Major Resin Prices Flat or Lower

Good news for buyers of PE, PP, PS, and PVC..

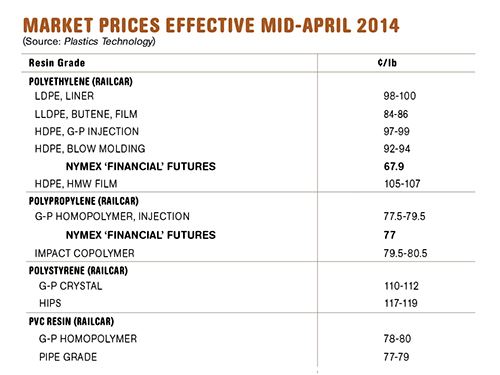

Prices for all four commodity thermoplastics are trending in the same direction—flat to down—after some pretty strong upward movement in the first quarter. Among the factors influencing this apparent reversal are better availability of key feedstocks, along with lower prices, despite an uptick in seasonal demand for all four resins. These are some of the views offered by resin purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange in Chicago.

PE PRICES FLAT

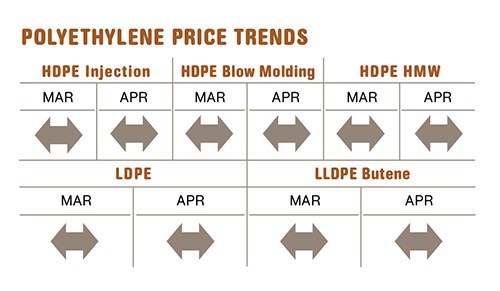

Polyethylene prices remained flat in April for the second month in a row, despite some suppliers’ intent to implement a 6¢/lb increase on Apr. 1. In the resultant maneuvering, Dow split its increase for HDPE to 3¢ for April and 3¢ for May, and pushed back its 6¢ hike for L/LLDPE to this month. Neither ExxonMobil nor Nova supported any increase from the start. Says Mike Burns, v.p. for PE at RTi, “Were these increases to go through, it would reduce the competitive edge that we have gained, opening up the floodgates for imported PE finished products.” He estimates that even without the price increase, bags cost 5% less to make in China than here.

Both HMW-HDPE and LLDPE have been very tight, leaving processors little leverage for negotiation, according to Burns. ExxonMobil and LyondellBasell Inc. (LBI) have had operational problems at their HMW-HDPE plants. In addition, those two firms plus Nova have each experienced problems in LLDPE production.

The Plastics Exchange’s Greenberg reported that spot PE prices were mostly flat after retreating slightly in March, and he projected them to remain flat through last month. He said higher volumes were available from both suppliers and resellers: “Houston traders have plenty of warehoused inventories and there is packaged material of practically every commodity grade ready to ship.”

Burns maintains that there are no cost-driven factors to support higher prices now, as was also the case during the first quarter. He cites ample ethylene monomer availability and monomer prices that have been flat-to-down and are trending that way for the rest of this year. He also says that PE supplier inventories are recovering after some weather-related depletion in the first quarter. Barring any major disruptions, he projects PE prices to trend flat-to-down through midsummer.

PP PRICES DOWN A BIT

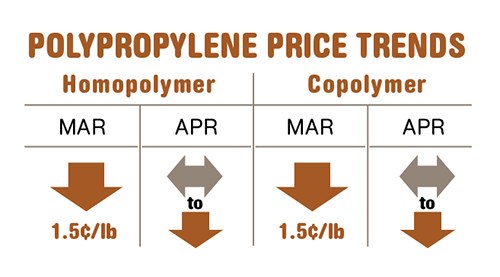

Polypropylene prices dropped in March by 1.5¢/lb in step with monomer. Nominations for April monomer contracts ranged from flat to lower by 1-2¢/lb.

