. This seems to suggest that manufacturers are ramping up production to make up for lengthened lead times and stretched supply chains.

Related Content

Impacts of Auto’s Switch to Sustainability

Of all the trends you can see at NPE2024, this one is BIG. Not only is the auto industry transitioning to electrification but there are concerted efforts to modify the materials used, especially polymers, for interior applications.

Read MoreCarbon Fiber Reinforced Nylon 12 for Injection Molding

CRP Technology’s new composite is 100% recycled from Windform XT 2.0 IMG industrial 3D printing material.

Read MoreIndustrial Resin Recycling Diversifies by Looking Beyond Automotive

Recycler equips for new business in medical, housewares and carpeting.

Read MoreAutomotive Awards Highlight ‘Firsts,’ Emerging Technologies

Annual SPE event recognizes sustainability as a major theme.

Read MoreRead Next

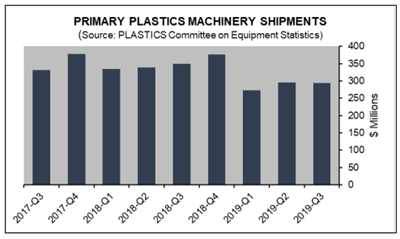

Plastics Machinery Shipments Finish 2019 Down Compared to 2018

A surge in the final quarter of 2019 could not salvage a weaker overall performance for North American plastics machinery and equipment sales compared to 2018.

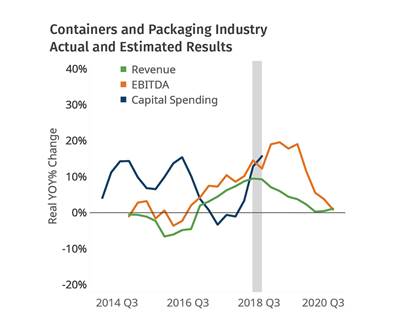

Read MorePackaging Growth Points to Strong 2019

As the plastics industry adjusts to 2018’s higher orders volume, capital expenditures in the industry have increased significantly.

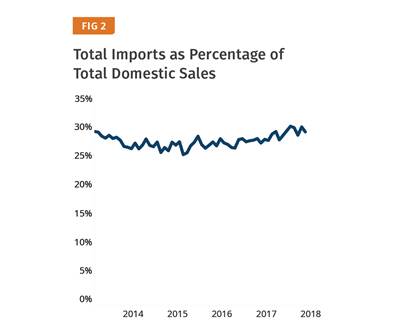

Read MoreUncertainty in Automotive Market for 2019

It’s not clear yet how trade tensions and interest rates will affect stagnant vehicle sales.

Read More

.JPG;width=70;height=70;mode=crop)