Commodity Resin Prices Still Dropping - January 2015

Led by lower global feedstock and resin prices, commodity resin prices continue to decline.

Prices of the four main commodity resins dropped further in December and were all expected to decline by nearly equal amounts last month. Leading the pack was PP, with double-digit price reductions, although PS price decreases appeared to be next in magnitude. Yet PVC suppliers are aiming for an increase this month, though its outcome looks dim. These are the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of The Plastics Exchange, Chicago, and global industry experts at IHS Chemical, Houston.

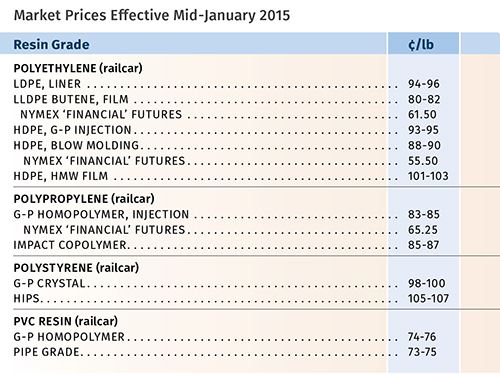

PE PRICES LOWER & LOWER

Polyethylene contract prices dropped by a total of 7¢/lb by the end of 2014, with decreases of an additional 7-10¢ possible in this first quarter. Mike Burns, v.p. of PE at RTi, ventured that a price decrease on the order of 3-5¢/lb was possible last month. Greenberg noted that Equistar had announced a decrease of 4¢, but he speculated that a higher amount was possible by January’s end.

Spot PE prices by year’s end were at least 10-15¢/lb lower than prime resin prices, the largest delta since 2008-2009. Greenberg noted that spot prices, depending on the grade, range from the low 50s to mid-70s ¢/lb range. Meanwhile, supplier inventories grew to the highest level in years, according to Burns. While crude oil remains under $65-70/bbl, he says, no PE resin price hikes are likely to emerge. Burns notes that the North American cost to produce PE pellets from ethane (natural gas) is now below 25¢/lb.

Nick Vafiadis, senior director of global polyolefins and plastics at IHS Chemical, said domestic PE prices will have to come down more this year to meet China’s prices.

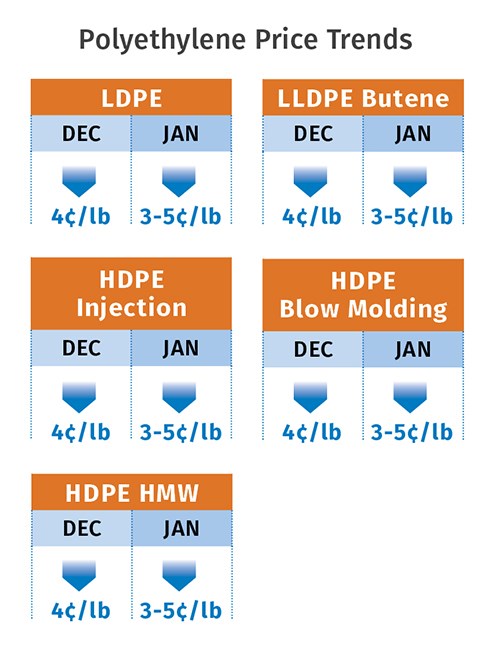

PP PRICES PLUNGE

In December, polypropylene prices fell 10¢/lb in step with propylene monomer, following a 5¢/lb drop in November. Resin prices were expected to sink even lower in January and this month, according to Scott Newell, RTi’s director of client services for PP.

Newell noted that monomer contract price nominations for January were likely to sink at least 8¢/lb lower and perhaps even 10-12¢/lb. He added that PP resin prices would follow, but 2¢/lb higher, as PP suppliers aim to implement their fourth-quarter margin expansion plan. Greenberg noted that PP supply is still relatively snug and spot prices have varied from the mid-60s to nearly 80¢/lb for buyers in a hurry. He said patient buyers can get material at the lower price level.

Meanwhile, Newell said monomer supply is in good shape. He added that with lower global feedstock prices, there are now some propylene monomer imports from Asia coming into the Americas.

PP resin demand appears to be relatively good, with some pretty strong restocking likely to be taking place through the first quarter. Newell cautions that until new on-purpose propylene monomer units come on stream in the second half, and until domestic PP prices (still the highest globally) come down further, imports of both PP resin and finished goods are a threat.

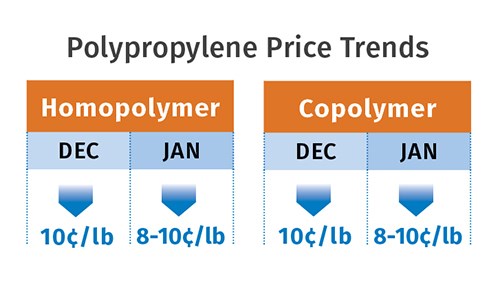

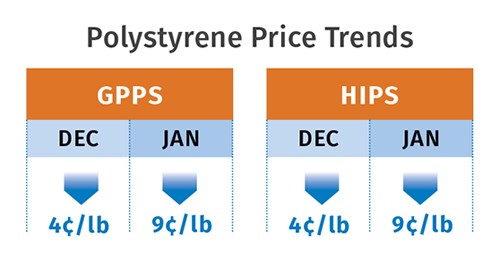

PS PRICES TUMBLE

Polystyrene prices dropped a total of 7¢/lb in the last two months of 2014, and at least one supplier had announced a decrease of 9¢/lb for January.

Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC, noted that the announced decrease was driven by the precipitous drop in January benzene contracts of $1.17/gal. December ethylene contracts settled 7.25¢/lb lower, and January contracts were expected to drop some more, owing to improved monomer supplies. Styrene monomer exports have slowed significantly due to lower monomer prices abroad, resulting in ample domestic monomer supplies.

Meanwhile, demand is sluggish because of seasonally slow markets, but also because processors are holding back on buying, waiting for prices to bottom out.

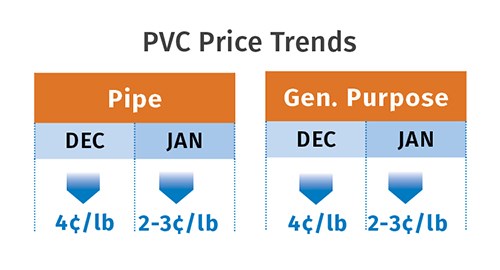

PVC PRICES DROP

PVC prices dropped 3¢/lb in December following a 2¢ decrease in November, and

further decline was expected last month due to the 7.5¢/lb drop in December ethylene contracts, with more softening anticipated.

In the teeth of all this, PVC suppliers announced an increase of 3¢/lb for Feb. 1. The chances of such a move succeeding appear to be slim. Demand has slowed as buyers anticipate lower prices. Says RTi’s Kallman, “This increase’s implementation faces a lot of obstacles. Feedstock prices are down, there is the seasonal demand slowdown, and PVC exports are down due to lower global PVC prices.” PVC suppliers, who reportedly throttled back production significantly before the end of 2014, cite three planned plant maintenance shutdowns in this year’s first quarter as support for their price initiative.

Related Content

The Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MorePrices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More