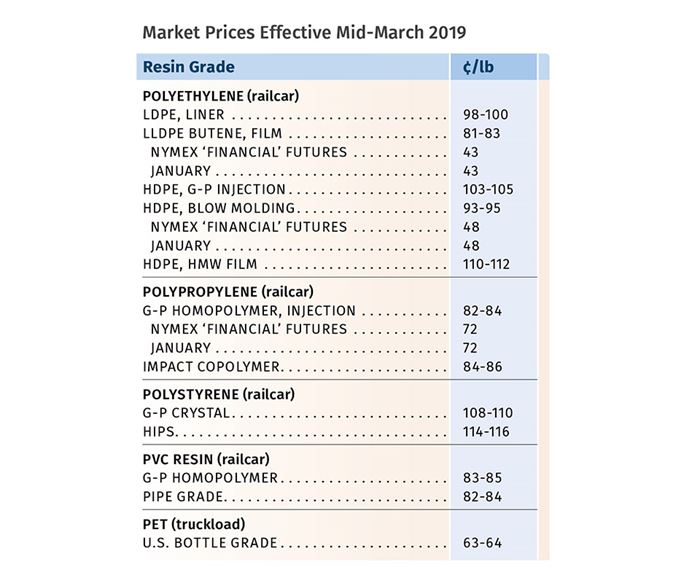

Flat or Lower Resin Prices—Except for PS, PVC

Lower prices of feedstocks, slowed demand, record-high inventories, and lower-priced imports impacted resin prices.

The first quarter came to a close with prices of nearly all volume resins—including engineering types—trending flat to lower. The exceptions were PVC and PS: PVC prices rose a bit after remaining flat for months, but success of a newly posted increase appeared dicey. PS was perhaps the true “maverick,” with increases last month and more to come this month, due to a cost push from feedstocks. These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; senior editors from Houston-based PetroChemWire (PCW ); and CEO Michael Greenberg of The Plastics Exchange in Chicago.

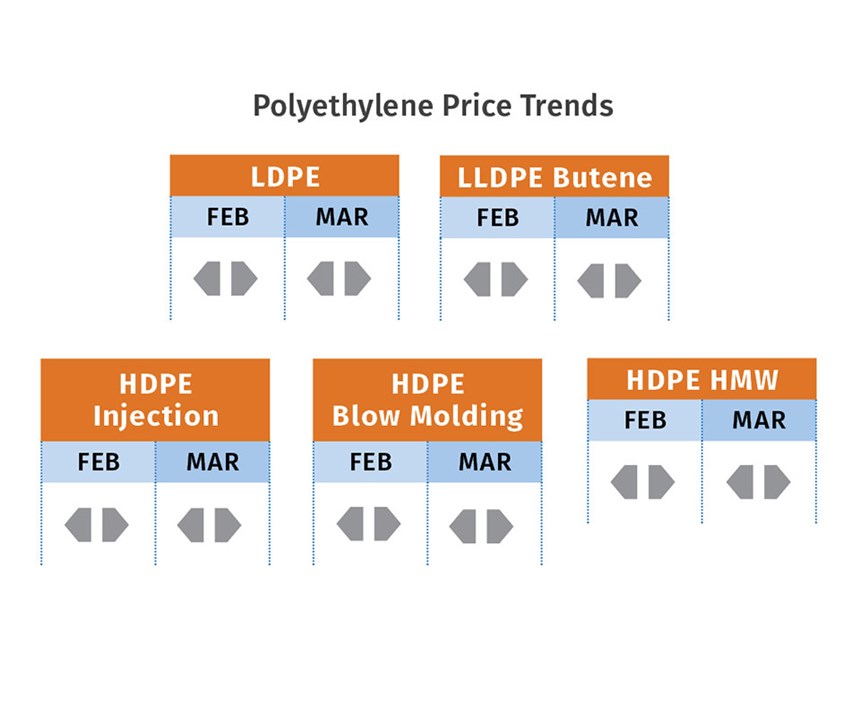

PE PRICES FLAT

Polyethylene prices did not move in February, as suppliers were unable to push through a 3¢/lb increase. They posted another 3¢ increase for March, with no formal comment on the fate of the February increase, according to Mike Burns, RTi’s v.p. of PE markets.

