Major Resin Prices Soften

Major Resin Prices Soften

The continuation of lower feedstock and energy prices has resulted in a downward trajectory for prices of nearly all commodity resins, including common engineering resins like ABS, PC, and nylon 66. Barring any major production disruptions or reversal in feedstock and energy costs, most fourth-quarter prices are likely to be flat to lower. These are among the views of purchasing consultants at Resin Technology Inc. (RTi) of Fort Worth, Texas, and CEO Michael Greenberg of Chicago-based The Plastics Exchange.

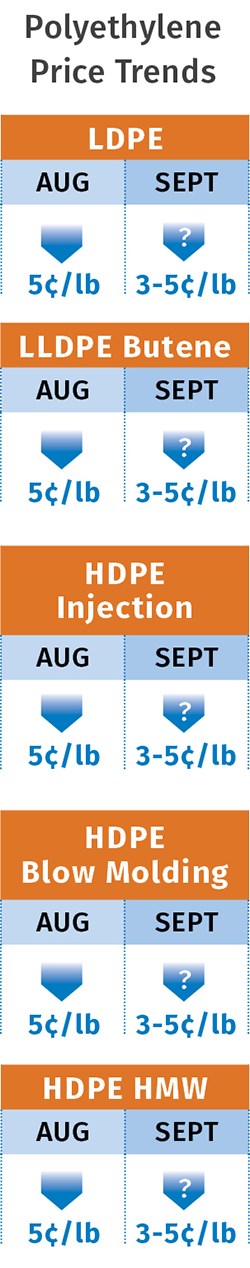

PE PRICES DROP

Polyethylene prices dropped a full 5¢/lb in August, with some offgrade material down by as much as 8-10¢/lb since the May price peak. Moreover, another contract-price drop of 3-5¢/lb was expected for last month, driven by falling oil prices and the devaluation of the Chinese Yuan, according to Mike Burns, RTi’s v.p. of client services for PE, and Greenberg of The Plastics Exchange.

Greenberg reported that spot PE trading was above average in late August and dropped to light trading in early September. “There seems to be plenty of material available at a fair market price,” he commented. Greenberg expected that most suppliers would support a 4¢/lb decrease for September, which would result in PE contract prices down a net 13¢ for the third quarter—or 20¢ in the last 10 months.

Notes RTi’s Burns, “The devaluation of the Yuan will limit imported pellets and accelerate imports of finished plastics products such as bags. This global competition will increase price pressure on North America.” Meanwhile, he expected suppliers’ inventories to grow in August and beyond, as processors have been buying cautiously in anticipation of further price declines. Asked if prices are likely to stabilize or start increasing before year’s end, Burns notes a few factors that could bring this about: a surge in oil prices; global demand improvement, or PE supply-chain disruptions.

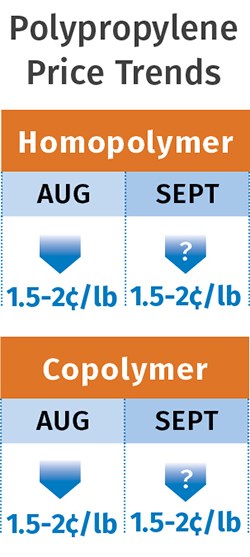

PP PRICES LOWER

Polypropylene prices generally dropped in August by about 1.5-2¢/lb following a 3.5¢ decrease for contract propylene monomer. PP suppliers aimed for a 5¢/lb profit-margin increase in August, which was realized fully by some, while others saw that increase split between August and September, and some saw none of it. “I keep saying there is no one-size-fits-all in the PP market—it depends on who you’re buying from, and if you’re behind or ahead of the curve,” says Scott Newell, RTi’s director of client services for PP.

This diversity has characterized the continued efforts by PP suppliers to gain profit margin while resin supply is snug and monomer prices are declining. Another 6¢ PP margin increase was attempted last month but had not gained industry support at press time, since most suppliers were still trying to implement the August 5¢ hike, says Newell.

