Mixed Bag for Volume Resin Prices

As hurricane aftermath recedes, PE, PS, PVC prices are retreating; engineering resins are rising; PP and PET are “iffy.”

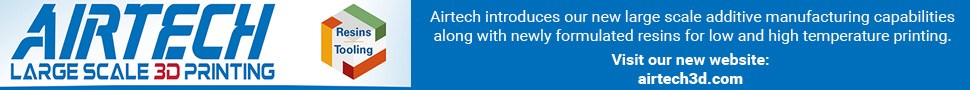

As we head into the new year, the course of high-volume resin prices was up, down, and undecided. Supply/demand fundamentals are key to the projected downward trend for PE, PS, and PVC; while higher feedstock costs and, in some cases, strong demand, are key to the upward move for volume engineering resins. There’s a more indeterminate scenario for PP and PET, owing to snug capacity for the former and overcapacity for the latter.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of Plastics Exchange, The in Chicago, and Houston-based PetroChemWire (PCW).

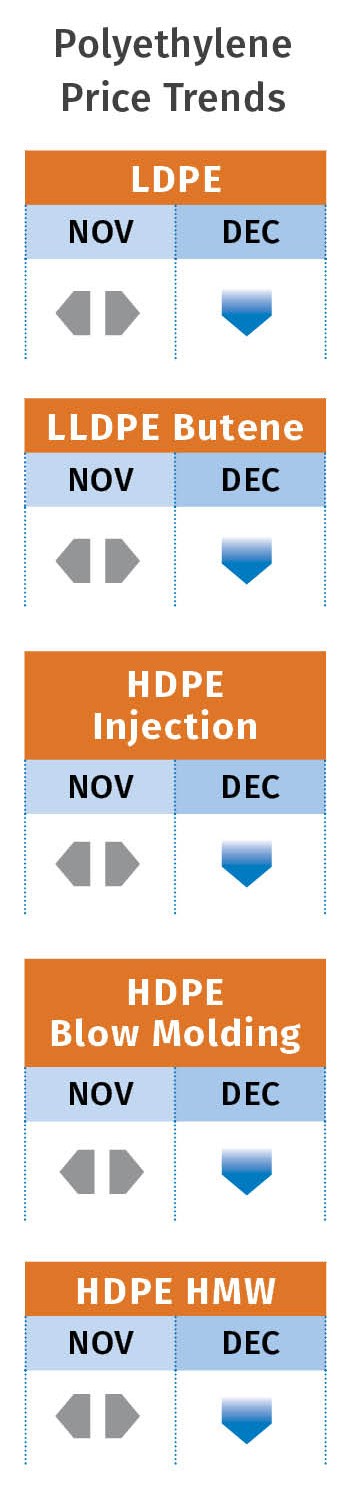

PE PRICES FLAT TO LOWER

Polyethylene prices remained flat in November, as there was still not enough inventory buildup, due to minor production issues at several suppliers, for post-hurricane prices to settle back to “normal” levels, according to Mike Burns, RTi’s v.p. of client services for PE. Burns said last month there was potential for a supplier-driven decrease of up to 3¢ even before the end of the year. “Current price levels cannot be sustained as inventories recover,” he explained. Burns expected further reductions this month and next, with decreases totaling 7-10¢/lb by March.

By early December, both The Plastics Exchange’s Greenberg and PCW reported that spot PE prices continued to “unwind,” a signal of what could be a course reversal in contract prices. Said Greenberg, “There was a series of price increases since August that varied by amount and implementation date. It seems that 10¢/lb on average took hold. Now, with the spot market falling sharply, we would not consider any further contract-price advancement and expect to see contract prices begin to decline, maybe as early as December.” Secondary-market prices dropped by 7¢/lb from their peak gain of 15¢/lb in mid-October, according to all three sources.

PCW said spot PE prices were mostly lower as supplier inventories continued to recover from Hurricane Harvey disruptions. Burns added that new PE capacity continues to come on stream, with the majority of that added volume going to exports. “U.S. export PE prices will be 7-10¢/lb lower than global prices,” he said. Burns noted some concerns in the industry that ethylene monomer availability will be a challenge in the second quarter, as new PE capacity could well outpace new monomer capacity coming on stream.

