Construction spending has been growing at a slower rate recently, but the 10-yr U.S. Treasury bond rate and housing permits are moving in a direction that points to further growth in construction spending. Let’s look at the underlying factors.

Real 10-Yr Treasury Rate. The real (inflation-adjusted) 10-yr Treasury (“T-Bill”) rate was 0.70% in September, falling below 1% for the fourth month in a row and reaching its lowest level since February 2015. Since the Federal Reserve Bank announced it was raising its overnight rate, the real 10-yr Treasury rate has dropped in each of the last 10 months. A significant reason for this is that the rate of inflation, while still low historically, has picked up from what it was in 2015. In September, the annual rate of inflation was the highest since October 2014, according to the Consumer Price Index. The year-over-year change in the real rate (the nominal rate minus inflation) fell to -115 basis points.

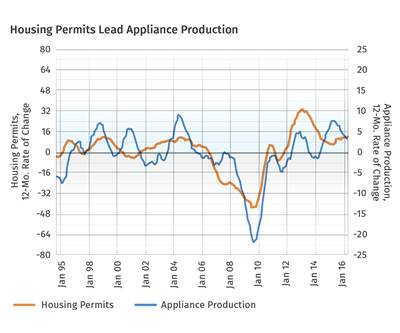

Housing Permits. There were 107,600 housing permits filed in September. In four of the last five months, permits were above 100,000. While the number of permits was still relatively low relative to the last four decades, the level is almost the highest since 2007. Compared with one year ago, housing permits increased 10.7%, for the second month of growth—both at double digits—in a row. The annual growth rate accelerated to 2.9%, which was the second month in a row of accelerating growth.

The change in the real 10-yr Treasury rate is a likely cause for September’s increase in housing permits. Changes in the interest rate lead changes in housing permits by about 12 months on average. In fact, housing permits seem to have bottomed six months after interest rates started falling on a year-over-year basis.

Total Construction Spending. The real value of construction put in place in September was $106,189 million. Compared with a year ago, this was an increase of just 0.5%, the slowest rate of growth since construction spending started the current growth cycle in December 2011. The month-over-month rate of change has grown at a decelerating rate since September 2015. The annual rate of change peaked in the same month and has grown at a decelerating rate since then. Annual construction spending is growing at a rate of 3.2%, which is the slowest rate since January 2012, the last time spending contracted.

Residential construction spending is slowing as well. Month- over-month growth decelerated to 2.3% in September, which was the slowest rate of growth since January 2012. The annual rate of growth, now 13.4%, has decelerated nine months in a row.

In the short term, the trend in construction spending is negative for products, parts, and production of equipment used in construction. However, the change in the real 10-yr Treasury rate and the change in housing permits are moving in a positive direction, which should help maintain growth in construction spending and may even cause growth to accelerate next year.

Bottom line: The business for processors serving commercial and residential construction markets should remain quite strong.

ABOUT THE AUTHOR: Steven Kline Jr. is part of the fourth-generation ownership team of Cincinnati-based Gardner Business Media, which is the publisher of Plastics Technology. He is currently the company’s director of market intelligence. Contact: (513) 527-8800 email: skline2@gardnerweb.com; blog: gardnerweb.com/economics/blog

Related Content

Compact Entry Rotating-Rack Series of Weather Testers Expanded

Atlas’ Xenotest now also available to meet American standards.

Read MoreArchitectural Mesh Made from Covestro’s Bioattributed PC

Kaynemaile’s new RE8 Architectural Mesh will deliver an ISCC Plus certified sustainable share of up to 88% of its architectural product.

Read MoreEV Chargers Made From Renewable PC

SABIC is enabling Charge Amps to manufacture electric vehicle (EV) chargers with a housing made from certified renewable PC, a first for the industry.

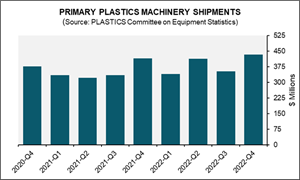

Read MorePlastics Machinery Shipments Rose in 2022’s Final Quarter

The Plastics Industry Association’s (PLASTICS) Committee on Equipment Statistics (CES) reported that injection molding and extrusion machinery shipments totaled $432.7 million in Q4.

Read MoreRead Next

Positive Signs for Appliances

Indicators suggest growth in production of appliances should kick in mid-2017.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More

.JPG;width=70;height=70;mode=crop)