Greenberg reports that the forward curve for monomer flattened a bit more by the end of March, and he expects stable pricing for the next few months. Scott Newell, RTi’s director of client services for PP, projected PP prices would remain flat or at most a penny lower last month. “We’ve been making it through all the planned cracker outages just fine and have been fortunate not to have any unplanned outages, so monomer operating rates are already improving.”

PP demand for the first quarter was down 6-7%, same as last year, according to Newell. The spot PP market was sluggish through March, according to Greenberg, who described material availability as “having swelled to the highest level in recent memory.” However, there was evidence of an April-May start of a rebound, partially due to processors needing to restock and to optimism that the warmer weather would boost demand for home consumer goods as the construction season kicks in, along with continued good demand in markets like automotive.

Newell projects PP plant operating rates that were down to the low-80s percentile will be throttled up significantly in the very near term. He also projects steady to slightly lower pricing for PP. Both Phillips 66 and LBI have had shutdowns of PP production lines due to operating problems, which were expected to be resolved before the end of April. But unforeseen delays in these restarts, coupled with a big rebound in demand, could tighten the PP market and result in higher prices.

PS PRICES FLAT TO DOWN

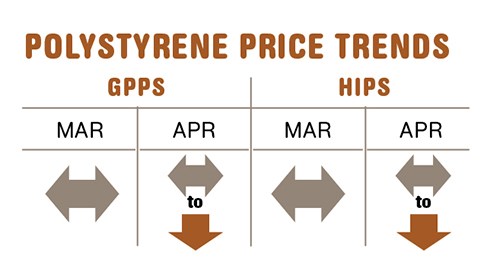

Polystyrene prices were flat through March, after rising by 11¢/lb. Price relief on the order of 2-4¢ appeared likely by the end of April, and possibly more this month, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC.

Factors driving lower prices include a drop in benzene prices—down 14¢/gal in March and 15¢ in April to $4.80/gal—and even lower prices projected for this month, along with a 4¢/lb drop (to 45.5¢/lb) in March ethylene contract prices.

Kallman sayss processors could see relief in the April-May time frame totaling 3-4¢/lb, noting that 3¢ would cover the existing benzene price decline and 4¢ would include the ethylene price drop. Supply availability for both feedstocks has improved, while seasonal demand for PS in recreational and construction markets is expected to result in higher plant operating rates.

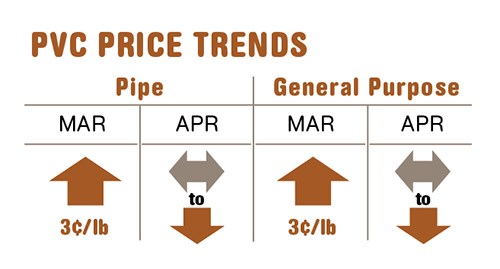

PVC PRICES UP BUT TRENDING LOWER

PVC prices moved up in March as suppliers implemented their third consecutive 3¢/lb increase this year. However, change was in the air last month. The March increase was bolstered by planned and unplanned vinyl monomer and PVC plant outages. However, material availability is improving. PVC plant operating rates dropped below 80% in February, but are projected to be up in the high-80s this month, according to RTi’s Kallman.

Not only is there optimism for a strong domestic construction season, but export activity was already picking up last month as material availability began to improve. Kallman notes that demand in the first quarter was inflated by prebuying ahead of price increases, so how things shape up remains to be seen. More importantly, he sees downward pressure on PVC pricing, starting with the lower March ethylene contract price settlement, and flat-tolower

prices expected to continue for the monomer. Depending on how quickly PVC operating rates recover, Kallman ventures that processors could see price relief of 1-3¢/lb in April-May.

Related Content

Commodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreNexkemia Acquires Polystyrene Recycling Assets

The polystyrene manufacturer finalized its purchase of Eco-Captation, a recycler.

Read MorePrices Up for PE, ABS, PC, Nylons 6 and 66; Down for PP, PET and Flat for PS and PVC

Second quarter started with price hikes in PE and the four volume engineering resins, but relatively stable pricing was largely expected by the quarter’s end.

Read MorePrices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More