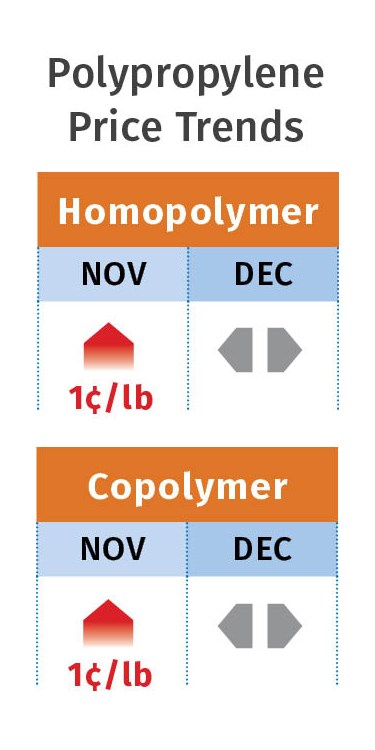

PP PRICES INCH UP

Polypropylene prices move up 1¢/lb in November, once again in step with propylene monomer contract settlements, though some industry sources reported that PP suppliers tacked on an additional 1¢ in margin expansion. However, Scott Newell, RTi’s v.p. of PP markets, did not see evidence of margin expansion; he expected monomer prices to top out, possibly in December if the new Enterprise Product Partners propylene unit ramped up production. “In that case, December monomer contract prices could be flat to down—but if the new plant were not to ramp up enough, monomer could be flat to up,” he said.

Though unconfirmed, some industry talk had it that as 2018 contract negotiations were underway, the market was becoming somewhat more competitive, and some suppliers were backing out of margin expansions and even offering some margin erosion.

The PP spot market was characterized as snug—with supplies of higher-flow impact copolymer and clarified random copolymer particularly tight—by both PCW and Greenberg. In early December, Greenberg said, “Despite the fact that PE prices are coming back down hard, PP market fundamentals are quite different; and, to buyers’ frustration, prices remain firm to higher. Producers have responded to rising prices and good demand with added production, running reactors as close to capacity as practical. This has helped to keep a lid on PP prices.”

Both Newell and PCW characterized the overall market at year’s end as tightly balanced and demand as somewhat lackluster. Newell noted that for 2017, total sales (including exports—which dropped) will be up about 1%, though domestic sales were up by 3.5%. He expected to see some continued growth in demand in 2018. PCW reported that talk of planned maintenance at several units in the first quarter, combined with no new capacity, might tighten up the market further. Although some PP has come in from abroad, Newell did not expect a flood of imports, though a lot will depend on domestic PP pricing.

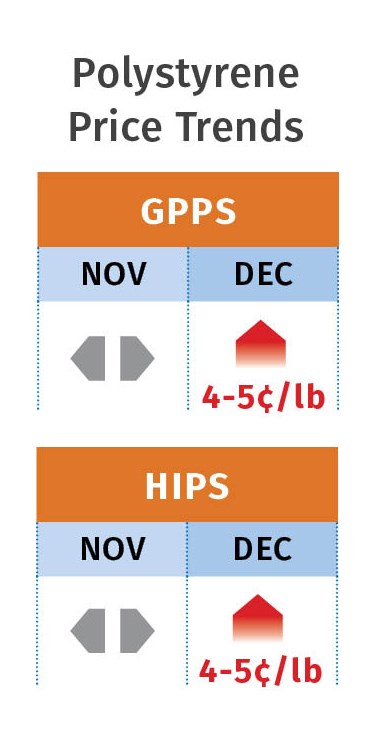

PS UP, BUT NOT FOR LONG

Polystyrene prices were flat in November, but suppliers were seeking increases on the order of 5-6 c/lb, effective Dec. 1, according to PCW and Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC. PCW noted that the move was supported by a 50¢/gal increase in December benzene contracts (each 10¢/gal increase is roughly equivalent to a 1¢/lb increase in PS cost), but also characterized December as a seasonally weaker demand month.

Kallman ventured that suppliers would more likely implement 4-5¢/lb, but he also expected that “a good part, if not all, of this increase will come off in January and February due to anticipated better benzene availability.”

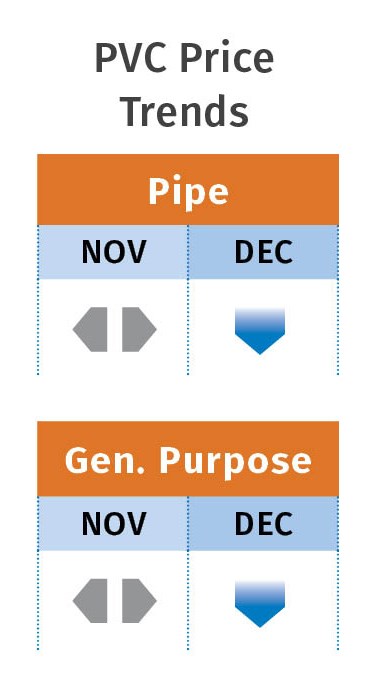

PVC FLAT TO DOWN

PVC pricing in November was a bit “muddled,” according to RTi’s Kallman, ranging from flat to 2¢/lb lower—after a 3¢ price hike in October. Kallman expected further price reduction in December from recognized discounts or incorporated into new 2018 contracts—for a total of 3¢/lb across the board. Not only were PVC inventories starting to build, but export business was off.

