Processing Business Still Growing

Processing market grows for the third time in four months.

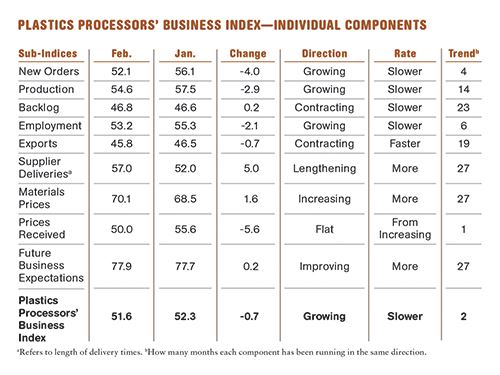

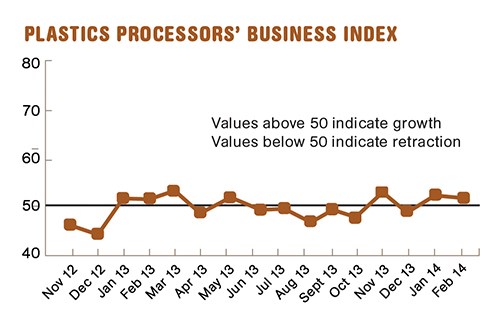

With a reading of 51.6, Gardner Business Media’s exclusive Plastics Processors’ Business Index grew for the third time in four months.

Since August 2013, the level of business activity among plastics processors has been picking up. The rate of growth in February was the fourth fastest since May 2012. Compared with a year ago, the index was up 0.8%. February was the fourth month in a row, and the sixth time in seven months, that the index was higher than it was one year ago.

New orders increased for the fourth month in a row. The trend in new orders has been improving fairly rapidly since October. Production expanded for the 14th straight month. The rate of growth in production is at the high end of the last 14 months. Backlogs contracted at a consistent rate in three of the last four months. However, the backlog index was higher than a year ago in each of the last four months.

The annual rate of change has contracted at a slower rate in each of the last three months. This is an indication that capacity utilization and capital investment should increase in 2014. Other than the stretch from August to October, employment has expanded at a fairly consistent rate since March 2013. Exports have contracted at a consistent rate since October 2012. Supplier deliveries lengthened the most since May 2012.

Materials prices have increased at an accelerating rate in each of the last three months. In fact, material prices are increasing at their fastest rate in the last year. However, prices processors received for their products were flat in February and have increased at only a modest rate since last May. Future business expectations edged up in February, reaching their highest level since March 2012 and their second highest level since the index began in December 2011.

Plants with more than 250 employees expanded very rapidly in February. Facilities with 20-249 employees experienced either modest growth or contraction. Processors with 19 or fewer employees continued to contract, and their future business expectations were significantly below the industry average.

Five of the six regions (those with enough response to compute an index) expanded in February. The Pacific region grew at the fastest rate. It was followed by the South Atlantic, West North Central, New England, and East North Central regions. The Middle Atlantic contracted at a very significant rate.

Capital spending plans increased 1.6% compared with one year ago. Future spending plans have grown month-over-month in each month but one since December 2012. In general, it appears that capital spending plans are slowing down slightly. But, if the overall trend in the industry continues to be up, then future spending plans should turn back around soon.

ABOUT THE AUTHOR

Steven Kline Jr. is part of the fourth-generation ownership team of Cincinnati-based Gardner Business Media, which is the publisher of Plastics Technology. He is currently the company’s director of market intelligence. Contact: (513) 527-8800; email: skline2@gardnerweb.com; blog: gardnerweb.com/economics/blog.

Related Content

-

Plastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

-

Plastics Processing Activity Drops in November

The drop in plastics activity appears to be driven by a return to accelerated contraction for three closely connected components — new orders, production and backlog.

-

Processing Activity Dips in May

Plastics processing took a downturn in May, the first appreciable dip since November 2023.

.JPG;width=70;height=70;mode=crop)