Processors Still Going Strong

Processor business grows for fifth month out of six.

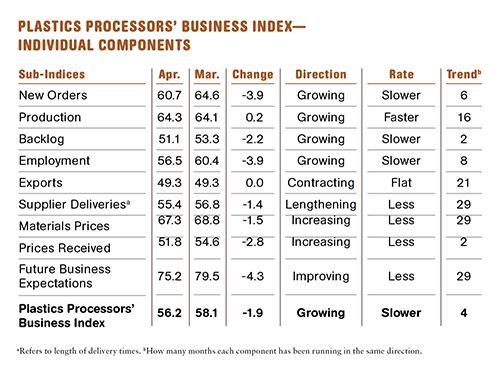

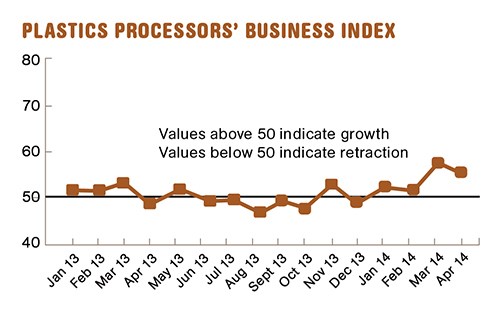

With a reading of 56.2, Gardner Business Media’s exclusive Plastics Processors’ Business Index revealed growth for the fifth time in sixth months. It was the second month in a row that the processing market’s index climbed beyond 56, which is a very fast rate of growth. The industry has not seen growth this strong since early 2012. Compared with one year ago, the index was 15.6% higher this month. That is the second fastest month-over-month growth since the index began in December 2011. Annually, the rate of growth has accelerated each of the last three months.

New orders continue to grow at a very strong rate. The new orders index was above 60 for the second month in a row. Production has expanded for 16 straight months. The last two months have seen production increase at a constant rate.

Backlogs grew for the second month in a row. In April, backlogs were 36.6% higher than they were a year ago. This is nearly double the next-fastest rate of monthly growth. Annually, backlogs are growing at an accelerating rate, which indicates higher levels of capacity utilization and forecasts higher capital spending at plastics processors. Employment continues to grow at a steadily increasing rate since October 2013. Exports just barely contracted for the second month in a row. Supplier deliveries continue to lengthen at a rate faster than they did in 2013.

Material prices are increasing at a much faster rate in 2014 than in 2013, but the rate of increase slowed slightly in the last two months. Prices received for processed goods increased in four of the last five months, though the rate of increase in prices received is much less than the rate of increase in materials prices. Future business expectations are still strong.

Processors with fewer than 20 employees contracted at a modest rate. Processors with 20-49 employees saw their rate of growth accelerate for the third straight month. Facilities with 50-249 employees saw their rates of growth slow noticeably. Processors with more than 250 employers are growing at their fastest rate since March 2012.

All five regions grew for the second month in a row. The Southeast region grew the fastest. Its index has been above 60 for two straight months. It was followed by the North Central-East, West, Northeast, and North Central-West regions. All of these regions are growing at a very strong rate.

Average per-plant future capital spending plans were above $1 million for the second month in a row. However, April’s spending plans were 0.2% lower than a year ago. This was the first contraction in the monthly rate of growth since December 2013. Annually, the rate of growth in spending plans has been decelerating, but the rate of growth is still extremely high.

Related Content

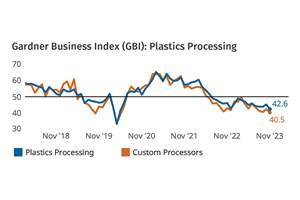

Plastics Processing Index Remains Virtually Unchanged

Future business indicators rose again this month, but other inputs changed only slightly.

Read MorePlastics Processing Activity Drops in November

The drop in plastics activity appears to be driven by a return to accelerated contraction for three closely connected components — new orders, production and backlog.

Read MoreProcessing Activity Dips in May

Plastics processing took a downturn in May, the first appreciable dip since November 2023.

Read MorePlastics Processing Activity Contracted in July

Plastics processing GBI contracted for the third month in a row.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More

.JPG;width=70;height=70;mode=crop)