Commodity Resin Prices Up, Engineering Resins Steady

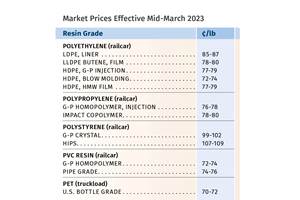

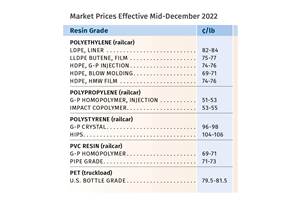

Strong year-end demand, somewhat tighter supplies of polyolefins, and a spike in feedstock prices with the possibility of more to come for PS, PVC and PP, have already brought higher prices to commodity resins, and continuing upward pressure will likely generate further hikes. Meanwhile, despite strong demand in the automotive market, prices of the four largest-volume engineering resins have been flat or slightly lower.

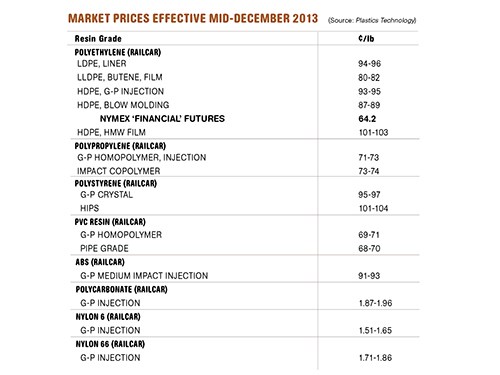

Strong year-end demand, somewhat tighter supplies of polyolefins, and a spike in feedstock prices with the possibility of more to come for PS, PVC and PP, have already brought higher prices to commodity resins, and continuing upward pressure will likely generate further hikes. Meanwhile, despite strong demand in the automotive market, prices of the four largest-volume engineering resins have been flat or slightly lower. But ABS suppliers are already moving to implement a price increase this month and similar actions are possible for the other three resins, all driven by higher feedstock costs. However, domestic oversupply and competitively priced imports will dictate how such actions shape up, if at all. These are the views of resin purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange in Chicago.

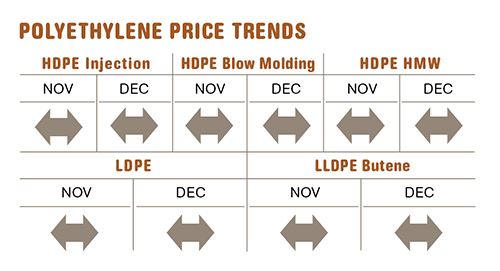

PE PRICES SET TO REBOUND

Polyethylene prices were expected to bottom out last month, having remained flat two months in a row. By mid-December, no price increases had been announced. But despite the fact that supplier inventories are higher than they have been in the last four years, supply/demand is well balanced and suppliers are likely to seek increases as early as this month, according to Mike Burns, v.p. of PE at RTi.

By the end of the first week of December, The Plastics Exchange’s Greenberg reported very active polyolefin spot resin trading and prices were mostly higher. “The PE spot market saw buyers searching for resin all along the slate of commodity grades, and prices mostly edged a half-cent higher,” he noted. Spot ethylene monomer prices moved higher from 54¢ to 56¢/lb and Greenberg says there is significant activity in forward months, with April monomer futures as high as 65.25¢/lb.

Burns sees an upward curve for PE prices, too, and North American PE demand has been driving the market. “In the past a resin supplier might have had 100 railcars, with 30% going to domestic contract buyers and 70% to exports and secondary markets. Today, 90% is going to contract buying and 10% to exports and secondary markets. The influence of exports and secondary markets has all but disappeared.”

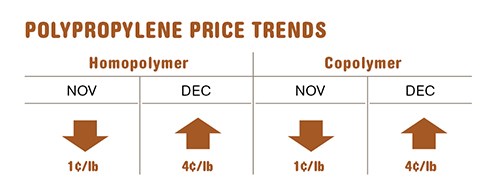

PP PRICES ALREADY UP

Polypropylene prices settled a penny lower in November but by early December, PP was set to move up 4¢/lb in step with propylene monomer’s December contract settlement. The monomer factor arose from planned and unplanned cracker outages and the delay of Petrologistics’ restart of its propylene unit, according to Scott Newell, RTi’s director of client services for PP.

Greenberg reported that spot propylene, which typically trades at a discount from contract pricing, continued to move above contract levels and he saw this as early indication that another contract monomer increase may be possible for this month.

Both sources confirm strong end-of-year PP prebuy deals. Says Newell, “There’s a sense that today’s price is better than what’s to come and spot material has been tight.” He says that if this interest does not wane, and given the possibility of higher monomer prices, a PP resin hike in the 3-4¢/lb range is possible this month. Spot PP prices were already up 3¢ in early December, according to Greenberg.

