Resin Buying Strategies: Commodity Resin Prices Down

Prices of four major commodity resins continued to drop last month, albeit at a somewhat lesser velocity than in May.

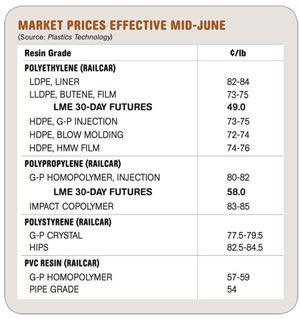

Prices of four major commodity resins continued to drop last month, albeit at a somewhat lesser velocity than in May. Further decline was expected this month and perhaps longer, according to purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas. Here’s more of what RTi experts see ahead.

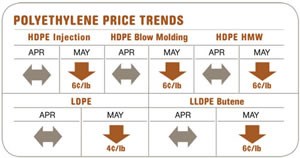

PE PRICES LOWER

Polyethylene prices dropped in June by 4¢/lb for LLDPE and HDPE and 2¢ for LDPE. This followed May’s 6¢ drop for LLDPE and HDPE and 4¢ for LDPE. The London Metal Exchange (LME) North American short-term futures contract for butene LLDPE film in June dropped to 49¢/lb from May’s 51¢, which was down 8¢ from April. That takes a big bite out of the 18¢ total price rise in the first four months. Where prices go from here will be determined by suppliers’ inventories and whether and when exports revive.

Domestic demand lost steam in April, in anticipation of lower prices, but reportedly improved a bit in May and June. It has been difficult to determine whether the demand uptick in the first half was true demand or buyers restocking ahead of price increases.

Spot ethylene monomer prices in May dropped to around 42¢/lb, a 56% decline from April. By mid-June, spot ethylene averaged closer to 33¢. Contract ethylene prices for May dropped 7.75¢ to 44.75¢/lb. June contracts remained unsettled at mid-month.

Except for LDPE, which remains tight globally, supplier inventories of LLDPE and HDPE grew by four days to 32. This is higher than the 2009 average of 29 days, but still 10 days below the pre-recession average of 42 days. LDPE inventories averaged 29 days. That is largely due to suppliers throttling down production since April to the high 70s percentage of capacity utilization for HDPE and low 80s for LLDPE. Operating rates for LDPE remained at around 73%. Demand rates through May stood at 93% of capacity for HDPE, 92% for LLDPE, and 96% for LDPE.

Outlook & Suggested Action Strategies

30 Day: Keep in touch with your RTi partner or other sources to determine daily pricing. Such information is critical in a falling market. Today’s best deal may be tomorrow’s worst. Continue to buy as needed and negotiate for additional price concessions.

60-90 Day: Resin inventory levels and feedstock prices will be the key price indicators. As inventory builds, look for suppliers to control production rates. Watch out for weak feedstock prices that may lead to lower ethylene production, which could result in price increases for ethylene and PE.

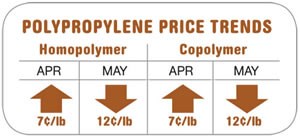

PP PRICES PLUNGE

Polypropylene prices dropped 12¢/lb in May, mirroring the slide in monomer contract settlements, which fell 12¢ to 63.5¢/lb in May. In June, monomer contract prices slid to 55.5¢. PP resin prices were expected to follow by end of June. The LME short-term futures contract in June for g-p injection-grade homopolymer dropped 2¢ to 58¢/lb after a 9¢ decline in May.

In May, resin could be had in the secondary market at prices even lower than the monomer contract price of 63.5¢/lb. Off-grade resin prices were even lower—in the low- to mid-50s. With the June monomer contract down 8¢/lb from May, even lower secondary-market PP prices were possible. However, by early June, there were signs of tighter conditions, at least for certain grades. PP suppliers were expected to reign in excess inventory, stabilizing secondary market prices by the month’s end.

Suppliers’ operating rates, in the 85% to 90% range for the first quarter, were throttled back to the mid-80s in April and May as demand dropped. Demand rates stood at 80% of capacity. Suppliers faced an inventory gain of about 120 million lb, forcing them to try to move excess material to non-traditional accounts while discounting prices along the way. Average inventory days of supply rose to 35.5. Still, demand rebounded somewhat in May, when processors’ inventories were low.

Outlook & Suggested Action Strategies

30-60 Day: PP prices were dropping last month, following the June monomer contract price, and resin spot prices were attractive through May and into June. But as suppliers seek to rebalance inventory levels, and as monomer prices bottom out, resin spot prices are likely to level out and possibly rebound. Monomer and resin prices are likely to start bottoming out this month, making it a good time for any restocking efforts.

PS PRICES FALLING

Polystyrene prices were dropping in June by 2¢ to 3¢/lb, after remaining flat from April into May. The 4¢ to 5¢ price increase posted for May 1 received no support for GPPS and HIPS, and spotty support for EPS. A further drop of 2¢ to 3¢ was expected in late June or July. For both PS and EPS, U.S. prices are still the highest in the world. There is a 9¢ to 13¢ delta in spot GPPS between the U.S. and Asia. Europe’s prices are within 5¢ of ours.

Styrene monomer’s contract price in April moved up to 68-71¢/lb, but May contracts settled 0.75¢ lower. The June contract was expected to drop at least 3¢ to 5¢. Spot monomer prices for June were on a downward trend to 49-51¢/lb.

Meanwhile, continued tight supply of butadiene resulted in May contract prices moving up 3¢. Improved imports are expected to stabilize pricing in the third quarter. Butadiene supply issues have supported an increase in the price spread between GPPS and HIPS to 6-7¢/lb, which is expected to hold through most of this year.

Outlook & Suggested Action Strategies

30-60 Day: Expect PS prices to continue downward this month by another 3¢ to 4¢/lb. Inventories are expected to build as demand tapers off. Continue to buy only as needed. Keep an eye out for the impact of the usual summer plant turnarounds.

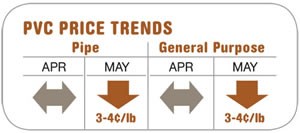

PVC PRICES DOWN A BIT

PVC resin tabs drifted down 3¢ to 4¢/lb in May, and further decline was expected last month after the significant drop in ethylene monomer prices. The net increase in feedstock costs for making PVC in the first four months was 3¢ to 4¢/lb. But the price of PVC moved up 13¢/lb in the same time frame, indicating a significant margin gain for suppliers as they moved into May. That gain was supported by strong exports and tight ethylene supply, which sent PVC suppliers into the more expensive spot market.

Outlook & Suggested Action Strategies

30-60 Day: Buy as needed and expect PVC prices to drop further this month due to improved ethylene supplies and lower prices. Demand will improve during the construction season.

Related Content

The Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More