Resin Buying Strategies - October 2010 A Brief Respite from Price Hikes?

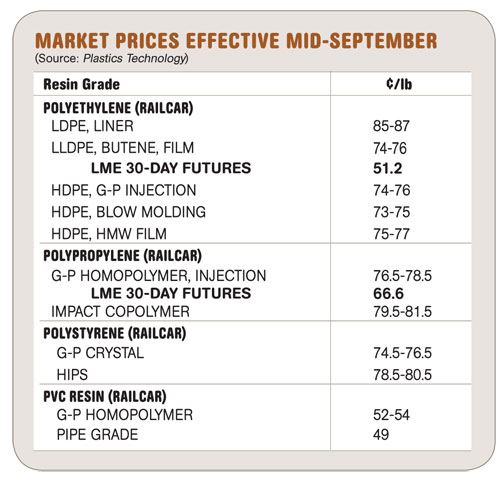

Prices of commodity thermoplastics, except for PVC, moved up last month.

Prices of commodity thermoplastics, except for PVC, moved up last month. Despite some market factors putting upward pressure onprices of polyolefins and PS, attempts to raise prices this month are generally “unlikely to fly,” barring any major production disruption, say resin purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas (resinpros.com). But the respite may be short-lived. Here’s more of what RTi experts project for the fourth quarter.

PE PRICES RISE

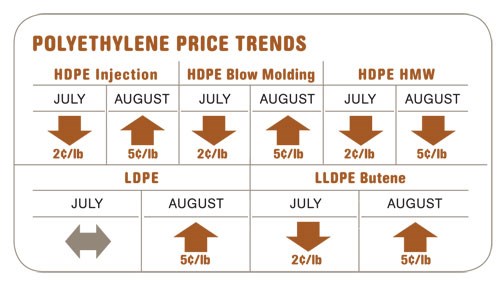

Polyethylene prices were moving up last month as suppliers implemented a 5¢/lb price hike. A 4¢ increase issued by one major supplier for Oct. 1 was expected to gain support from others. The London Metal Exchange (LME) North American short-term futures contract for butene LLDPE blown film grade in September was 51.2¢/lb, up very slightly from August’s 51¢/lb.

Supporting upward price movement are higher feedstock costs, low supplier inventories, and tight material supplies. Ethylene monomer spot prices moved 11.7% higher in August to an average of 37¢/lb, up from 31.8¢ in July. But September spot prices fell back to around 33¢/lb. August monomer contract prices also went up 2¢, but September contracts were likely to remain flat. The spike in August monomer prices was linked primarily to unplanned shutdowns of Dow and Shell ethylene units, which tightened supplies. The supply situation was already improving in September.

In July and August, LDPE producers maintained higher margins by not cutting prices, unlike the case with LLDPE and HDPE. Higher prices and tight supplies of LDPE caused many processors to switch to alternatives like LLDPE where possible. That, in turn, caused a bit of tightness in LLDPE. The strong PE buying of July and August did not reflect improved demand, but was prebuying in anticipation of the hurricane season and price hikes. Domestic buying halted in September, as processors held ample inventories. Export demand also subsided last month.

Outlook and Suggested Action Strategies

30-60 Day: Expect the start of the fourth quarter to see some upward pricing pressure. If exports rebound (unlikely), or if feedstock prices rise, there will be further support for more resin price hikes. Expect resin suppliers to manage inventory levels by throttling down production while demand remains flat.

PP PRICES UP FOR NOW

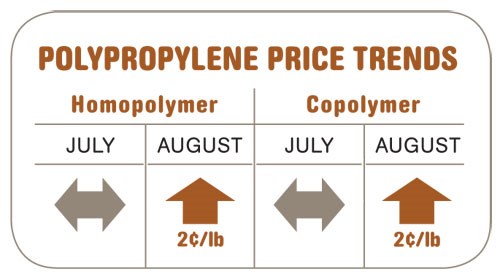

Polypropylene prices moved up 2¢/lb in August and 2.5¢ more in September. Those hikes just matched the monomer’s movement, adding nothing to PP suppliers’ margins. LME’s North American short-term futures contract on injection-grade homopolymer for September was 66.6¢/lb, down from August’s 67.8¢.

PP demand was very strong in June, July, and August. These higher volumes are attributed to real demand, not prebuying due to other factors. The secondary market remained tight through August, and prices were up between 2¢ and 5¢/lb, in many cases higher than prime-resin contract prices. Barring any major production disruptions, the PP market is likely to remain quite stable through the fourth quarter. Domestic demand is expected to slow. Exports, which were down 45% for the first three quarters, are not expected to rebound soon unless domestic PP prices drop significantly.

