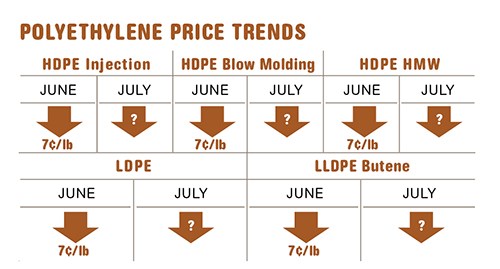

Commodity Resin Prices Still Dropping - July 2012

Lower feedstock costs, ample material availability, and overall sluggish demand has driven prices down for the four commodity thermoplastics.

Lower feedstock costs, ample material availability, and overall sluggish demand has driven prices down for the four commodity thermoplastics. Further decline through at least this month is being projected both by consultants at ResinTechnology, Inc. (RTi), Ft. Worth, Texas, and Michael Greenberg, CEO of Chicago-based The Plastics Exchange.

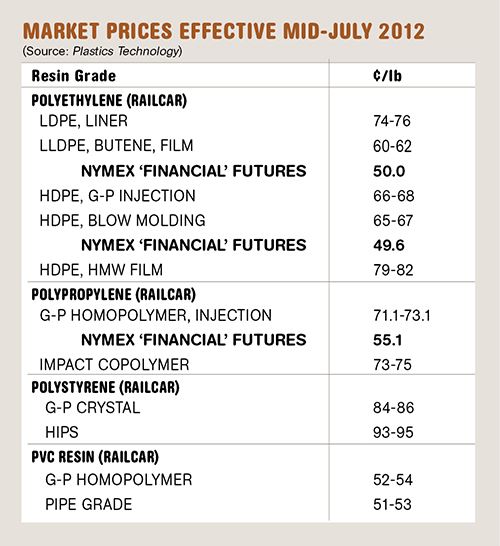

PE PRICES DROP

Polyethylene contract prices dropped another 7¢/lb in June, following the May 7¢ price drop, and a smaller additional decline was expected by the end of July, according to Robin Chesshier, director of client services at RTi. Even so, PE suppliers issued a 5¢ price hike for Aug. 1, interpreted by both Chesshier and Greenberg as an attempt to stop the downward momentum.

Spot PE prices slumped after rising by around 1.5¢/lb in late June/early July. Says Chesshier, “We have seen spot material availability decrease, though contract material availability is good. Domestic demand is not robust, and there is no problem getting material. We’re just not seeing so many good deals in the spot market anymore.” Greenberg also saw some evidence that material availability was getting tighter, as suppliers attempted to raise export prices by 2¢/lb.

PP PRICES PAUSE DOWNWARD SLIDE

Polypropylene prices remained relatively steady last month, following the whopping 15.5¢/lb drop in June. In concert with propylene monomer pricing, July PP contract prices remained flat. A proposed 3¢ price increase lacked broad industry support. Greenberg reported that while there was a minor recovery in PP spot tabs in late June, prices had slipped back a penny or so by the first week of July. Moreover, he projected that August monomer contract prices are likely to drop, leading to further erosion of PP prices. He adds, “While exports appear to be regaining in strength, there is ample material.” Scott Newell, RTi’s director of client services for PP, says exports are not that strong yet in terms of significant volume, but “we are getting to the point where exports will become a factor that influences domestic PP prices.”

Newell also notes that June domestic demand was well above average for PP but that it was “opportunistic pre-buying vs. real demand,” as converters aimed to benefit from the drop in prices and to restock dwindling inventories. The result of this contract-market activity left very little for secondary markets, and spot prices firmed up almost in parity with contract prices.

Monomer prices have largely been driving PP pricing, and by June, polymer-grade propylene had dropped by 25.5¢ to 52¢ from a high of 77.5¢/lb. By the second week in July, spot monomer prices were trading in the mid-to-upper 40¢ range. That was about 6¢/lb lower than monomer contract prices, so PP spot prices are likely to go down, followed by August PP contract prices. “Crackers are really running well again. Refineries are running well, and there are good profit margins across the board,” says Newell.