Greenberg’s assessment in the first week of September was that while suppliers were adamant about enforcing the entire 5¢/lb margin increase for August PP, when the dust settled, it seemed that only about 2¢ of that increase held. So with propylene monomer down 3.5 ¢/lb in August, average prime PP prices declined 1.5¢/lb. “There are additional PP margin increases on the table, so considering that monomer is primed to decrease about another 3.5¢/lb in September, it’s plausible to see contract PP go down another 1.5¢/lb.”

According to Greenberg, spot PP trades were few and prices edged a penny higher in early September. “Surplus material is generally hard to come by and is usually offgrade. Contract pricing continues to be lower than spot due to continuing inadequate supply, but even contract buyers are willing to pay up as needed.” Newell says, Converters have continued to buy strongly just to catch up and have a bit more inventory on hand just so they don’t have to pay that big premium in the spot market.”

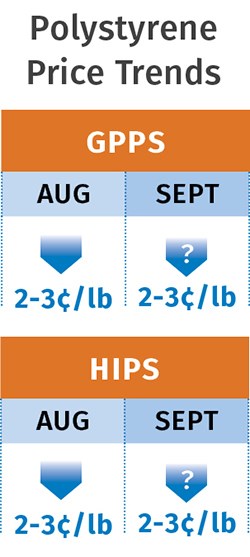

PS PRICES DROPPING

Polystyrene prices dropped in August by 2-3¢/lb in step with a 25¢/gal drop in benzene prices, and PS was expected to fall even more as September benzene contracts settled 79¢/gal lower.

Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC, points out that ethylene monomer contracts dropped a total of 4.25¢/lb in July/August to 29.5¢/lb, the lowest since before 2009. He anticipated that PS prices would definitely drop farther in September or October. “Any price recovery for suppliers will be on the smaller side for the remainder of the fourth quarter,” ventured Kallman.

PVC PRICES SOFT

PVC prices dropped 1¢/lb in August and were likely to drop by at least another 1¢/lb last month, according to RTi’s Kallman. While he does not anticipate any upward pressure in the fourth quarter, particularly in view of lower-cost feedstocks and the slowdown of the construction season, he said it was difficult to predict whether PVC prices would drop farther. He pointed to the start of fourth-quarter PVC plant turnarounds this month, which could tighten the market.

ABS PRICES UP, THEN DOWN

ABS prices moved up on the order of 2-4% in July, following the June benzene contract, which settled up 21¢/gal. But ABS reversed course in August, following benzene prices downward. With benzene’s even heftier price drop in September of 79¢/gal, ABS prices were expected to sink lower last month, noted RTi’s Kallman. He foresaw further downward pressure coming from lower-cost Asian imports, which are on the increase.

PC PRICES FLAT TO DOWN

Polycarbonate prices were largely flat through the third quarter but fourth-quarter prices were expected to be adjusted lower. PC prices are typically set on a quarterly basis.

Driving the downward price trend are significant price drops in both propylene and benzene. And while domestic PC demand has been strong this year, driven by the automotive and construction sectors, exports are down. Domestic suppliers have always relied on exports, and the decline is affecting overall demand, along with an increase in cheap imports from both Europe and Asia, RTi’s Kallman notes

NYLON 6 PRICES FLAT; NYLON 66 DOWN

Nylon 6 prices moved up by about 5¢/lb in the June/July timeframe, following spikes in benzene contract prices, then remained flat through August. RTi’s Kallman anticipated that with currently lower benzene prices and ample supply, prices of nylon 6, for which demand has been steady, would remain mostly flat. Nylon 66 prices remained primarily flat through the third quarter, but a downward adjustment for fourth-quarter pricing appeared imminent, according to Kallman. Downward pressure is driven by lower prices for benzene, propylene, and butadiene. This is despite strong automotive demand for the resin, which is expected to show a bit of an uptick in consumption this year over 2014.

Related Content

The Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More