Commodity Resin Prices Move Upwards

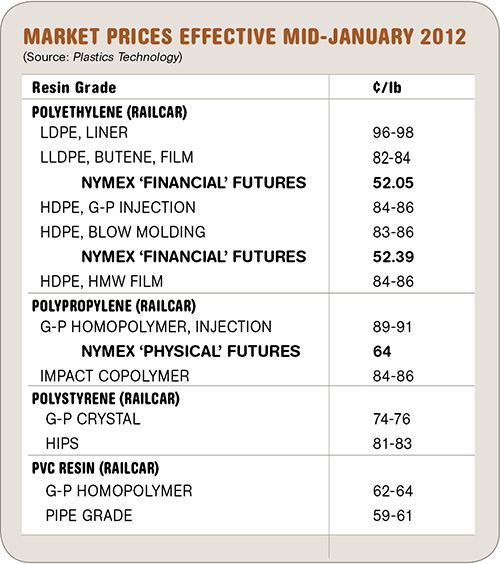

After falling almost continuously through the second half of 2011, prices of PE, PS, and PVC were all on the way up last month, with PE prices already rebounding by the end of December.

After falling almost continuously through the second half of 2011, prices of PE, PS, and PVC were all on the way up last month, with PE prices already rebounding by the end of December. Although lagging a bit, PP prices appeared to have bottomed out and there were indications that a price increase could be coming this month or next. The upward movement is attributed primarily to higher feedstock costs, according to resin purchasing consultants at Resin Technology, Inc., (RTi), Fort Worth, Texas (resinpros.com).

PE PRICES UP

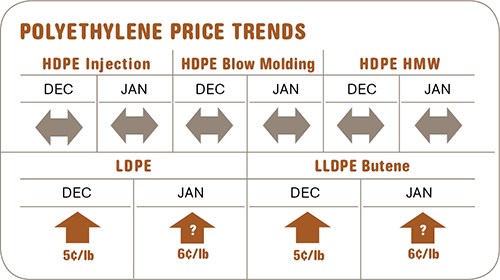

Polyethylene prices rose 5¢/lb by the end of December. The move is attributed primarily to suppliers’ aim to boost profit margins. They were also aiming to implement a 6¢ increase last month, and Mike Burns, PE v.p. at RTi, sees a good possibility for full implementation of this increase.

Although not directly relevant to PE producers, it’s worth noting that ethylene spot prices in mid-January had climbed to the upper 50¢/lb range, about 7¢ higher than December. There will be several planned cracker outages in the first quarter. Although there is plenty of ethylene, any unplanned outages could quickly create a shortage.

Suppliers’ inventory levels are reportedly very low, and prebuying in anticipation of price hikes played a key role. Resin suppliers expect need-based buying to make a strong enough return to support price increases.

In the first four months of 2011, PE prices went up by 11¢/lb. After that, prices eroded due to improved resin availability around the globe. Within the second half of last year, LLDPE and HDPE prices dropped 12¢/lb while LDPE prices dropped 14¢. The average price for large-volume commodity PE last year stood near 70¢/lb—up 5-6¢ from 2009 and 2010 average selling prices. The cost to produce PE from January 2010 through end of 2011 ranged from 44¢ to 49¢/lb. Margins are over 20¢/lb.

Outlook & Suggested Action Strategies:

30-60 Days: Buy as needed. Suppliers’ determination to protect margins will continue to influence pricing and production. If ethylene costs increase from current levels, suppliers will continue to push for higher prices and/or control output rates throughout this year.

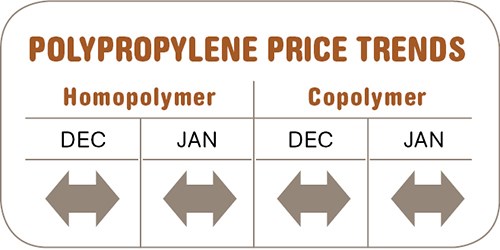

PP PRICES BOTTOMED OUT?

Polypropylene prices dropped a total of 41¢/lb from May to December 2011, and the consensus is that PP prices now have bottomed out. Nonetheless, an attempt by a couple of suppliers to push through 2¢ increases in January appears to have failed. PP secondary market activity was scant due to the lack of material available and suppliers holding firm on prices, according to Scott Newell, RTi’s director of client services for PP.

As with PP prices, propylene monomer contract prices in January were flat. However, since early January, propylene spot prices began to move up. There was also speculation of propylene contract price increases.

Outlook & Suggestion Action Strategies

30-60 Days: Buy as needed. With propylene monomer trading well below its normal levels and the likelihood of tighter supply due to planned outages, a price rebound is very likely at this time for both monomer and PP.

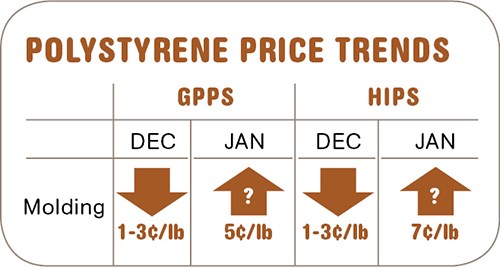

PS PRICES UP—HOW MUCH?

Polystyrene prices were poised to move up by end of last month. Suppliers had issued increases ranging from 5-7¢/lb for GPPS to 6-8¢ for HIPS. The likely scenario is that prices will rise about 5¢ for GPPS and 7¢ for HIPS, with another increase likely to follow, says Stacy Shelley, RTi director of business development for engineering resins, PVC, and PS. Impending plant turnarounds for a number of key feedstocks are expected to tighten supply as we head into spring, according to Shelley.

The key driver is benzene, whose price jumped $1/gal in a 40-day period. In mid-January, spot benzene had risen to $4/gal with January contract benzene at $3.70. The result is that the cash cost to make styrene monomer has risen by 10¢/lb. Meanwhile, styrene spot prices rose to around 65-66¢/lb and were expected to move up by end of last month in concert with the spike in benzene.

Both contract and spot prices for butadiene were poised to increase by the end of last month. Spot prices had moved up to $1.04/lb and increases on contract prices ranging from 7¢ to 20¢ were being discussed, which would keep contract prices over $1/lb.

Outlook & Suggested Action Strategies

30-60 Days: Expect prices to rise even further this month in step with higher projected feedstock costs. Generally weak to flat demand and improved supplier margins will slightly limit the amount of increases.

PVC PRICES RISING

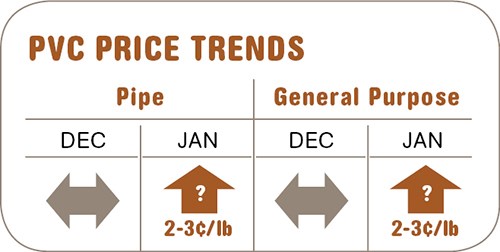

PVC prices were expected to move up by the end of January as suppliers aimed for hikes ranging from 3¢ to 5¢/lb. Actual implementation was likely to fall closer to around 2-3¢, according to Mark Kallman, RTi director of client services for engineering resins.

A key driver is ethylene, with spot prices on the way up, based on the possibility of tighter supply due to several planned outages this quarter. Ongoing strength in PVC exports due to an extended VCM outage in Japan is another factor. Partially offsetting these factors are a drop in chlorine prices and seasonally softer demand.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed. Look for possible competition from lower-priced European resin as the U.S. dollar strengthens. Softer global demand through the Chinese New Year is expected; however, global easing of credit by the central banks is expected to help support exports later this quarter.

Related Content

Prices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MorePrices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More