Construction Outlook: Residential Recovery Starting

Wood on Plastics

The worst is over but the rebound will be slow.

It has been five long years since the bubble burst in the residential real-estate market, but it looks like the residential construction sector has at last turned the corner. Our forecast calls for a 15% increase in the number of new houses started in the U.S. in 2012. This follows a 3% rise in 2011.

For most markets, a forecast of 15% growth next year would sound wildly optimistic, but as the accompanying chart indicates, even an annual gain of this magnitude does not get the residential construction sector back to anywhere near its pre-bubble range. Residential construction this year will finally start to be a boost to economic growth rather than a drag, but it will take another couple of years before this market can be deemed fully healed.

Housing starts are a crucial leading indicator of future spending patterns for American households, and the fact that this data has remained depressed at very low levels over the past three years is a major reason the recovery in the overall economy has been rather feeble. But as 2012 got under way, the economic recovery was gaining momentum. Thus far, this has spurred apartment demand because at present many households lack either confidence or access to credit, so they will rent rather than buy.

However, pent-up demand is growing and the depressed building levels during the past few years means that inventories of all kinds of new houses are lean. Conditions for single-family construction will emerge more rapidly as job growth and confidence levels grow stronger. For the next couple of years, housing affordability will remain very high and mortgage credit availability will improve slowly but steadily.

So the prospects for processors that supply construction products are looking up, but there are still a few hurdles that must be overcome. In terms of the macro-economy, there are problems in Europe that could spill over and push the U.S. economy back into a recession. This is not the most likely outcome, but households and businesses alike are still a bit on edge after the Great Recession and amid Washington’s partisan acrimony.

The other big hurdle that is currently affecting the housing market is that house prices are still falling, and more than 14 million homeowners are currently underwater on their mortgages. There are some new programs in the pipeline that will help a substantial number of these homeowners refinance their mortgages, but the total number of foreclosures will not start to decline until the third or fourth quarter of 2012. Falling prices and rising foreclosures are stifling the flow of credit, and this will probably only be cured by the passage of more time. This problem will not be completely solved in 2012, but we should see some light at the end of this tunnel by the second half of this year.

Home sales as well as construction of new houses and renovations of existing structures will all start to gain traction by the second half of this year. The prices of fuel and materials (resins, copper, lumber, steel, etc.) are also expected to rise, and this will cause ongoing headaches for consumers, builders, and suppliers alike. It will undoubtedly take a long time for us to get back to the good ol’ days, if we ever do. But this year will be noticeably better than last year, and that is a start.

WHAT THIS MEANS TO YOU

•The worst is over. It might be a good time to review your equipment inventory to see what upgrades might be needed.

•Energy is and will remain a key issue. Focus design and development efforts on products that are energy efficient.

•Resin prices will continue to increase. Processors that figure out a way to make more judicious use of their materials will have a competitive advantage.

Related Content

Architectural Mesh Made from Covestro’s Bioattributed PC

Kaynemaile’s new RE8 Architectural Mesh will deliver an ISCC Plus certified sustainable share of up to 88% of its architectural product.

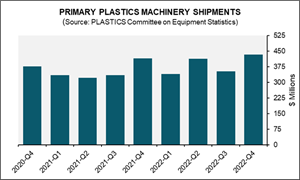

Read MorePlastics Machinery Shipments Rose in 2022’s Final Quarter

The Plastics Industry Association’s (PLASTICS) Committee on Equipment Statistics (CES) reported that injection molding and extrusion machinery shipments totaled $432.7 million in Q4.

Read MorePlastic Compounding Market to Outpace Metal & Alloy Market Growth

Study shows the plastic compounding process is being used to boost electrical properties and UV resistance while custom compounding is increasingly being used to achieve high-performance in plastic-based goods.

Read MoreIneos Nitriles Launches Biobased Acrylonitrile

The company’s Invireo is said to deliver a 90% lower carbon footprint compared to conventionally produced acrylonitrile.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More