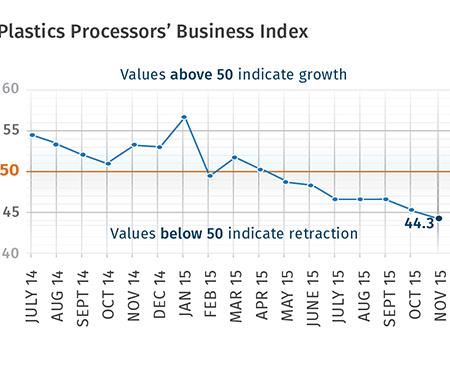

November 2015—44.3

Processors plan to invest in capital equipment as smaller processors are doing better.

With a reading of 44.3, Gardner’s Business Index—Plastics Processing contracted at a slightly faster rate in November than in the month before. The index contracted for the seventh month in a row and was at its lowest level since December 2012.

While larger plastics processors had performed quite well over the last couple of years, business conditions at even these companies weakened significantly in November. Plants with more than 250 employees had an index of 37.5, down from 56.3 in October. Facilities with 100-249 employees saw their index drop to 48.9 from 60.2. Smaller facilities still contracted in November, but they contracted at a slower rate. Processors with 1-19 employees had their highest index since July 2015.

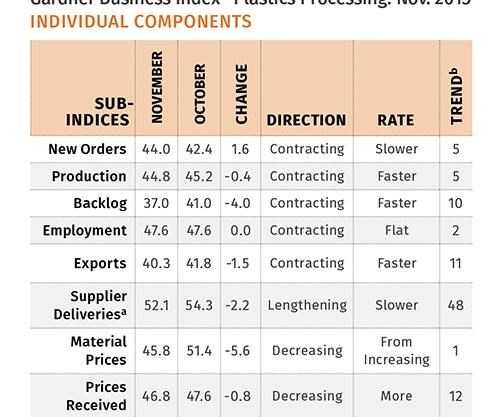

New orders contracted for the fifth month in a row. The rate of contraction decelerated somewhat from last month. Production also contracted for the fifth month in a row. The rate of contraction continued to accelerate, and the index was at its lowest level since December 2012. The backlog index has contracted since January 2015. Since August, the rate of contraction in backlogs seems to have accelerated. The continued contraction in backlogs indicated that capacity utilization at plastics processors would continue to weaken. Employment contracted for the third time in four months.

Because of the strength of the dollar, exports remain mired in contraction. In November, the index fell to its lowest level since the survey began in December 2011. Supplier deliveries lengthened at a somewhat slower rate in November compared with October.

After increasing last month, material prices decreased in November. The index fell to virtually its lowest level since the survey began. Prices received continued to decrease. But the rate of decrease has decelerated slightly since June. Future business expectations weakened for the second month in a row. They were at their lowest level since November 2012.

The Southeast region grew at the fastest rate in November. The West grew for second month in a row. The North Central-East contracted at the slowest rate.

Future capital spending plans in November were above average for the first time since January 2015. They increased nearly 50% from the previous two months. However, they were still contracting compared with a year ago.

ABOUT THE AUTHOR

Steven Kline Jr. is part of the fourth-generation ownership team of Cincinnati-based Gardner Business Media, which is the publisher of Plastics Technology. He is currently the company’s director of market intelligence. Contact: (513) 527-8800 email:skline2@gardnerweb.com; blog: gardnerweb.com/economics/blog

Related Content

-

How to Configure Your Twin-Screw Extruder: Part 3

The melting mechanism in a twin-screw extruder is quite different from that of a single screw. Design of the melting section affects how the material is melted, as well as melt temperature and quality.

-

Sirmax Adapts Integrated Recycling Approach to US Supply Conditions

Integrating compounding and recycling to leverage untapped postindustrial recycling feedstocks.

-

Strategically Manage Pressure to Help Ensure Quality in Co-Rotating Twin-Screw Extrusion

Pressure measurement provides an invaluable window into any extrusion process, but it must also be strategically managed at every stage of the process to ensure a quality part is being extruded.

.JPG;width=70;height=70;mode=crop)