Commodity Resin Prices End Year with 'Soft Landing'

Prices of PE, PP, PS, and PVC declined further last month.

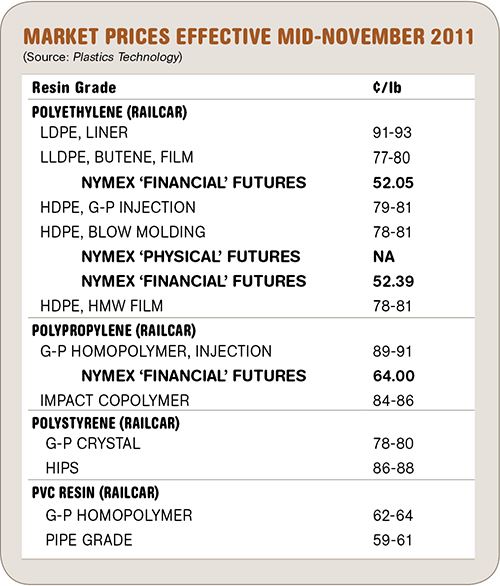

Prices of PE, PP, PS, and PVC declined further last month. With the possible exception of PP, even softer prices are likely this month. Price erosion in all the basic chemical feedstocks for these resins, as well as lackluster (or worse) domestic demand and an uncertain global market, are all contributing factors, according to resin purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Tex. Here’s more of their analysis.

PE PRICES DROP

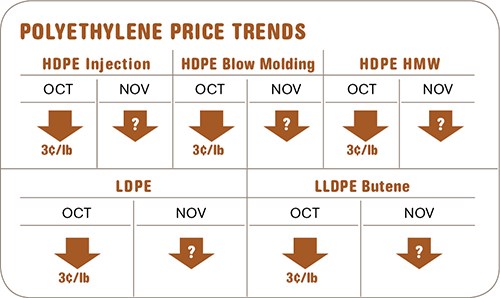

Polyethylene prices dropped 3¢/lb in October, even while two price increases were on the table. The first is the delayed 5¢ hike that was to take effect Nov. 1; the other, a new 6¢ hike on HDPE for Dec. 1.

PE prices were poised to fall even lower, by about 5¢/lb, owing to poor domestic demand and flat exports since September. However, higher feedstock prices halted the slide. Ethane (natural gas) prices jumped a whopping 14¢/gal due to pipeline problems and strong demand. While ethylene (made from ethane) did not follow suit, spot prices moved up to 52.25¢/lb and then fell back to 48¢ at the start of last month. The cash cost to produce ethylene increased by 25¢/lb in October.

ExxonMobil placed HDPE on allocation for the second time in this quarter, citing “unplanned operational issues” at its Mont Belvieu facility. No end date for the allocation was given.

Material was ample for most resins in the secondary markets, except for HMW-HDPE. Suppliers were offering PE for export at very attractive prices (e.g., 49¢/lb for HDPE).

There was an across-the-board drawdown of supplier inventories, but this was due neither to strong demand nor higher total sales—both of which dropped by 6%; instead, it was the result of a 2.5% reduction in domestic production.

Outlook & Suggested Action Strategies

30-60 Days: Feedstock prices will be the key market driver. Resin prices could drop further if feedstock prices fall, domestic demand stays as is or gets weaker, and if the export market remains flat. Buy as needed.

PP PRICES TUMBLE—FOR NOW

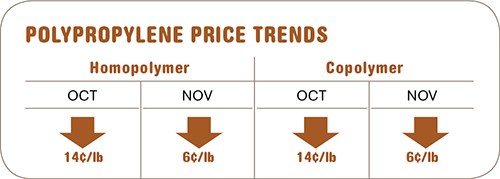

Polypropylene prices dropped a whopping 14¢/lb, in step with October contract settlements for propylene monomer. At press time, November monomer contracts were being settled another 6¢ lower and PP prices were moving down accordingly. There are indications that the market has hit bottom. With the exception of a possible drop of 1-2¢/lb this month, prices are generally expected to be flat for both monomer (which RTi now considers “undervalued”) and PP. Ditto for spot prices, which are already coming back to more traditional levels in relation to contract prices.

Through October, excess inventory moved at heavily discounted prices and there were reports of several big-volume deals. Many forward deals were also concluded, which were expected to have an effect on demand levels through November and December. True demand did not appear to be all that strong. Most processors were concerned about their future product orders, but that did not stop many companies from taking advantage of the lowest prices of the year.

Outlook & Suggested Action Strategies

30-60 Days: Expect the market to hit bottom by year’s end, with prices flat or with a slight drop of 1-2¢/lb. The key is monomer supplies and downstream demand. RTi anticipates a rebound in demand within first quarter. RTi thus urged stocking up, as PP prices are at the lowest they’ve been all year.

PS PRICES DROP FURTHER

Polystyrene prices dropped further through October and into November, driven by declining feedstock prices and soft demand. Having fallen an average of 3¢/lb in September, GPPS prices

dropped another 4¢ to 6¢, while HIPS prices dropped 6-8¢.

Based on price movements in key feedstocks, the average cash cost to make GPPS was down 13¢/lb while cash cost for HIPS decreased by 17.5¢/lb. The premium for HIPS has narrowed dramatically from its peak. Buyers are aided by the decrease in butadiene rubber cost, combined with current competitive leverage.

Benzene prices dropped 13¢ to $3.20/gal, while styrene monomer prices dropped a total of 11¢/lb in the September-October, and November contracts were expected to decline another 2¢. Meanwhile, butadiene spot prices dropped as low as $1.06/lb and were expected to continue to fall through year’s end. October contracts settled at $1.41/lb but November contracts were expected to drop to around $1.20/lb.

Outlook & Suggested Action Strategies

30-60 Days: Expect resin prices to continue to fall through end of the year. Due to the rapid drop in feedstock prices and their effects on the supply chain, resin prices are very fragmented. Knowing where your previous price was in relation to the rest of the market is critical to understanding the amount of decrease you should have received and how much is yet to be achieved. Timing is everything. End-of-year deals should be plentiful. Continue to push to close the differential between HIPS and GPPS.

PVC PRICES DOWN

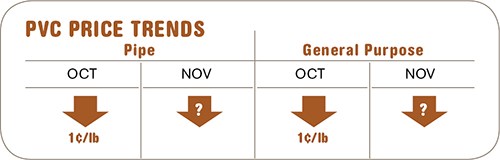

PVC prices dropped another penny in October, with expectations of another 1¢/lb decrease by the end of November. Continued drops in feedstock prices, spot prices, and exports are applying downward pressure.

Domestic demand remains weak. PVC feedstock prices (ethylene and chlorine) have slumped. PVC suppliers have been trying to resist price decreases by reducing operating rates. Resin plant operating rates dropped to 83%, while demand rates fell to 78%, creating a build-up in inventory of an additional 72 million lb.

Outlook & Suggested Action Strategies

30-60 Days: Expect softer global demand through year’s end to drag PVC feedstock and resin prices downward. Reduced exports in the face of global economic concerns will be a key factor.

Related Content

Commodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreFungi Makes Meal of Polypropylene

University of Sydney researchers identify two strains of fungi that can biodegrade hard to recycle plastics like PP.

Read MorePrices Flat-to-Down for All Volume Resins

This month’s resin pricing report includes PT’s quarterly check-in on select engineering resins, including nylon 6 and 66.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More