Resin Buying Strategies: Rising Prices in This Quarter

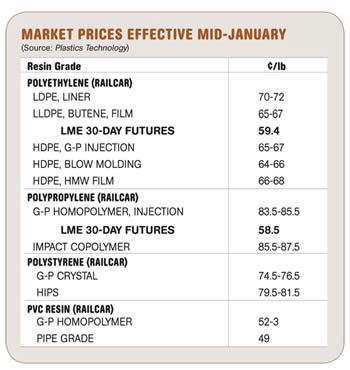

Prices of all four commodity resins were moving up last month and in some cases into this month.

Prices of all four commodity resins were moving up last month and in some cases into this month. Look for a push toward higher prices throughout the entire first quarter, according to purchasing consultants at Resin Technology, Inc. (RTI) in Fort Worth, Texas. Contributing factors include higher feedstock costs, tighter resin supplies, export demand, and producers’ aim to recover margins.

PE PRICES HIGHER

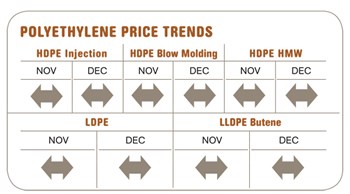

Polyethylene prices were expected to climb by 4¢/lb last month, as December price hikes stuck. The 3¢ January increase was pushed back to the first of this month. In addition, a new 5¢ hike was announced for Feb. 1. The London Metal Exchange (LME) North American short-term futures contract for butene LLDPE film resin in January leaped to 59.4¢/lb from December’s 51.2¢.

This series of hikes is related to two factors. First, feedstock costs have continued to climb, with ethylene monomer spot prices hitting 42¢/lb in mid-January. Since early November, spot ethylene tabs rose nearly 30%, while contract prices—currently at 43¢/lb—are up 14%.

Second, PE producers have reduced operating rates in order to control inventory levels enough to put pressure on PE pricing and prevent any erosion. For the last two months of 2009, operating rates for HDPE injection, blow molding, and HMW grades were in the 86% to 89% range; demand stood at 88% of capacity, and producers’ inventories were between 24 and 28 days. Operating rates for LDPE and butene LLDPE were at 87-90% and 95-97%, respectively, while demand rates stood at 85% and 92%. Producers’ inventories for LDPE were 34 to 36 days and for LLDPE, 40 to 43 days.

Outlook & Suggested Action Strategies

30 Day: The direction of monomer prices in late January will have some bearing on the pending Feb. 1 price hike. There has been short-term ethylene supply concern due to outages related to cold weather.

Even as the price of precursor ethane has dropped, spot ethylene prices remained firm and producers’ margins widened to 10-13¢/lb. This won’t last, once ethylene markets become more balanced. Watch the spot ethylene market for the first sign of supply balance. Then, oil prices and exports will be the price drivers for PE.

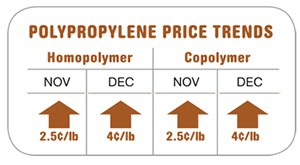

PP IS UP, TOO

Polypropylene prices moved up 3¢/lb in January, mirroring the increase in propylene monomer contract prices. Although spot monomer prices were trending downward in early January, a couple of crackers experienced unplanned shutdowns. LME’s North American short-term contract for g-p injection-grade homopolymer jumped to 58.5¢ from December’s 49.9¢/lb.

Last month showed a bit of an uptick in domestic PP resin sales, due primarily to inventory replenishment following holiday plant shutdowns. PP supply is tight as producers make only as much as needed, with their inventory levels at 31 to 32 days. December operating rates were down to 85%, with demand rates at 75% to 80%.

Outlook & Suggested Action Strategies

Watch monomer prices, which are likely to be flat or rising this month; buy as needed.

PS RISING

Polystyrene tabs rose 5¢/lb across the board on Jan. 1. By the end of the month, it looked like most of the Jan. 15 hike of another 5¢/lb would also be implemented. Feedstock costs have increased the cost of making PS by 10¢/lb since early December.

Meanwhile, implementation of a 5¢ increase on Feb. 1 was uncertain at press time. Benzene spot prices were trading 30¢/gal above contract prices, but fell back 10¢ by mid-January. So the prospects for this month’s 5¢ PS hike appear to be weakening, although a couple of cents might stick.

December contract prices on styrene monomer last month moved to a range of 59¢ to 62¢/lb—up 4.5¢/lb from November. January contracts appeared likely to settle 6¢ to 8¢ higher.

Last month, wide-spec PS railcar prices ranged from 58¢ to 60¢/lb for GPPS and 65¢ to 70¢/lb for HIPS—all with limited availability. Distributor railcar costs increased 5¢ to 79¢/lb for GPPS and 85¢/lb for HIPS.

December PS operating rates for GPPS, HIPS, and EPS were at 68%, with demand rates at 85% to 87%. After record-low inventories of 20 days in November, producers continued to squeeze inventories through December. EPS prices are on the way up, despite weak demand. The December 4¢/lb increase on EPS was pushed back to January, while BASF issued an 8¢/lb hike for Feb. 1.

Outlook & Suggested Action Strategies

30-Day: Higher prices of benzene and ethylene raised the cost of making PS by more than 8¢/lb. This pressure continues. Try to find deals on older inventory from secondary or distributor channels to hold you over until the “benzene storm” passes. Secure enough inventory to cover your needs through February.

60-Day: Upward pressure from benzene and ethylene will continue to affect PS pricing through the first quarter. Producers will look to improve their margins, and short-term supply problems may surface if demand increases. This could result in prices rising another 3¢ to 5¢/lb before they start to decline in the second quarter.

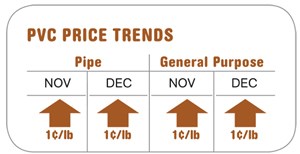

STRONGER PVC PRICES

PVC prices moved up 1¢/lb by year’s end, and were expected to gain 3¢ more last month as a partial implementation of the 5¢ hike posted for Jan. 1. At press time, a new 5¢ increase was announced for Feb. 1.

Ethylene increases in November-December added nearly 3¢/lb to the cost of producing PVC. Weak domestic demand continued to plague producers. There was a significant drop in pending home sales during November, although new home construction was up nearly 9% following a drop in October. Plant operating rates appeared to have decreased further, and the year closed in the high-70% to low-80% range as construction sales dropped and exports took a breather. PVC demand in 2010 is expected to rebound nearly 5%.

Outlook & Suggested Action Strategies

60-day: Cover your shorter-term needs. Higher feedstock costs, increased export demand, and producers pushing for margin recovery will push prices up in Q1. Volatility in feedstock costs should continue, as the economic recovery will be uneven. When talking to suppliers, focus on real, not anticipated, increases in feedstock prices.

Related Content

Prices Flat-to-Down for All Volume Resins

This month’s resin pricing report includes PT’s quarterly check-in on select engineering resins, including nylon 6 and 66.

Read MoreFlexible-Film Processor Optimizes All-PE Food Packaging

Tobe Packaging’s breakthrough was to create its Ecolefin PE multilayer film that could be applied with a specialized barrier coating.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More