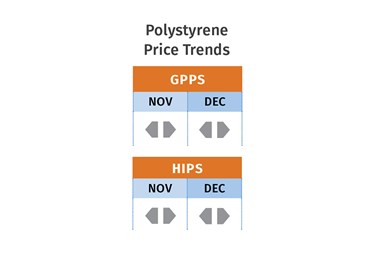

Mixed Pricing Outlook for Volume Resins

The direction is down for polyolefins and up for nearly all others.

The end of 2021 signaled a buyers’ market for polyolefins and possibly for PS, but mostly a seller’s market for PVC, PET, ABS, PC and nylons 6 and 66. The key factor for polyolefins and PS was supply outpacing demand. Factors cited for the upward pricing forecast for nearly all other volume resins included increases in feedstock and energy costs, shortages of additives and reinforcements, and supply-chain disruptions.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior editors from PetroChemWire (PCW), and Michael Greenberg CEO of The Plastics Exchange.

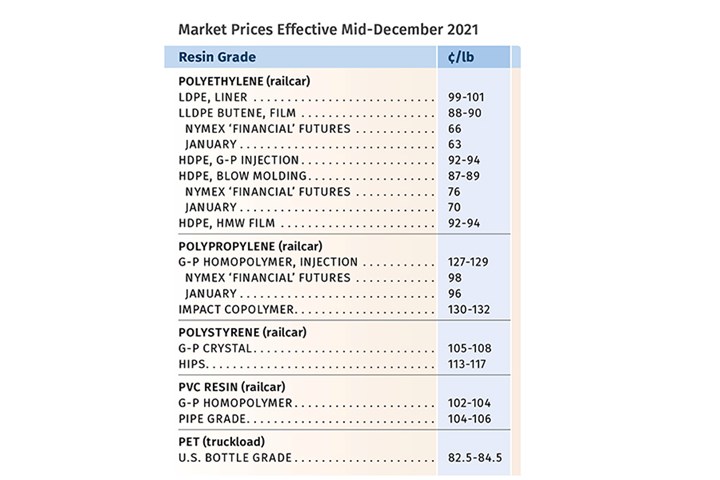

PE Prices Drop

Polyethylene prices were poised to drop by another 5¢/lb in November after falling 5¢/lb in October. Another 5¢/lb drop was likely for December, according to Mike Burns, RTi’s v.p. of PE markets, as well as PCW senior editor David Barry and The Plastic Exchange’s Michael Greenberg. Total 2021 price increases up to November stood at 36¢ to 38¢/lb.

Burns ventured that there was potential for another 10¢/lb drop in the first quarter, for a total price correction of 20¢ to 25¢/lb. He noted that current market dynamics are reversed from those of the last few years. For example, supplier inventories are at an all-time high, with further oversupply expected as scheduled new capacity hits the market, amid a significant drop in exports due to logistical issues. “The lack of truckdriver availability in Texas is becoming a concern for the year-end export market. Freight rates to Latin American have doubled for some regions.” Meanwhile, Burns said domestic PE demand is expected to continue strong through the first half of the year for U.S. processors producing such basic products as plastic bags and cutlery, as imports of these products drop due to high freight costs.

PCW’s Barry reported that PE spot prices continued to trend lower in the last week of November, as producer inventories grew and buyers worked to trim finished goods and resin inventories. “Processors continued to cite labor and trucking issues as their major operational constraints, and overall resin demand remained healthy. Some plastic film and bag producers continued to see order backlogs at least twice as long as normal,” he reported.

The Plastic Exchange’s Greenberg reported in late November that spot HDPE availability was still strained following a recent force majeure in Texas earlier in that month. He noted that there were some other supply challenges and a handful of allocation programs still in place. However, with operating rates much improved and new capacity coming online, availability was expected to grow even further, he said.

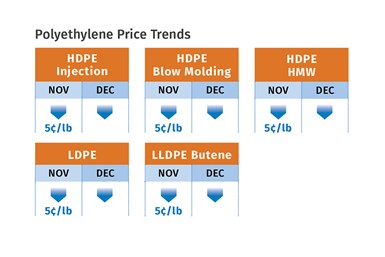

PP Prices Plummet

Polypropylene prices in November were expected to drop in step with propylene monomer—between 8¢ and 10¢/lb, but with an additional drop of 4¢ to 5¢/lb in “supplier margin give-back,” according to Scott Newell RTi’s v.p. of PP markets, PCW’s Barry, and The Plastic Exchange’s Greenberg. For December, further price decline of near similar proportion was expected for propylene monomer, with PP prices following in step, along with another 4-5¢/lb trim to supplier margins. In the new year, monomer prices are expected to level off, PP demand to potentially rebound, and planned refinery shutdowns to curtail monomer production.

Said Newell, “Everything looked very bearish in the fourth quarter—supplier inventories were very high, despite their throttling back production to 84.5% of capacity, which barely made a dent, and we have had record-high PP imports, as demand appeared to have slowed.” He and Barry noted that the slide in the monomer prices was due largely to slowed PP demand.

Barry noted that spot PP was selling 20¢ to 25¢/lb lower than contract prices. He also noted that from late 2020 through 2021, PP suppliers expanded their margins by 30¢ to 40¢/lb.

