What Happened the Last Time(s) Oil Markets Went Crazy

With oil prices bouncing around record highs and inflation in the double digits, things may look bad now, but the plastics industry has been there before—and came out ahead.

At least twice within living memory, international crises sounded alarms for plastics processors about where they would get materials to put in their hoppers, and at what price. (Photo: Matthew Naitove)

How many of you remember the Arab Oil Embargo of 1973-’74, when crude oil prices quadrupled in just five months and plastics supplies became hard to find? Or the second big Oil Shock of 1979, when oil prices jumped 149%?

Not many of you, I’d guess, but I was starting my career at Plastics Technology back then, and the way today’s oil and gas markets are being roiled by events abroad brings back memories.

The first big Oil Shock (you can Google it) arose out of the first Arab-Israeli war. Oil production in the Middle East was nationalized and exports were cut to the U.S. and certain other Western countries that had supported Israel. Between October ’73 and March ’74, oil prices exploded from$3 to $12 a barrel. (Those were the days!) It was scary times. Gas lines were around the block. And when I had to fly somewhere for an interview, I remember landing at an airport at night, and renting a car that had only a quarter tank of gas. “Fill it up when you can find some more,” was all the advice I got.

To top it off, the Nixon Administration decided that it had to take charge of allocating where the scarce oil imports would go—and they initially decided that the plastics industry was inessential and therefore undeserving of much oil supply. They must have thought that, in a crisis, we could certainly live without cold-drink straws and those other throw-away items, as well as Hula Hoops and other cheap toys. I joined a delegation of plastics editors who went to Washington, D.C., to inform an Administration functionary that plastics meant more than that to the American economy—a whole lot more. Eventually, they got the message and loosened supplies.

But the effects were evident at my first NPE in 1973 (which filled only the old East Hall of McCormick Place back then). At the show, one of the major resin companies, chagrined at having to turn away customers because it was sold out, was handing out “Crying Towels” at its booth, instead of sales contracts.

Plastics processors suddenly took an interest in where their raw materials ultimately came from. In our January 1974 issue, we published a foldout diagram inside the back cover that showed how every type of plastic resin is derived from crude oil and/or natural gas. It proved unexpectedly popular, and we had to do a separate printing of just the Simplified Flow Chart of Plastics Resins—How They’re Derived. It’s now long out of print, alas.

To investigate how processors were dealing with this unprecedented challenge of soaring prices and tight supplies, I went on the road to learn about efforts to conserve resin by reclaiming process scrap. Inline film-scrap reclaim was suddenly a hot topic. I recall visiting a Midwest pipe producer that had automated a way to vacuum up the PVC sawdust from cutoff saws on its extrusion lines. It also salvaged hundreds of pounds of PVC from large pipe dies by disassembling them quickly after a run, before the resin could degrade. Another editor investigated how computer controls were gaining acceptance as a way to prevent making scrap in the first place.

These concerns re-emerged a few years later when the Iranian Revolution of 1979 brought on the second Oil Shock, when oil prices took another leap of 149% from $15.85 to $39.50 a barrel between April ’79 and April ’80. That was accompanied by a one-year increase of 31% in average prices of plastic raw materials, as reflected in the 1979 U.S. Producer Price Index for Plastic Materials and Resins. I’m guessing that the reason the rise in the PPI for plastics was only 31%, vs. 149% for crude oil, was that the plastics industry was more reliant on natural gas than oil, even back then.

If you don’t remember those events, you’ve no doubt heard about the “stagflation” of the late 1970s and the sharp recession of 1981-’82 that arose from Federal Reserve efforts to shake the U.S. economy out of those doldrums. Those were uncomfortable times, and some pundits warn that we may have to relive them.

I’m convinced that the industry today is much, much better prepared to overcome such challenges than it was all those decades ago. Here are some reasons why:

• Energy efficiency is no longer a topic that produces a shrug or a casual dismissal (“Yeah, sure”). Nearly every processor my colleagues and I speak with takes this seriously and is outfitting its plants with more efficient lighting, process cooling and material handling, as well as electric-powered machines.

• Likewise, in-plant scrap recycling is virtually gospel, as so many processors are implementing “zero landfill” policies.

• Purchasing post-industrial and post-consumer waste from outside sources is also a growing trend, especially among packaging producers. Although many processors say using recycle costs more than virgin resin, that calculus could change under a steady drumbeat of resin price hikes.

• So-called “advanced recycling,” which involves various chemical means of purifying or depolymerizing and reconstituting “virgin-quality” reclaimed resins, presents an exciting and barely tapped potential for high-volume reclamation of more kinds of plastic waste than ever before, and at modest cost.

• Recent interviews with packaging producers highlight lightweighting as another popular step toward sustainability, but the original motivation—cost reduction—may be more important than ever.

• Computer controls are vastly more sophisticated than in the 1970s. Microprocessors didn’t even appear on plastics equipment before 1975. Reduced scrap levels are one result.

• Automation, which was in its infancy in plastics in the 1970s, is now a high priority among plastics processors. I hear the repeated comment that automation is essential to combat chronic labor shortages that have become more acute since the COVID-19 pandemic, as well as a brake on rising labor costs. This factor, combined with the computer controls cited above, is making “lights-out” operation an everyday reality in both large and small plants that would formerly have considered it a pipe dream.

• Globalization is not dead, but domestic processors are reaping new opportunities from “reshoring,” which is growing with renewed energy, and even urgency, in response to world events.

• Surveys conducted by this magazine in the 1990s indicated that efficiency-enhancing new technologies often took decades longer to achieve widespread adoption here than in Europe or Asia (which then meant mainly Japan). Today’s plastics processors have a broad menu of new options at their disposal—additive manufacturing, conformal cooling, industry 4.0, to name a few—and my personal observations suggest that U.S. processors are far less hesitant than in the past to take advantage of opportunities to prosper.

If any of what I have just cited suggests something you’d like to look into yourself, I can think of no better opportunity than the upcoming PTXPO 2022 show at the Donald E. Stephens Convention Center in Rosemont, Ill., March 29-31. Over 230 exhibitors will be there to help you meet your productivity and profitability goals, despite all the challenges being thrown at you.

Related Content

Prices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

Read MorePrices Up for PE, ABS, PC, Nylons 6 and 66; Down for PP, PET and Flat for PS and PVC

Second quarter started with price hikes in PE and the four volume engineering resins, but relatively stable pricing was largely expected by the quarter’s end.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

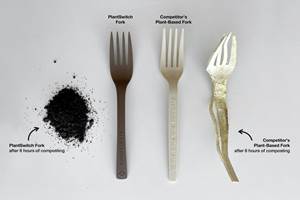

Read MoreAdvanced Biobased Materials Company PlantSwitch Gets Support for Commercialization

With participation from venture investment firm NexPoint Capital, PlantSwitch closes it $8M bridge financing round.

Read MoreRead Next

The Man Who Loved Trade Shows

I must have attended nearly 100 trade shows—why can’t I get enough of them? Why am I itching to get to PTXPO 2022?

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More