Industry sources doubted prospects for any change in March contract prices. Said the Plastic Exchange’s Greenberg, “There is another attempt to implement a price increase in March, which now seems to average around 3¢/lb, but realistically, can it stick?” RTi’s Burns expected a strong effort from suppliers to push the March increase through. He noted that higher oil prices could support that effort. Added PCW’s Barry, “Exports are going down and supplier inventories are growing. I think March will be quite the same. We do not see market dynamics that would support an increase.” The wild card is China tariffs, which may impact domestic and export demand.

Burns noted that spot prices failed to increase in February despite strong efforts from suppliers. Some off-grade LLDPE resins were offered below December prices—as low as 42¢/lb, at February’s end. Barry noted that spot prices had weakened—2¢/lb lower on average going into March, and about 10¢/lb lower than contract prices. Greenberg reported that “spot PE prices fell heavily over the past six months, while contracts simply have not. There continue to be large discounts provided for fresh spot railcars and we believe the gap will eventually need to shrink.” He noted that a quick correction was not clearly imminent, as spot prices had failed to rally.

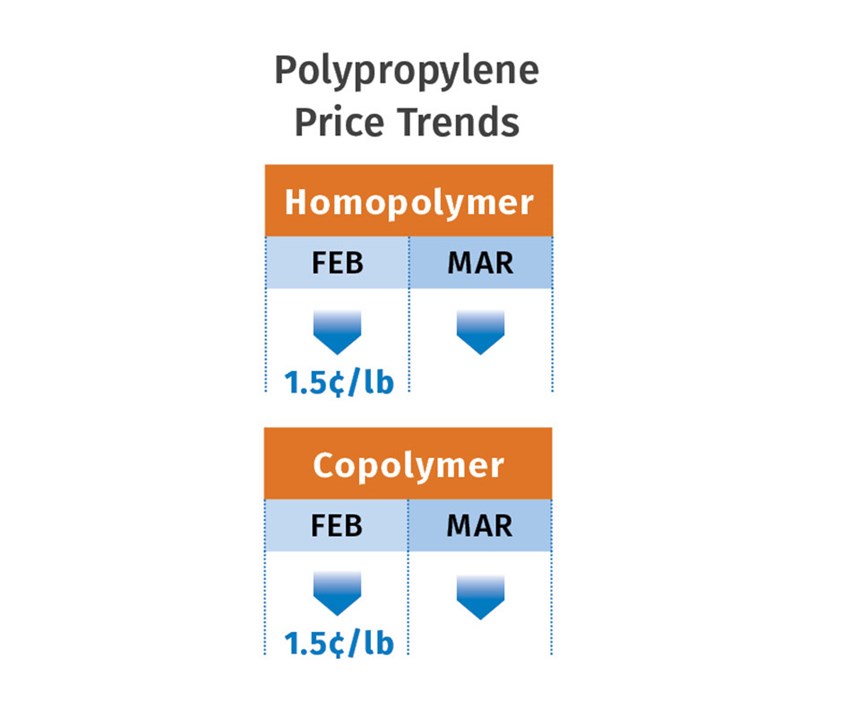

PP PRICES DOWN

Polypropylene prices dipped 1.5¢/lb in step with propylene monomer, which industry sources thought was less of a drop than was justified by record-high inventories and sluggish demand. Spot monomer dropped to 32¢/lb, and Scott Newell, RTi’s v.p. of PP markets, said he would not be surprised to see it sink to the low 20s. It has been a buyer’s market for both PP and monomer, and he said it was difficult to tell when PP prices would bottom out. “Inventories for both monomer and PP were at multi-year highs after a four-month buildup, and demand has not come back to the levels that had been expected.”