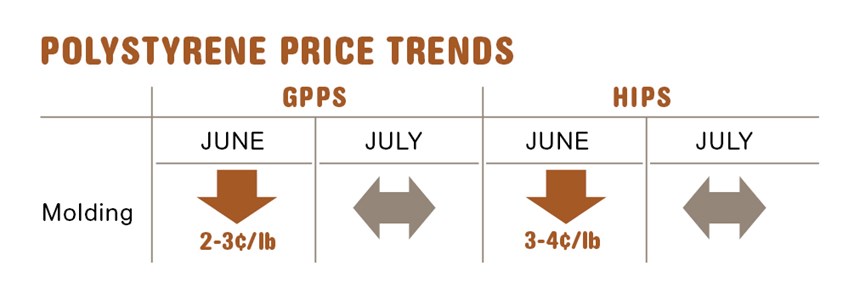

PS PRICES FLAT TO DOWN

Polystyrene prices stalled their downward movement in July, despite continued weak demand, prompted by escalating benzene and styrene monomer prices. June saw decreases in GPPS by 2-3¢ and HIPS by 3-4¢/lb. The downward slide was prompted by softer demand than originally projected plus ample resin availability domestically and globally, according to Stacy Shelly, RTi’s director of business development for engineering resins, PS, and PVC.

Shaking up this trend was one of the highest-ever spikes in spot benzene prices last month. Shelly says this started with a flurry in buying activity while supplies were tight, which drove up prices and forced traders to cover positions, which ultimately moved prices up even further. Styrene monomer spot prices were on the increase due to the spike in benzene costs. Ultimately, the rise in July benzene contract prices is expected to increase the cost to produce styrene monomer by roughly 2¢/lb. However, domestic demand is weak and higher monomer prices have caused a further reduction in export demand.

Meanwhile, July ethylene monomer contract prices dropped by 7.25¢ to 39¢/lb, and Shelly sees plenty of room for prices to come down further, with the cash cost to produce ethylene lingering well below 20¢/lb.

July butadiene contracts settled at a weighted average of 91¢/lb, while spot prices bounced back from a low of around 82¢ after declining for 13 consecutive weeks. The rebound is partially attributed to a tightening in global supply due to shutdowns and restocking in China. Shelly projected prices in August to be flat to higher.

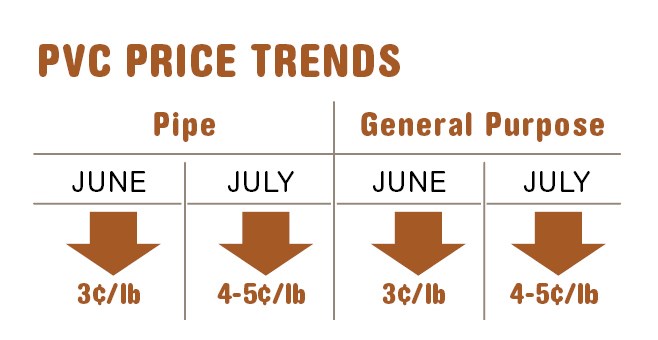

PVC PRICES DROP FURTHER

PVC resin prices dropped by 4-5¢/lb in July, following price drops of 2¢ and 3¢ in May and June, respectively. RTi experts project PVC pricing to be flat-to-down in August. Driving this movement are reduced feedstock costs and increased inventories as domestic demand continues to soften.

According to Shelly, June feedstock costs were down by about 4¢/lb from May, and more than 8¢ lower than in April. This was prompted primarily by drops in ethylene monomer contract prices during May/June. Domestic demand is reported to be down by 5%, while exports were up 8%, resulting in a slight decrease in overall sales. Meanwhile, production was flat and there was an inventory gain for the fourth straight month.

Despite reduced chlorine operating rates from seasonal turnarounds, supplies remain steady, as demand is soft and spot pricing has been flat. Plasticizer pricing is down 7¢/lb from May, due to weak downstream demand and an increase of imports, but held flat in July.

Related Content

Prices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Read MorePrices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More