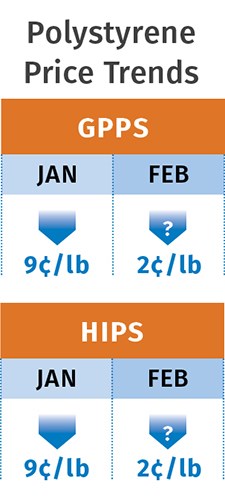

Commodity Resin Prices Drop More

Global feedstock and resin prices appear to be bottoming out, though PP tags might inch up.

All four commodity resins dropped in price in January, with PP and PS in the lead. More decline was generally expected last month, as global feedstock and resin prices appear to be bottoming out. One exception is PP prices, which were likely to either remain flat or possibly move upwards by a couple of cents, with some suppliers aiming to grab some margin and decouple resin prices from monomer prices. These are the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of Chicago-based The Plastics Exchange.

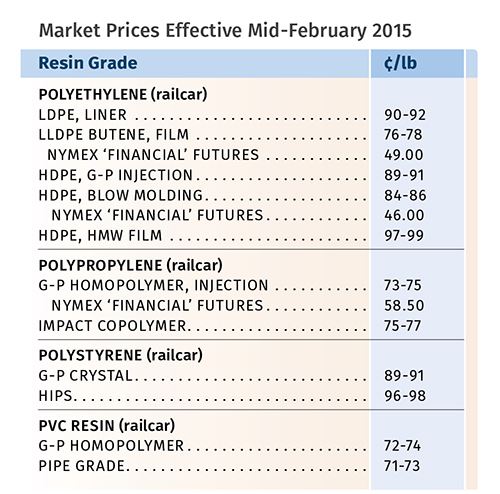

PE PRICES LOWER

Polyethylene prices dropped another 4¢/lb in January, bringing the total decline in two months to 11¢/lb. Further decrease was expected for February and March by both Greenberg and Mike Burns, RTi’s v.p. for PE. Says Burns, “Spot PE prices, down by over 20¢/lb, are very close to bottoming out. Off-grade resin for nearly all grades of PE continues to be available with a price range of 57-63¢/lb.”

Burns notes that global PE prices have reached bottom—with most regions down 15-20¢/lb since October. As a result, domestic PE contract prices will need to keep pace—meaning a drop of at least another 7¢/lb at today’s feedstock prices. Burns says that at today’s global resin cost structure, domestic prices need to be closer to 60¢/lb.

Meanwhile, there are no supply issues, with spot PE trading very active and offerings abundant, according to Greenberg. Burns says most processors are buying as needed in anticipation of lower prices ahead. “Buying activity after the Chinese New Year will be a strong indicator of the March price. Resin markets may not settle until post-NPE2015 in late March.” He notes that domestic prices will not reach the bottom until crude oil prices find the bottom and global markets return to normal buying.

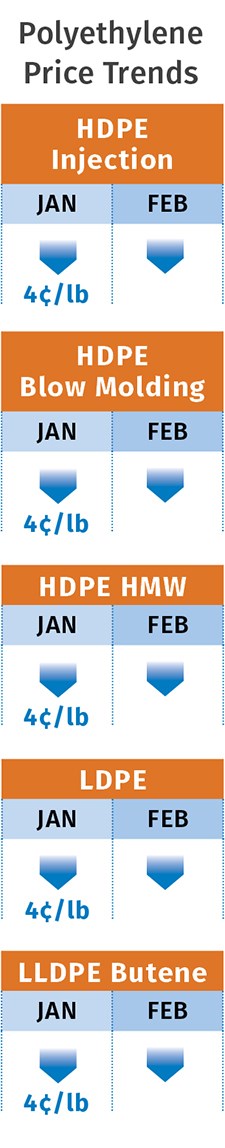

PP PRICES TUMBLE, BUT…

PP prices dropped by 10¢/lb in January but were expected to be flat or even a bit higher last month. Whereas propylene monomer dropped 12¢/lb, PP suppliers held on to the 2¢/lb profit margin they have been intent on implementing, and some processors felt that impact in late

fourth-quarter 2014.

Unsettled propylene monomer contract prices for February seemed likely to remain flat, although spot prices appeared to be firming up, with one nomination for an increase of 1.5¢/lb, according to Greenberg. Despite that, at least two PP suppliers came out with increases of 3-5¢/lb for February in a further attempt at profit-margin expansion. Says Scott Newell, director of client services for PP at RTi, “This margin expansion story is not over. The market is becoming more dynamic and less transparent.”

Both sources note that supply, which was relatively well balanced with demand by end of 2014, had become tighter due to a couple of reactor problems and suppliers aiming to match their output to forecasted orders. Both also note that suppliers have already made some headway in disengaging the formerly strong correlation between monomer and PP price movements. While PP suppliers may aim to jack up prices again, they may be hindered by an influx of lower-cost imported PP finished goods, according to Newell. “This is a small percentage at the moment—led by imports from the Far East, Europe, and Middle East—but something to be watching,” Newell says.

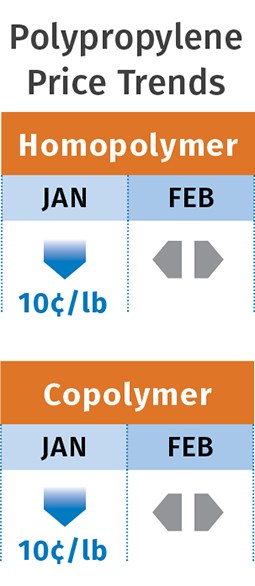

PS PRICES TUMBLE

Polystyrene prices dropped 9¢/lb in January, as had been projected by Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC. This was the fifth consecutive monthly drop since September 2014, for a total of 21¢/lb. At least one supplier announced a decrease of 2¢/lb for February.

Resin prices could have dropped even more in January, considering that January benzene contract prices dropped by $1.17/gal, and February contracts sank another 19¢/gal to a low of $2.01/gal. Also, January ethylene contract prices dropped 3¢/lb. Demand is at its typical seasonal slowdown for construction and recreation markets, but some pickup is anticipated starting this month, along with some opportunities for styrene monomer exports to Europe, according to Kallman.

PVC BUYERS RESIST HIKES

PVC prices fell 2¢/lb in January, following a 5¢ drop in the last two months of 2014, in step with the decline in ethylene contract prices. However, PVC suppliers announced two 3¢/lb price hikes for February and March, which RTi’s Kallman refers to as “a defensive move” in order to stem any further price erosion, but also due to planned plant maintenance outages taking place throughout the first quarter.

Kallman generally saw the attempted price increases failing last month, and even the possibility of further decline in PVC prices. Implementation of an increase this month remains an open question. There is a lot of optimism for some real growth this year in PVC demand as the construction season kicks in.

Related Content

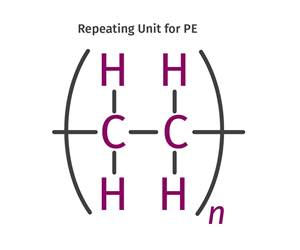

The Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MorePrices Flat-to-Down for All Volume Resins

This month’s resin pricing report includes PT’s quarterly check-in on select engineering resins, including nylon 6 and 66.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More