Greenberg characterized the spot market as limited, as supply improved with weak demand. He had anticipated that, as in October, spot PP prices would drop by another 9¢ to 10¢/lb in November-December. “Producer inventories coming into November were flush by historical standards, but the Houston spot market still was not flooded with material. While buyers are indeed working down their own supplies, they also know that producers are well stocked and that traders have inventories of most grades ready to ship. This has changed the market from being tight with challenged processor inventories and long supplier lead times to average processor inventories and shorter supplier lead times,” he reported.

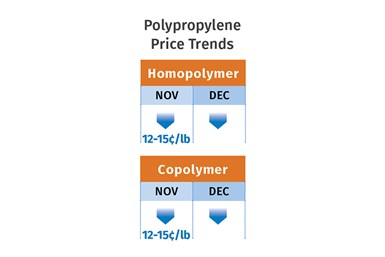

PS Prices Flat to Lower

Polystyrene prices were expected to hold even in November and December, but there was potential for price relief this month, according to Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets, and PCW’s Barry. Despite slowed seasonal demand, Cheshire believed that processors should be aggressive in seeking price concessions. She noted that for eight consecutive months of PS price increases in 2021, suppliers pointed to feedstock costs, which fell significantly by October—benzene by $1/gal and styrene monomer by 20¢/lb. She contended that PS prices should have come down, based on the reverse trajectory of feedstock prices, slowed demand and adequate supply.

PCW’s Barry reported that PS spot prices were trending flat to lower as feedstock costs edged lower in late November. The implied styrene cost based on a 30/70 ratio of spot ethylene/benzene was at 41¢/lb, down 9¢/lb from mid-November but up 2¢/lb from mid-October. Barry characterized supply as balanced, noting supplier operating rates in the low-to-mid 70% range. He noted that shortages of polybutadiene rubber continued to limit production of HIPS. “High freight costs from overseas have caused imports to be less competitively priced, which has helped PS producers obtain strong financial results this year, with margins well above forecast.”

PVC Prices Up

PVC prices moved up 5¢/lb in November as suppliers fully implemented their hikes, attributing them to recovery from unplanned outages in September, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. Kallman ventured that December and January would see flat prices, noting a substantial supply improvement and continued strong demand: “The overall market remains tightly balanced. While overall demand was lower this year due to a drop of exports from supply constraints, domestic demand appears to be up more than 10%.”

PCW’s Todd reported that several processors saw the price increase as a tactic by producers to keep prices from declining instead of an actual attempt to push prices up again, especially after prices rose every month in 2021, except for July and October.

PET Tabs Higher

PET prices were expected to rise another 1.5¢ to 2¢/lb in November, after a 1.5¢/lb hike in October, driven primarily by higher prices of feedstock MEG, according to RTi’s Kallman. He ventured that PET prices would drop by about 2¢ to 3¢/lb in December, as MEG supplies improved. As for this month, Kallman saw potential for suppliers to win back any lost ground due to higher energy costs and a recovery in PET demand from Asia.

Kallman characterized domestic PET supply as better balanced as production of MEG and other key feedstocks returned to normal levels. Domestic demand for PET packaging remained high as consumers and retail stores restocked. Sustained high volumes of PET imports bridged the demand gap, despite high freight costs—which were expected to drop in January.

ABS Prices Up for Now

ABS prices moved up 8¢/lb in September and suppliers were aiming to implement 5¢/lb in October-November, according to RTi’s Kallman. He ventured that prices in December and January would be flat, due to lower feedstock costs and improved supplies. He said, “Supply was still very tight in the fourth quarter as production lines were coming back on stream after force-majeure actions. Though costly, ABS imports continued to be an important part of the market in bridging the supply/demand gap.”

PC Prices Up

Polycarbonate prices moved up 11¢ to 15¢/lb in September-October, having risen an average of 40¢ in the first half of 2021. Suppliers announced an additional 10¢/lb hike due to a continued shortage of pigments, additives (such as flame retardants) and glass reinforcements for PC compounds and alloys, according to RTi’s Kallman. Kallman expected the latest price hikes to be implemented in December-January.

Prices Up for Nylons 6 & 66

Nylon 6 prices rose in November with suppliers seeking increases from 5¢ to 23¢/lb. Prices had already moved up 60¢/lb in the first half of 2021 due to feedstock and supply issues. Suppliers attributed their new price initiatives to higher energy costs and supply-chain disruptions, according to RTi’s Chesshier. She ventured that most processors were seeing increases of 5¢ to 9¢/lb, and projected largely flat pricing for December and January. She noted that there was a lot of pushback from the market on these latest increases, as suppliers had not made any concessions when energy prices were at all-time lows.

Nylon 66 prices were rising in the double-digit range at the turn of the year, according RTi’s Kallman, after gaining 29¢ to 40¢/b in the first half of 2021. The main culprits were said to be additives such as flame retardants and glass fiber. Kallman noted that some suppliers were seeking hikes of as much as 25¢/lb for compounds requiring those ingredients. “While nylon 66 is a tightly balanced market, it is definitely improving as major suppliers were lifting force majeure actions. Demand remains strong, though automotive has dialed back due to the shortage of semiconductor chips, for which improvement is projected by mid-2022.”

Related Content

Prices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MorePrices of the Five Commodity Resins Largely Flat

While price initiatives for PE and PVC were underway, resin prices had rollover potential for first two months of 2024, perhaps with the exception of PET.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MorePrices of PE, PP, PVC Up; PS, PET Flat

While prices moved up for three of the five commodity resins, there was potential for a flat trajectory for the rest of the third quarter.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More