Most Prices Up, PP Down

Prices of four of the five large-volume commodity resins are on an upward trajectory

Higher global energy and feedstock costs, higher resin prices abroad spurring domestic exports, and resin-plant maintenance turnarounds that have constrained supplies were all factors that have driven price increases in PE, PS, PVC, and PET. In contrast, PP prices fell further, a move that was needed to bring more price parity with the substantial PP resin and product imports so far this year, though there is potential for a reversal.

Those are among the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of Chicago-based The Plastics Exchange, and Houston-based PetroChemWire.

PE PRICES UP

Polyethylene prices moved up 4¢/lb in April, following the 5¢/lb increase in March. Dow issued a 5¢lb increase for May 1, but other suppliers had not followed suit by press time early last month. How long suppliers will be able to hold onto the April increase will depend on resin inventories, exports, and the direction of crude oil prices, said Mike Burns, RTi’s v.p. of client services for PE. The Plastics Exchange’s Greenberg noted that the combined two-month increases boosted PE contract prices to levels not seen since last August.

Burns viewed these price hikes as having significant potential for demand destruction. He pointed out that China and Asian PE prices have declined, and could sink lower due to weak demand and oversupply. These factors could result in a resumption of bag imports from China. Burns noted that the 10¢/lb delta needed between the North American PE price and other regions to maintain a global price balance will be tested if the oil price remains near $40/bbl, adding that big-box retailers were expecting competitive quotes on plastic bags from China and Southeast Asia.

Domestic PE demand is pretty solid, and another factor that could further strain inventories after several months of strong export activity is that Mexico’s Pemex announced PE allocations due to tight ethylene monomer supply. This was likely to drive Mexican and Latin American processors to buy from North America. PetroChemWire reported that spot PE was thinly Offered. Some suppliers were seeking higher prices for May, but traders were reluctant to take on inventory at what was perceived as peak pricing. Greenberg noted that prime railcars offered to the spot market included the full 4¢/lb increase, resulting in little buying interest compared with offgrade material, which was still offered at a discount.

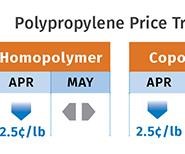

PP PRICES DROP

Polypropylene prices dropped 2.5¢/lb in March and April, while propylene monomer went up a total of 2.5¢/lb. PP suppliers dropped PP prices while absorbing the monomer increases, resulting in a 5¢/lb margin decrease, according to Scott Newell, RTi’s v.p. of PP markets.

PetroChemWire reported that with some exceptions, 3-6¢/lb of suppliers’ January-February 6¢/lb margin increase had rolled back, with potential for further erosion last month, as suppliers aimed to compete with lower-priced imports. Greenberg reported that the significant flow of imported PP seems to have satisfied the shortage that developed in 2015 due to strong demand and production issues, yet he still sees potential for a tighter market ahead.

A reversal in the strong flow of imports could occur as early as June. Noted Newell, “Polypropylene prices are up in Europe and Asia due to maintenance turnarounds and higher oil prices, so expect a harder sell for imports. The price points between imported and domestic PP have become much closer; and in some cases, domestic spot material is cheaper.” While he does not expect all imports to cease, given purchase commitments, he ventures that about 50% of the imported “speculative” resin volume could drop. He says, current domestic inventories of homopolymer PP are healthy. Meanwhile, Newell noted that first-quarter demand for domestic PP was down 1.5%, but with imports figured in, overall demand is up 1-2%.

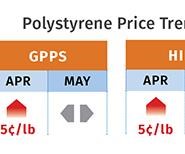

PS PRICES RISE

Polystyrene prices moved up 5¢/lb in April, driven by spikes in benzene, ethylene, and butadiene prices. PetroChemWire reported that it was not clear whether the 8-10¢/gal decrease in the May benzene contract price would be sufficient to move PS market prices lower—noting that, typically, a 10¢/gal shift in benzene changes the cost basis for PS by 1¢/lb.

Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC, ventured that PS prices would most likely remain flat through May, but with potential to go up again this month or next. “A lot will depend on how supply/demand for benzene shapes up,” he said, adding that a reduction in Asian benzene imports signals higher prices, as did high spot benzene prices. Moreover, the seasonal uptick in demand for PS was off to a good start. PetroChemWire reported that domestic PS demand appeared steady, with industry expectations still set on 1-1.5% volume growth this year.

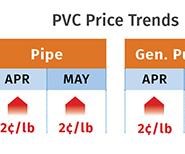

PVC PRICES UP

PVC prices rose a total of 4¢/lb in April and May, following a 3¢/lb increase in March. Several factors create potential for further increases, according to RTi’s Kallman.

Above all, the domestic supply/demand balance will determine PVC pricing, and exports play a major role. The catastrophic explosion on April 20 at the vinyl chloride monomer (VCM) and ethylene plant of Mexico’s PMV—a joint venture of Pemex and PVC pipe producer Mexichem, has resulted in U.S. exports of both VCM and PVC to Mexico. Higher prices of PVC abroad, due to higher oil prices, further bolster U.S. exports. And the domestic PVC market has entered the construction season, which is starting to create a more tightly balanced supply situation. PVC orders were strong in April and early May, an indication of an Uptick in demand coupled with prebuying due to rising prices, according to Kallman.

PET PRICES HIGHER

Botttle-grade domestic PET prime resin in April averaged 52.75¢/lb, and by May 4 had moved up 1.5¢/lb to 54.25¢/lb. The typical price of imported PET in early May moved up by 3.5-4¢/lb to 51.5-52¢lb, according to Xavier Cronin, senior editor of PetroChemWire’s Daily PET and Weekly Recycled Plastics reports. Moreover, Cronin ventured that both domestic and imported PET prices could rise another 2-3¢/lb in May.

Driving the upward movement are rising prices of key feedstocks PTA, MEG, and PX, for which the average cost in April was 49.3¢/lb, up 3¢/lb from March. On the other hand, PET supply in the U.S. is plentiful and growing, which could result in a supply glut by early 2017, according to Cronin. Central to this is M&G Chemicals’ 2.4-billion-lb/yr PET complex under construction in Corpus Christi, Texas.

Due on stream by year’s end, virtually all the PET that will be produced there is targeted for the U.S. market. Meanwhile, PET imports from China, India, and Oman have come to a virtual halt due to antidumping duties imposed in 2015, but imports from other countries like Taiwan have filled the gap.

Related Content

Improving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More