Appliances to Grow (Finally) in 2013

Wood on Plastics

Two factors will prompt growth in appliance demand this year. First is the continuing recovery in the residential construction and real estate markets. The other factor that will prop up demand for appliances in 2013 is the fact that the durable goods in American homes are aging.

In the first quarter of this year U.S. industrial production of household appliances increased by 6% compared with the fourth quarter of 2012, and by 7% vs. the same quarter a year ago. As anyone who has followed the U.S. appliance industry knows, this sector has had very few reasons to celebrate in recent years. So the strong start to this year is certainly noteworthy.

U.S. output of household appliances last registered a cyclical peak in 2004, and the industry has been declining ever since, contracting by 33%. I expect this downward streak to end in 2013. The bad news is that the annual increase this year will be moderate at best. The latest forecast calls for a gain of 5% to 6% in U.S. output of household appliances vs. 2012. This industry still has a long way to go before it gets back to pre-recession levels, but at least it will stop going downward.

Two factors will prompt growth in appliance demand this year. First is the continuing recovery in the residential construction and real estate markets. The trend in sales of household appliances correlates closely with trends in these two sectors. Appliance demand took a nosedive right after the housing bubble burst in 2008, and it continued to drift downward to historically low levels in the next three years. The long-awaited recovery in the housing market started to gain momentum last year, and this trend should continue for several years to come. This will spur demand for new household appliances for the next few years.

The other factor that will prop up demand for appliances in 2013 is the fact that the durable goods in American homes are aging. After the last recession, consumers were reticent to purchase big-ticket items. They chose to avoid debt and instead pay off their credit cards. But things are now starting to wear out and need to be replaced. This replacement demand started to show up in automotive over a year ago, and it will now start to positively affect the appliance industry.

Keen observers of the appliance industry will note that the conditions just described will generate rising demand for appliances, but that does not necessarily mean that the appliances will be produced domestically. A close look at the accompanying chart reveals that domestic appliance output was gradually drifting lower during the three years prior to the Great Recession.

Housing starts hit their cyclical peak in 2006, more than two years after the cyclical peak in U.S. appliance production. So this industry was clearly under stress from foreign competition long before it was hit by the disastrous bust in the housing sector.

The problems caused by imports will persist for the foreseeable future, but the advantages that foreign manufacturers once enjoyed are diminishing. The ever-rising costs for shipping, combined with rapid changes in both technology and consumer tastes, put a premium on manufacturing close to the market.

These factors can be overlooked for a brief period, but they cannot be ignored forever. Despite all of the hoopla pertaining to the dynamic growth in emerging economies, America is still one of the world’s most robust markets for household appliances. Those domestic OEMs and their suppliers who are innovative are still likely to find a way to make a profit in this marketplace.

WHAT THIS MEANS TO YOU

•Consumers want appliances that are quiet, energy efficient, fun to use, and beautiful. OEMs will design with those objectives in mind.

•“Smart” appliances, those that can be programmed and controlled remotely, will also be popular.

•Manufacturers and consumers will be increasingly aware of the problems emanating from the disposal of old appliances. Designs that enhance recyclability will gain attention

Related Content

In Sustainable Packaging, the Word is ‘Monomaterial’

In both flexible and rigid packaging, the trend is to replace multimaterial laminates, coextrusions and “composites” with single-material structures, usually based on PE or PP. Nonpackaging applications are following suit.

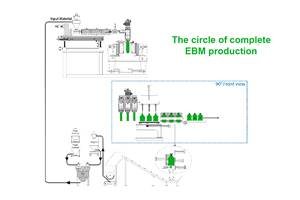

Read MoreMultilayer Solutions to Challenges in Blow Molding with PCR

For extrusion blow molders, challenges of price and availability of postconsumer recycled resins can be addressed with a variety of multilayer technologies, which also offer solutions to issues with color, processability, mechanical properties and chemical migration in PCR materials.

Read MoreHow to Optimize Injection Molding of PHA and PHA/PLA Blends

Here are processing guidelines aimed at both getting the PHA resin into the process without degrading it, and reducing residence time at melt temperatures.

Read MoreGet Color Changes Right In Extrusion Blow Molding

Follow these best practices to minimize loss of time, material and labor during color changes in molding containers from bottles to jerrycans. The authors explore what this means for each step of the process, from raw-material infeed to handling and reprocessing tails and trim.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More