Newell ventured that monomer and PP prices for March would drop 4-6¢/lb and that, depending on how much they dropped, further decline was possible this month. “We are seeing supplier margin erosion with discounts being offered to move volume.” PCW’s Barry thought that forecast to be a bit overly bearish, predicting instead that PP prices would drop 2-3¢/lb. Both sources also expected PP demand to rebound as soon as March.

Early in March, The Plastics Exchange’s Greenberg reported seeing a normal flow of offgrade resin, along with occasional well-priced prime railcars. But he characterized spot PP demand as soft because processors anticipated another decrease for March. “Polypropylene prices have come off dramatically the past several months and processors are enjoying the savings. But with market sentiment still negative, we have yet to see a major restocking effort.“ PCW’s Barry reported that that there was ample PP prime in the secondary markets with discounts on the order of 2-4¢/lb.

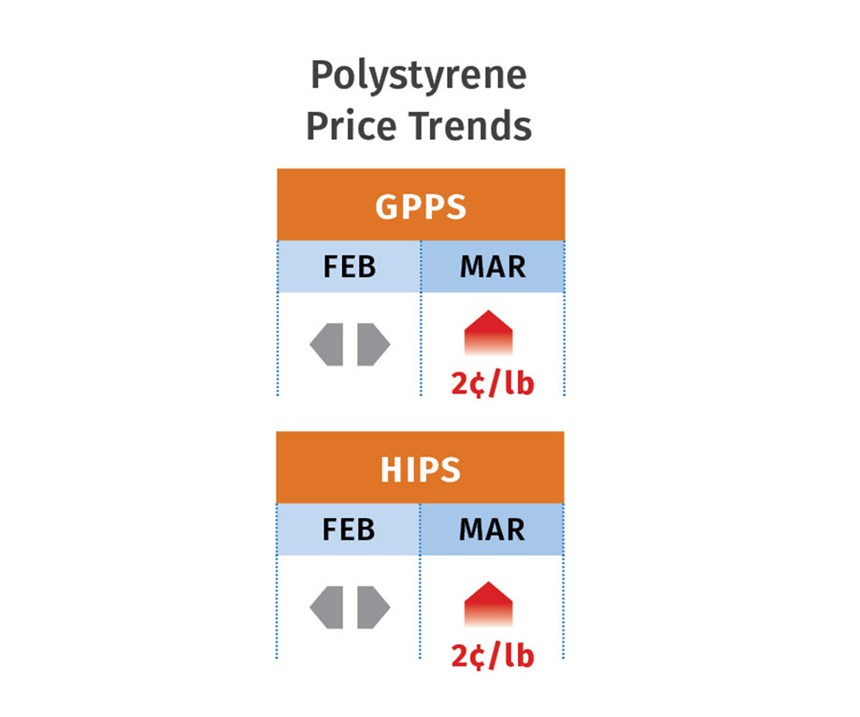

PS PRICES GOING UP

Polystyrene prices were heading up by 2-4¢/lb in March, after dropping a total of 9¢/lb by the end of January. Both PCW’s Barry and Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets, thought a 2¢/lb increase was more realistic, and both expected an uptick in prices this month.

According to Chesshier, feedstock price increases totaling a net 1.5¢/lb input value through early March support an increase at the lower end of the proposed range. She noted that while ethylene monomer contract prices dropped a bit, the reverse was true for benzene, styrene monomer and butadiene. Chesshier saw further PS increases as likely this month, driven primarily by increasing feedstock costs, but also supported by expected strong seasonal demand for PS, which starts in April. On the other hand, Barry predicted flat to slightly higher PS prices. Supply/demand are generally balanced, with production capacity utilization in only the 70s percentile. These sources said there has been an inflow of very attractively priced PS resin imports and a strong outflow of styrene monomer exports.

