February Index Dips a Tiny Bit

Index holds steady as optimism about future business conditions continues to increase among processors.

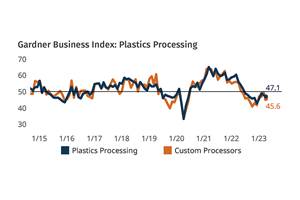

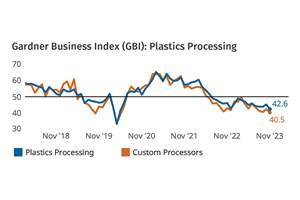

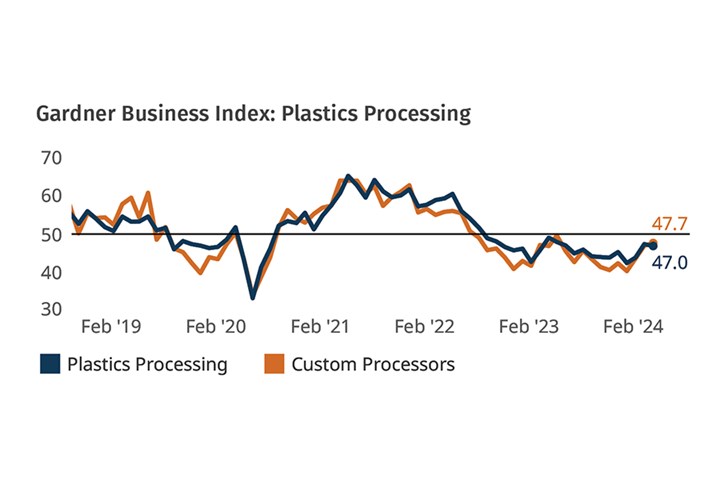

The Gardner Business Index (GBI) for plastics processing was 47 for February, down a smidge from 47.5. The index is based on survey responses from subscribers to Plastics Technology. Indices above 50 signal growth; below 50, contraction.

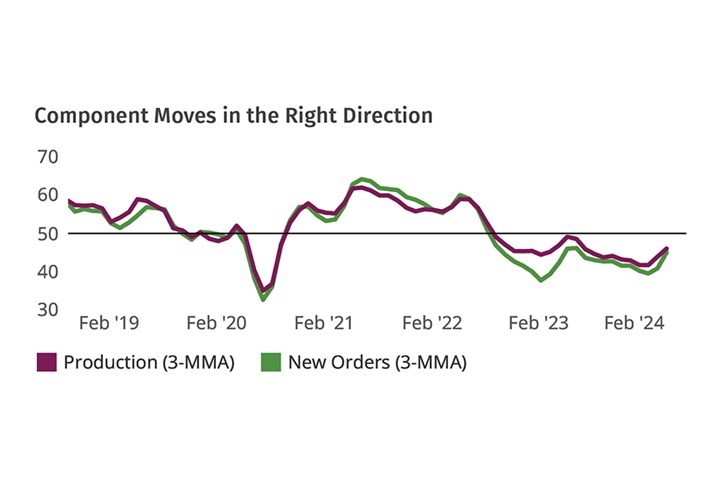

Slowed contraction in new orders and production was joined by a backlog in February. New orders marked the most progress, slowing contraction to the tune of 4 points. Supplier deliveries were a little slower in February, potentially signaling higher demand, while exports and employment were relatively stable, still residing in contraction zone.

FIG 1 Plastics processing activity continued to contract in February amid another month of slowed contraction among components.

Business optimism among processors has steadily increased since October 2023, reaching in February 2024 the highest level since May 2022. Sentiment is likely driven by market and anecdotal indicators that take longer to manifest in real business.

FIG 2 New orders contraction slowed the most and a lot, reflected in slowed production contraction as well.

Overall business activity for custom plastics processing changed almost the same amount as the overall index, but in a positive direction. This marks steadily slowing contraction for custom plastics processing for three months straight.

ABOUT THE AUTHOR: Jan Schafer is director of market research for Gardner Business Media, parent company of both Plastics Technology magazine and Gardner Intelligence. She has led research and analysis in several industries for over 30 years. She earned a bachelor’s degree in psychology from Purdue University and an MBA from Indiana University. She credits Procter & Gamble for 15 years of the best business education. Contact: 513-527-8952; jschafer@gardnerweb.com.

Related Content

Plastics Processing Index Remains Virtually Unchanged

Future business indicators rose again this month, but other inputs changed only slightly.

Read MorePlastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

Read MorePlastics Processing Activity Drops in November

The drop in plastics activity appears to be driven by a return to accelerated contraction for three closely connected components — new orders, production and backlog.

Read MorePlastics Processing Activity Contraction Continues in August

Four months of consecutive contraction overall.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More