Resin Buying Strategies: Resin Prices May Have Peaked

Though prices of major commodity resins were still rising in March, there were indications that they may have peaked, according to purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas.

Though prices of major commodity resins were still rising in March, there were indications that they may have peaked, according to purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas. They expected to see improved supplies of ethylene and propylene monomers help stabilize resin prices, despite a potential uptick in demand. Here’s more of what RTI experts see ahead.

POLYETHYLENE TIGHT, PRICES UP

Higher ethylene monomer costs lifted PE prices 8¢/lb by March 1, after full implementation of two February hikes. Another 5¢ increase was posted for Apr. 1. The London Metal Exchange (LME) North American short-term futures contract for butene LLDPE film grade jumped to 70¢ in March from February’s 64.8¢/lb.

By early March, there was significant tightening in ethylene supply due to planned and unplanned outages and refineries’ switch to heavy feeds, Spot ethylene prices were up about 35% since January. The cost to produce ethylene is near 34¢/lb. Tight ethylene supply potentially could cause a cutback in PE production, further tightening resin suppliers’ inventories depleted by strong export demand, restocking, and prebuying in anticipation of price hikes. Off-grade material has been tight. Domestic demand strengthened in the first quarter and the outlook is for continued improvement.

PE operating rates dropped in February from the mid-80s to a 72-76% range for LDPE and LLDPE and 80% to 83% for HDPE. Demand rates are 90% to 95% for LDPE and HDPE and 94% to 96% for LLDPE. Inventory levels are at a low of 21 days for HDPE, 24 to 27 days for LDPE, and 32 to 34 days for LLDPE.

Outlook & Suggested Action Strategies

30-Day: Ethylene monomer prices and exports could impact PE prices. By mid-March, spot ethylene prices had moved down a bit. It is important to communicate your resin requirements to your resin suppliers.

60-90 Day: Expect to see ethylene supplies improve with the restart of downed units. There is potential downward PE price pressure, depending when and how much ethylene prices retract.

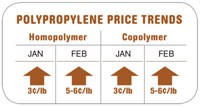

PP PRICES UP, SUPPLIES TIGHT

Polypropylene prices moved up 5¢/lb last month, following March monomer contracts, which rose to 68.5¢/lb. An earlier attempt to raise PP prices by 2¢ above the monomer increase appears to have had limited success, with perhaps a 1¢ gain in some instances. Many PP grades traded on the spot market at a premium over contract pricing. The LME short-term futures contract for g-p injection-grade homopolymer for March moved to 71¢/lb from February’s 69.3¢.

Suppliers kept production low to keep supply in line and also because of limited monomer availability. Overall inventory levels reportedly are at their lowest point in many years—around 31 days. PP operating rates are at 81% and demand rates are at 82.5%.

PP sales by the end of February were reported to have slowed as much as 20%, due to high resin prices dampening end-use demand. The secondary market remained extremely tight.

Outlook & Suggested Action Strategies

30-Day: As the March price hikes were going into place, there was limited opportunity for prebuying at February prices. Also, there was much concern about sinking downstream demand at the high price levels. There appears to be little reason to stock up on resin, as a price pullback is very likely this month or next.

60-90 Day: Watch for the effect of high PP prices on end-use demand—and a possible depressing effect on resin prices. RTi expects that the return of crackers and refineries from maintenance turnarounds will help ease monomer supplies in the next 30 to 45 days. That should drive down monomer and resin prices.

PS PRICES UP FOR NOW

Polystyrene prices moved up 3¢/lb in partial implementation of the February 5¢ increase, after the whopping 10¢ increase in January. PS prices appear to have peaked and are likely to soften in this quarter.

From November through February, PS production costs increased about 13¢/lb. Higher ethylene, butadiene, and styrene prices were to blame. However, benzene was already weaker by early March, and spot ethylene and styrene prices were starting to soften.

Meanwhile, the February price increases for EPS lost momentum due to dropping benzene prices and slow demand.

By the end of February, wide-spec PS railcar prices were 69¢ to 72¢/lb for GPPS and 73¢ to 75¢ for HIPS, though availability was limited.

Overall demand for PS has been good, and suppliers hope for growth of 3% to 4% in 2010, after last year’s 7.5% drop. Suppliers’ inventories are still tight—about 20 days vs. the 26-day average of the last couple of years. PS operating rates through February were about 76%. However, both styrene and PS operating rates were expected to rebound to 80% in this quarter.

Outlook & Suggested Action Strategies

30-60 Day: Benzene prices appear to have peaked as spot benzene began to trade substantially lower than contract. PS resin prices were expected to peak by end of February. As resin supply loosens, prices will start coming down. Continue to buy as needed and stay up to date on falling feedstock prices in order to better leverage resin prices downwards.

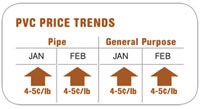

PVC PRICES UP

PVC prices moved up 4¢ to 5¢/lb, reflecting nearly full implementation of the February increase. Bids by some resin suppliers to raise contract prices 5¢ on Mar. 1 appeared unlikely to succeed, barring any further problems with ethylene supply.

The February price move was driven by higher ethylene prices and succeeded despite continued poor domestic demand. Ethylene has added 6¢ to 7¢/lb to the cost of making PVC since November. Domestic demand remains weak but exports picked up the slack through February.

Outlook & Suggested Action Strategies

30-60 Day: Movement of resin prices will depend on improved ethylene supply as well as PVC exports. If export prices to Asia hold up, they will support higher PVC pricing in North America into the second quarter. Buy as needed.

Related Content

Prices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MorePrices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MorePrices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More