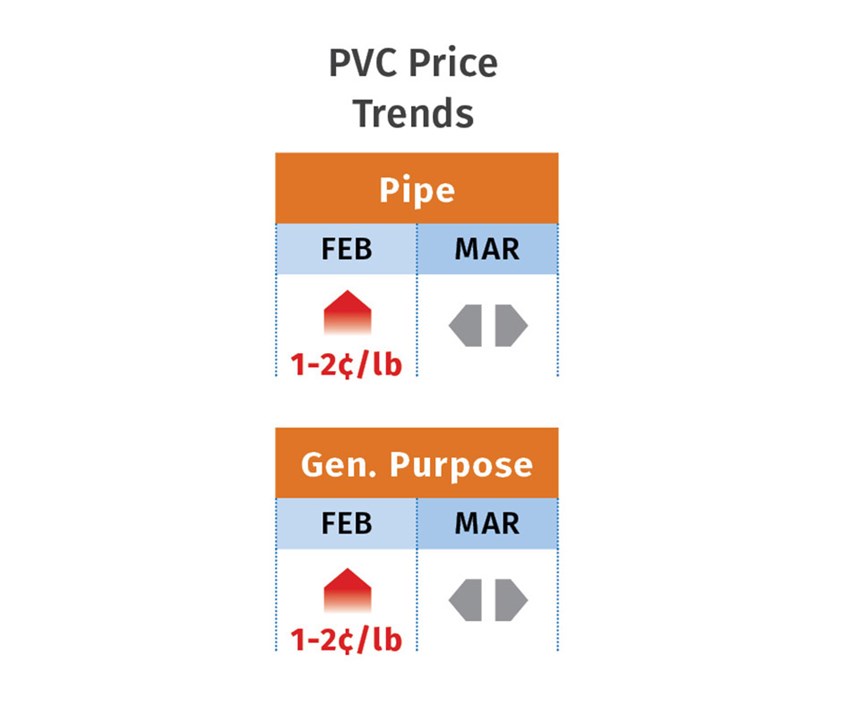

PVC PRICES SLIGHTLY HIGHER

PVC prices appeared to have moved up 1-2¢/lb in February, after holding even for the third month in a row. Prices for March were likely to be flat despite suppliers’ aim to implement the remainder of a 4¢/lb price hike, according to both PCW’s senior editor Donna Todd and Mark Kallman, RTi’s v.p. of PVC and engineering resin markets. As for this month, Kallman ventured that prices would be flat to 1-2¢/lb higher if demand improves as we enter the construction season.

Todd reported that suppliers were considering a 2-3¢/lb increase for April 1, though nothing was confirmed at press time. Both sources noted that there was not much support for an increase, after a downward trajectory for PVC prices, driven by lower ethylene and chlorine prices, lower export prices, sluggish global demand, impeded in part by bad weather.