PCW reported that processors—other than pipe extruders, who were able to push pipe prices to the highest level of the year—were mollified by the prospect of PVC prices dropping by at least .3¢/lb. PCW noted that the October hike brought the total increase in PVC prices to 9¢/lb, while ethylene contract prices through September were up only 1.75¢/lb since January 2017. Kallman predicted flat or lower PVC pricing in the first quarter, though the second quarter is expected to be strong domestically and globally.

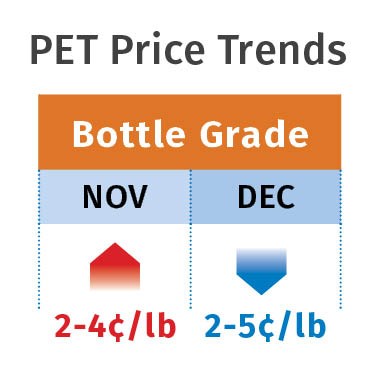

PET PRICES UP

PCW reported that domestic bottle-grade PET spot resin started December at 68-70¢/lb for railcar/bulk-truck shipments for Midwest spot delivery—up 2-3¢/lb from November. However, December contract business tied to feedstock costs was 2-5¢/lb lower for railcar and bulk-truck quantities. Domestic PET feedstock prices settled moderately higher in November, with paraxylene up 1.5¢/lb and PTA up 1¢/lb, while MEG dropped by 1.4¢/lb. Imported PET resin, with an IV of 78 or higher, on Dec. 6 was at 65¢/lb, delivered duty-paid (DDP) to the East Coast and 70¢/lb DDP West Coast, up 1-2¢/lb from November.

ABS FLAT TO HIGHER

ABS prices held flat from June through November, after increasing 15-20¢/lb through April and dropping 5¢/lb in May. But suppliers were seeking increases of 5¢/lb for mid-December, tied to higher benzene prices.

RTi’s Kallman noted that while benzene contracts settled higher, they were generally expected to drop in the first quarter, and butadiene prices dropped. He expected ABS prices for December and this month to range from flat to 2-3¢/lb higher.

He noted that imported ABS continues to be competitive but not by much. Characterizing the domestic ABS market as fairly well balanced, he expected ABS demand to be steady in 2018.

PC MOVING UP

Polycarbonate prices remained flat through 2017’s third and fourth quarters, after moving up 10-20¢/lb in the first two quarters. But bids of a 14¢/lb price increase for Jan. 1 were tied to the end-of-year spike in benzene prices. However, RTi’s Kallman noted that the increase—which was not supported industrywide at press time—did not equate to the benzene increase but was an attempt at margin expansion.

“As suppliers’ inventories build from improved plant production, I expect most buyers will be able to negotiate significantly lower reduction than the 14¢ sought,” Kallman said. In addition, he noted that there were significant PC imports in 2017, which were expected to continue strongly into this year due to major capacity expansions in Asia, making for a more competitive environment. He predicted that PC demand growth would continue into this year, though perhaps not reaching 2017 levels, driven by automotive, electronics, and construction.

NYLON 6 & 66 UP

Nylon 6 prices gained 5¢/lb in November, after moving up 2-7¢/lb in the second quarter and holding flat from July through October. RTi’s Kallman expected prices in December to rise another 5-8¢/lb.

The swiftly implemented November increases were attributed to strong demand and some limitations in feedstocks availability following Hurricane Harvey. Moreover, there was further pressure from higher global prices of both benzene and caprolactum. Yet he expected prices to decline through the first quarter as benzene availability improves.

Nylon 66 prices in October and November were flat to higher. Some increases were pushed through distribution channels, although most held flat for 2018 contract negotiations, according to Kallman. Overall, he expected nylon 66 buyers to see increases of 5-10¢/lb, though one supplier was asking for 14¢. Kallman ventured that once increases were implemented this month, first-quarter pricing would likely be flat. Kallman sees continued demand growth for nylon 66 driven by key markets such as automotive, and characterized the market as balanced to a bit tight.

Related Content

Prices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More