Industry operating rates approached 90% in August, accompanied by a demand rate of 98.9%. Supplier inventories shrank by another 50 million lb to 28.8 days.

Outlook & Suggested Action Strategies

30-60 Day: New capacity for 1.2 billion lb/yr of propylene monomer was being started up last month by Petrologistics. That should ease propylene supply and keep monomer prices stable.

PS PRICES MOVE UP SOME

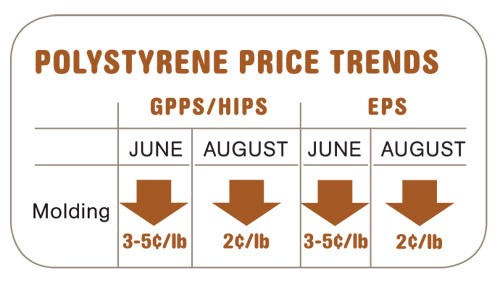

Polystyrene suppliers were aiming to boost prices by 4¢/lb on Sept. 1, but one supplier’s 2¢ TVA resulted in a 2¢ hike in September and another 2¢ increase slated for Oct. 1. Increases of 3¢ to 5¢/lb were also posted for EPS on that date, as suppliers aimed to regain margins cut by price declines in July and August of up to 7¢/lb.

Supporting the September increase were rising feedstock costs in August (2¢/lb higher ethylene contracts), though feedstock prices were flat or lower in September. Benzene prices dropped 73¢/gal between June and August. However, spot prices rose to over $3.01/gal and September contracts were expected to rise. August monomer contract prices held at July’s 54.25¢/lb but there were signs of a 5¢ increase in September. Monomer supply has tightened.

Domestic PS production was up 2.6% though the first half. Domestic demand dropped almost 2% while exports rose 27%. Food packaging was up 55% while all other markets were down.

Outlook & Suggested Action Strategies

30-60 Day: PTi expected upward price pressure last month, based on rising styrene and benzene prices as well as strong exports. PTi suggested taking a position on your inventory needs through October, as supply is tightening. Keep an eye on the weather (hurricanes), too. Evaluate your purchasing strategy for the quarter early, as more price increases are possible.

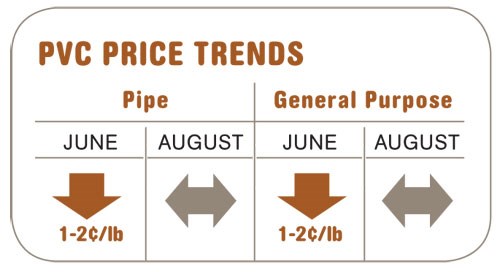

PVC PRICES FLAT

PVC prices remained flat in both August and September. Suppliers issued price hikes of 3¢/lb for Oct. 1. They are likely to have a difficult time implementing this increase, as domestic demand has faltered with the declines in housing sales to record lows. In sharp contrast, export volumes to South America and Asia rose 30% in the last two months. Domestic demand was up 3% in the second quarter but dropped sharply by 10% in July.

PVC operating rates dropped to 85% as domestic demand fell, but the increased exports have served to maintain a steady demand level and only a slight inventory increase. Meanwhile, spot ethylene prices went from a big spike in August back down to nearly July’s average levels last month. Chlorine prices actually reduced the cost of making PVC by 15¢/lb in the first half, but then added 0.5¢ to 1¢/lb in the third quarter.

Outlook & Suggested Action Strategies

30-60 Day: RTi suggested buying ahead in July/August to cover September in case of hurricanes and/or announced price hikes. October could then be leveraged on higher inventories as the hurricane season winds down, assuming there are no major storms. Prices should be held down by the startup of Shintech’s 660-million-lb PVC expansion, a possible slowdown of exports, and weak prospects of a housing recovery to push up demand before next year.

Related Content

Flexible-Film Processor Optimizes All-PE Food Packaging

Tobe Packaging’s breakthrough was to create its Ecolefin PE multilayer film that could be applied with a specialized barrier coating.

Read MorePrices Flat-to-Down for All Volume Resins

This month’s resin pricing report includes PT’s quarterly check-in on select engineering resins, including nylon 6 and 66.

Read MoreNew Facility Refreshes Post-Consumer PP by Washing Out Additives, Contaminants

PureCycle prepares to scale up its novel solvent recycling approach as new facility nears completion.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More