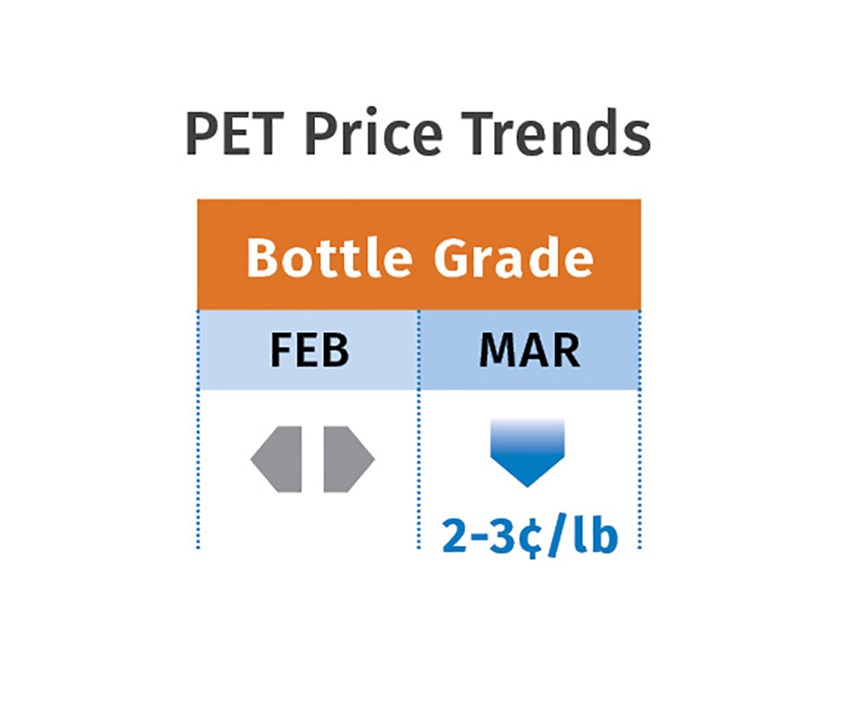

PET PRICES DOWN

Prices for domestic bottle-grade PET as well as imported material ended February at 62-64¢/lb on a delivered rail Midwest basis, and had remained steady from the start of that month, according to PCW senior editor Xavier Cronin. In the first week of March, Cronin reported that California ports were oversupplied with imported PET, while demand was “still way below normal,” according to a PET resin distributor. “The U.S. remains an attractive destination for PET produced around the world because domestic PET prices are higher than in most other regions,” said Cronin.

He ventured that PET prices in March would trend lower by at least 2-3¢/lb due to sluggish demand and surging imports. Meanwhile, global PET feedstock costs—PTA and MEG—climbed higher in February due to higher hydrocarbon prices. This month, PET prices could dip to under 60¢/lb, if imports continue to be robust and demand from thermoforming does not peak by mid-March, ventured Cronin.

ABS PRICES TURN CORNER

ABS prices dropped late in the fourth quarter and into January by 4-6¢/lb, following significant declines in feedstock costs. While prices in February and March held even, this month was expected to be flat to higher, according to RTi’s Kallman. Any April increases would be driven by higher costs of benzene, acrylonitrile and butadiene.

While the market is characterized as balanced, demand for ABS doesn’t typically pick up until the second half of the year. Moreover, there are plenty of low-cost imports still available, which serve to hold prices down, said Kallman.

PC PRICES DOWN

Polycarbonate prices were trending down in late fourth-quarter 2018 and early 2019, with suppliers giving concessions of 8-10¢/lb on new contracts, according to RTi’s Kallman. This shaved off quite a bit from the price increases of up to 14¢/lb implemented in first-quarter 2018.

February and March prices were unchanged, and Kallman foresaw continued flat pricing this month. “Feedstock cost pressure has been incremental, the market is very well supplied, and there is plenty of opportunity for low-cost imports.” The market has gone from well-balanced to oversupplied due to an influx of lower-priced Asian imports and ample domestic availability,” he said.

NYLON 6, 66 LARGELY FLAT

Nylon 6 prices were flat to slightly lower in January as suppliers provided some small price concessions, though not across the board, according to RTi’s Chesshier. Prices held even in February and March. However, if benzene and caprolactam contract prices were to move up, coupled with higher nylon 6 prices in Europe, this month’s nylon 6 prices could move up too, she noted. “Seasonal demand—ranging from textiles to automotive—has been delayed this year, but is likely to pick up through the second quarter,” said Chesshier.

Nylon 66 prices were largely flat through the first quarter, following 2018 increases of 25-40¢/lb that were driven by globally tight supply of intermediate chemicals. RTi’s Kallman noted that a force majeure by Ascend Performance Materials was to end last month. A couple of planned turnarounds in intermediates last month were expected to contribute to a continued tightness through midyear. However, after those interruptions, the slowdown in automotive nyon 66 markets in Europe and Asia will help loosen up supplies. He ventured that nylon 66 prices would most likely remain flat in April, as suppliers have seen increased margins of about 10¢/lb through lower feedstock costs in the first quarter.

Related Content

First Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MorePrices Flat-to-Down for All Volume Resins

This month’s resin pricing report includes PT’s quarterly check-in on select engineering resins, including nylon 6 and 66.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More