Suppliers maintain that PP is tight, even though industry operating rates dropped to around 85% in the fourth quarter—a far cry from being maxed out. Total demand for PP in 2013 was pulled down by the second consecutive year of dismal exports, and the year appears poised to end up with the weakest demand since 2007, according to Newell. Total demand was expected to end up 1.2% lower than in 2012.

On the bright side, domestic demand will end up in positive territory, even if only by a fraction. Certain market segments will also come away with something to feel good about: Injection molding will end positive, anchored by housewares, cups, and containers. Another large-volume market, fibers, will also end on a good note.

PS PRICES ON ROLLER COASTER

Polystyrene prices dropped 2¢/lb in November, leaving a penny remaining from the October 3¢ hike. But things changed drastically by early December, as benzene contract prices for the month shot up by 38¢/gal, due to planned and unplanned production disruptions. Polystyrene suppliers swiftly issued a 4¢/lb price hike, effective last month.

By the second week of December, spot benzene was selling at 20¢/gal above contract prices, an indication that January benzene contracts may well settle higher, according to Mark Kallman, director of client services for engineering resins, PS, and PVC. “Polystyrene prices are being driven by feedstock costs. So further benzene volatility could precipitate further upward movement despite supply/demand fundamentals not supporting such a move.”

PVC PRICES MAY MOVE UP SOON

Having dropped 1¢/lb in October, PVC prices remained mainly flat through November and December, a typical seasonal scenario. But some PVC suppliers have issued price hikes in the 3-5¢/lb range for this month or next.

According to RTi’s Kallman, this is more of a positioning move in case ethylene contract prices move up. After hitting bottom in October, November ethylene contracts settled 1.5¢/lb higher and there were industry projections that December ethylene contracts would settle a bit higher still, with a continuing upward curve through the first quarter.

Kallman did not forsee a PVC price hike materializing this month, noting that there has been a buildup of supplier inventories, despite some return of export demand, because of the domestic seasonal drop in demand in the construction market. If exports continue to grow, however, PVC resin supply is expected to tighten. Along with higher ethylene prices, this could result in suppliers implementing their price hikes before this quarter’s end.

ABS PRICES DOWN, THEN UP?

ABS prices dropped further in the fourth quarter after losing 1-3¢/lb in the third. At least one supplier issued a 4¢ increase, effective this month, right after the jump in benzene contract prices, and others were expected to follow, according to Kallman.

Whether suppliers will be able to implement an increase will depend on the strong imports market. Says Kallman, “If suppliers of imports opt to remain highly competitive and do not jump on the opportunity to also hike prices, domestic suppliers will be hard pressed to implement any increase.” ABS demand has remained strong in automotive and electronics, and appliances have also improved.

PC PRICES MOSTLY FLAT

Polycarbonate prices were mostly flat through the third and fourth quarters, with very modest erosion in some cases. Global oversupply is expected to result in flat prices for the first quarter, unless feedstock prices rise. Kallman sees the possibility of a price hike emerging this month if benzene contracts settle up again.

Demand has been healthiest in North America, primarily because of the automotive market. Kallman says there also have been recent improvements in Asian and German automotive markets.

NYLON FEEDSTOCKS VOLATILE

Nylon 6 prices remained flat through the last quarter. A price increase could emerge this month if benzene prices move up again, says Kallman. He notes that demand was a mixed bag last year, slowing down at year’s end. Suppliers’ success in implementing any future price increase will be influenced largely by oversupply, which has resulted in very competitive domestic pricing, as well as some competition from imports.

Nylon 66 prices, meanwhile, eroded a bit more in the fourth quarter after a 1-2% price drop in the third, and very competitive pricing activity by suppliers, as well as low butadiene prices. Nylon 66 supply/demand is said to be well balanced. But a price hike could arise this month, depending on benzene price movement. Butadiene costs did go up in December to 54-55¢/lb from the low of 42.5¢ in September, but Kallman says that’s still a far cry from over $1/lb in the last couple of years.

ACETAL PRICE HIKE

Celanese is raising prices for all Hostaform and Celcon polyacetal (POM) resin grades by 5%, effective Jan. 1 or as contracts allow.

Related Content

Prices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MorePrices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MorePrices of Volume Resins Drop--Except for PE

The downward trajectory appears to be continuing into the first quarter for most resin prices, though PE and possibly PP may remain somewhat stable.

Read MoreNPE2024 Materials: Spotlight on Sustainability with Performance

Across the show, sustainability ruled in new materials technology, from polyolefins and engineering resins to biobased materials.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More