Industry Grows…But Slower

Backlogs continue to grow, suggesting that processors’ capacity utilization and capital equipment investment should increase in 2015.

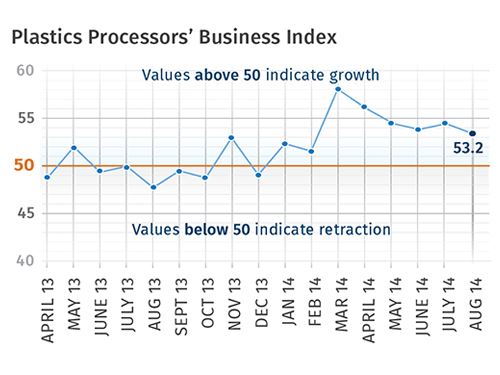

With a reading of 53.2 in August, Gardner’s Plastics Processors’ Business Index grew for the ninth time in 10 months. Still, the index was at its lowest level since February. The processing market has experienced generally slower growth since its peak in March. However, the industry was still growing faster than at any other time since April 2012. The month-over-month rate of change of the index increased more than 10% for just the second time this year. The annual rate of growth has accelerated in each of the last seven months.

New orders have grown for 10 straight months. The rate of growth has been relatively flat recently, though at a high level. Production continued to expand. The rate of expansion dipped just slightly this month, but production has expanded faster than in all but three months since May 2012. Backlogs have contracted for four months in a row. But compared with a year ago, the backlog index continues to grow. This indicates that capacity utilization and capital equipment investment should increase in 2015.

Employment continued to grow, but at its slowest rate since October 2013. Exports have contracted faster in each of the last two months. Supplier deliveries have lengthened since September 2013.

Material prices increased at a slower rate in August than in July. Prices received have increased for six straight months. This is the longest such streak since the summer of 2012. Future business expectations were unchanged in August and remained at their lowest level since September 2013.

Facilities with more than 100 employees continued to see strong and relatively consistent expansion. And compared with last month, processors with 20-49 employees expanded notably. Processors with 19 employees or less contracted for the third month in a row, but the rate of contraction has been relatively constant. However, plants with 50-99 employees saw a steep drop in their index. Their index fell to 48.5 in August from July’s 60.5.

Every region expanded for the second month in a row. Future capital spending plans were more than $1 million for the fifth time in the last six months. After contracting last month, the month-over-month rate of change increased by 4.8%. The annual rate of change has slowed significantly since November 2013. However, the rate of growth is still above 10%.

Related Content

-

Plastics Processing Contraction Slows Slightly

While the market is still sluggish, future business outlook rose significantly from last month.

-

Processing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

-

Plastics Index Shows Fourth Consecutive Monthly Gain

December reading hints at slowing contraction as plastics industry outlook improves

.JPG;width=70;height=70;mode=crop)