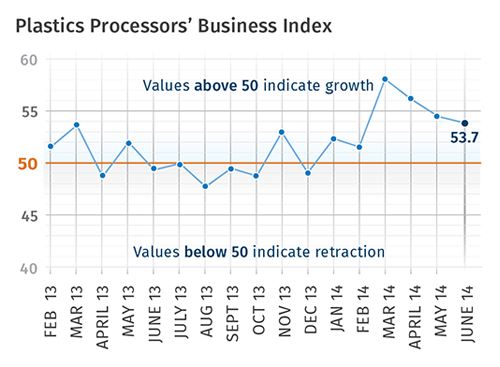

Growth For Seven Out of Eight Months

All signs point to an uptick in capacity utilization for the rest of 2014.

With a reading of 53.7, Gardner’s plastics processor’s business index grew for the seventh time in eight months in June. While the rate of growth has slowed in the last three months, the growth rate over the April-to-June time frame has been the fastest since April 2012. Compared with June 2013, the index was 7.8% higher. That marks the eighth consecutive month that the index was higher than one year ago. The annual rate of growth in the index (now 5.8%) has accelerated in each of the last five months, a positive sign.

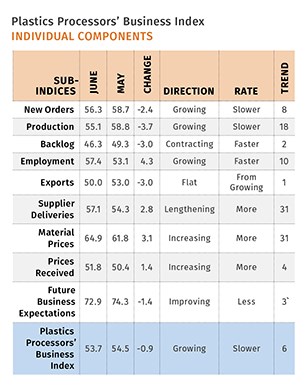

New orders have grown for eight consecutive months, and the rate of growth here is strong. Production has grown for 18 straight months. Backlogs contracted at an accelerating rate for the second month in a row. The index has trended lower since March. However, the backlog index was higher than a year ago for the eighth consecutive month. The annual rate of growth in backlogs has improved dramatically over this time period. This is a very positive sign that capacity utilization at plastics processors will improve in the second half of 2014. Exports were flat after growing in May. Supplier deliveries continue to lengthen and are lengthening at their fastest rate since May 2012.

Material prices increased at a faster rate in June after growing at a slower pace since February. Prices received have increased four months in a row, although the rate of increase has been relatively modest for the last three months. Future business expectations have softened in the last three months.

Facilities with more than 250 employees continued to see significant expansion, although their rate of growth has slowed in the last two months. Processors with 20-249 employees saw significantly better business conditions in June compared with May. The most significant improvement came at plants with 100-249 employees. But processors with fewer than 19 employees contracted after growing for two of the last three months. These facilities contracted at their fastest rate since December 2013.

All regions but one expanded in June; the Northeast was flat. Future capital spending plans were above $1 million for the fourth month in a row. This was their second highest level since November 2013. Compared with a year ago, future spending plans increased 31.3%. This was the fastest rate of month-over-month growth since November 2013. The annual rate of change accelerated slightly after decelerating since November.

Related Content

-

Processing Takes a Dip in June

Plastics activity took a relatively big downturn in June, ending at a low for the year and lower than the same month a year ago.

-

Plastics Processing Contraction Continues

Contraction dominated the GBI index for overall plastics processing activity and almost all components, collectively suggesting a slowdown.

-

Processing Making Slow, Steady Progress

Plastics processing activity didn’t make its way into expansion territory in March, but seems headed in that direction.

.JPG;width=70;height=70;mode=crop)